This report on the anode is the second of our five “Battery 101” reports. The goal is to outline the key components of EV batteries and note the companies we believe will make the most profit as we shift into a multi-decade chapter of electrification.

Note: This topic gets geeky, so we took the liberty of simplifying how the anode works.

The big picture

When discussing electrification, EV makers have been top of mind for investors given the industry’s 35% annual growth forecast over the next 10 years. While impressive, we expect investment in battery materials to exceed that of EV growth. The shift is already underway and made clear by a recent White House estimate that $36B has been invested into EV manufacturing and $48B into batteries over the past two years. While battery design will change in the years ahead, we believe that the basic chemistry will not change and remain anchored in lithium, graphite, nickel, copper, and cobalt.

Three forces are driving the growth in battery investments. First, a shift to renewables. Second, the better user experience that comes with going electric. Third, a geopolitical dynamic. Today, China controls the majority of the battery resource supply chain, including lithium, cobalt, graphite, and copper foil along with battery cell production. Given the long-term importance of battery production independence, Western governments are prioritizing a shift of the supply chain away from China. This will create more battery investment within the US and Western Europe around mining, recycling, and production.

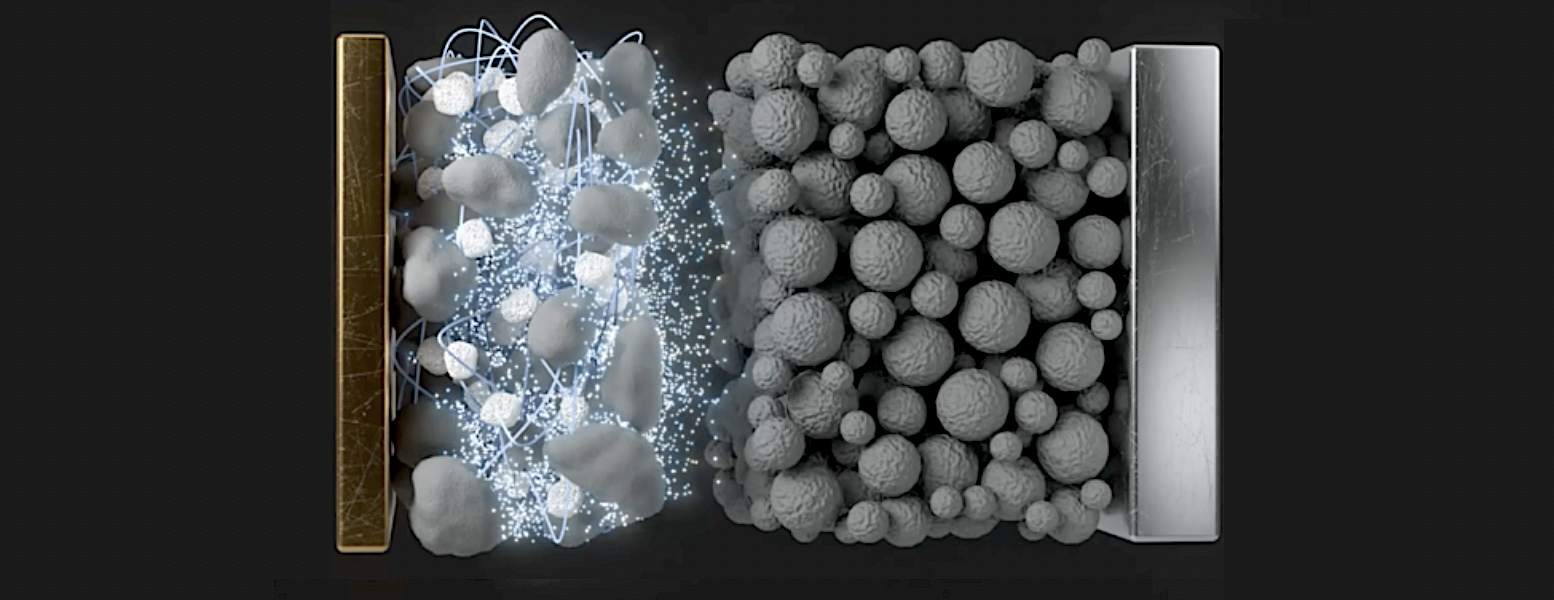

What is an anode?

