The trend line is undeniable. Today, EVs account for about 5% of global car sales. In 2021, an estimated 16.5m EVs were on the road worldwide (according to IEA), compared to about 1.4B vehicles total. Within the next 20 years, all vehicles will be electric. To say that the electrification of transportation is just starting is an understatement. To date, the investment approach of Wall Street has largely been focused on the OEMs. If you’ve invested the last few years on getting smart about OEMs, you’re in a good place. That foundation will be helpful for the next EV learning curve: batteries.

We believe that over the next two years the investor focus will shift away from the OEM to US battery production. Battery sourcing will move away from Asia and domestic policies like IRA will continue to ramp, both fueled by an underlining 35+% annual growth in EV deliveries.

Companies and investors are beginning to get behind the opportunity. Recently, the White House highlighted that since Biden took office, “companies have announced investments of more than $36B in electric vehicle manufacturing and $48B in batteries right in the United States.” We believe that spending over the next three years will exceed those estimates, with the actual investments leaning closer to $40B and $55B, respectively. Either way, there is a shift in dollars going from OEMs to batteries.

OEMs and manufacturers are lining up

At last count, 22 companies have made announcements over the past year regrading an increase in battery production within the US. More recently, from February to August 2022, the following OEMs and manufacturers have announced additional plans to scale US facilities, including:

- CATL: The Chinese-based, world’s largest battery manufacturer has paused its announcements on a plan to expand battery production to the US (potentially South Carolina and Kentucky). We expect CATL to make its plans for US manufacturing official within the next two months.

- Toyota: Committed to an investment of up to $3.8B with a portion allocated to EV battery production. Production capacity will be increased to 40 GWh.

- Honda and LG Energy: Announced a joint venture to invest $4.4B toward a US-based battery production facility, with lithium-ion battery production to start by 2025. Annual production capacity will match 40 gigawatt hours.

- GM and LG‘s Ultium Cells LLC: The Department of Energy’s Loan Programs Office announced a $2.5B investment into the company battery cell manufacturing facilities located in Ohio, Tennessee, and Michigan.

- Ford: Announced a new battery capacity plan to localize 40 GWh annually and direct source raw materials from the US, Australia and Indonesia.

- Hyundai: Committed an investment of $5.5B for its first dedicated EV plant and battery manufacturing facility in Georgia, with production set to begin in 2025. Annual capacity will reach up to 300K units.

Built for the US and Europe from the ground up