The anode is an important component of the battery cell. The word “anode” comes from the Greek word ánodos which means “ascent” or “way upward,” referring to the flow of energy through a battery. At a basic level, the transfer of electrons between the anode and cathode creates a circuit which allows electrons to exit the battery in the form of energy.

The battery in an EV is expensive, accounting for between 15-20% of overall vehicle cost. For example, in a $55K Model Y, the battery represents about $10-$12K. The material contents of the anode make up about 9% of the battery cell cost. In other words, the anode makes up just under 2% of the cost of an EV. This is less than the cost of the Cathode Active Material (CAM), which makes up 8-10% of the cost of an EV.

The most common material in the anode chemistry is graphite (CSPG), which is a crystalline form of the element carbon. It makes up 20-30% of the lithium-ion battery by weight. World Bank’s Minerals for Climate Action report highlights that battery graphite will represent about half of mineral demand for the next twenty years. There are alternatives to graphite including silicon and lithium metal anodes which are largely still in R&D. Another important component related to the anode is copper foil, which acts as a protective layer to the anode.

Graphite is largely controlled by China

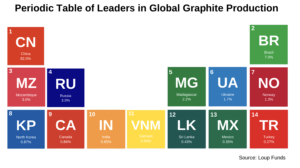

According to data aggregated from the US Geological Survey 2022, synthetic graphite is produced in primarily four countries: China (82%), Brazil (7%), Mozambique (3%), and Russia (3%). Global reserves of recoverable graphite can be found predominantly in Turkey, China, Brazil, Mozambique, and Madagascar.

While graphite mining is geographically diversified, we estimate that almost 90% of total graphite supply is directly or indirectly controlled by China. The reason is that over the past two decades, China has invested in infrastructure in 35 of the 54 total countries in Africa, from roads and railroads, to dams and ports, airports, and—most importantly—mines. In exchange, China has been Africa’s largest trading partner for the past 13 years.

Amid the intensified demand for lithium batteries, the scarcity of concentrate minerals and components like graphite and copper foil will prompt an increase in localized battery component manufacturing. In recent years, the US, EU, and Japan have all identified graphite as a “critical raw material,” prioritized ahead of lithium but slightly behind cobalt on the spectrum of economic importance and supply risk.

Tesla to source graphite from East Africa, maybe US in the future

In 2021, Tesla said that no US-based company is “capable” of producing enough graphite to meet their production capacity. Echoing this statement, SK Group—the second largest South Korean industrial manufacturer behind Samsung Group—said that obtaining graphite from within the US would be “unfeasible.” Given this dynamic, in 2021, Tesla signed a four-year exclusive deal with Syrah Technologies who operates a graphite mine in Mozambique, East Africa.

While Mozambique accounts for just 3% of global graphite mining, the relationship with Tesla has the potential to more than double the country’s current graphite production. Beyond East Africa, Syrah Technologies recently received a $100m loan from the DOE to build a facility in Louisiana to process graphite within the US.

US graphite mining companies are small

There are three small public companies targeting graphite mining in the US with an average market cap of $300m. This begs the question: If US graphite mining is such an exciting theme, why are the valuations of these companies so low?

The answer is: Graphite mining is a less attractive business long-term since graphite represents a much smaller piece of the battery value chain. As a point of comparison, lithium is a more valuable input as evidenced by Livent’s (LTHM) $5.0B market cap.

- Syrah Resources Limited (SYAAF), market cap of $800m, down (-21%) YTD.

- Graphite One (GPHOF), market cap of $65m, down (-46%) YTD. They operate the largest known graphite deposit in the US is located at Graphite Creek in Alaska, and is expected to produce enough annual graphite to power 2.2m EVs.

- Wastewater Resources (WWR), market cap of $53m, down (-48%) YTD. They are building a graphite processing plant in Alabama with an investment of $202m announced in April 2022. The mining site is expected to open by 2028 and is expected to produce enough annual graphite to power 300k EVs.

The bigger US opportunity is vertically integrated battery production

The graphite mining market will eventually be diluted by more sustainable battery production companies. On the private side, Redwood Materials is a vertically integrated battery component supplier. The company recycles batteries and reuses the materials to produce Cathode Active Material (CAM) and copper foil. This August, the company announced that Panasonic will purchase copper foil for battery production at Tesla’s Nevada gigafactory. The company’s last price round was $3.7B in September of 2021.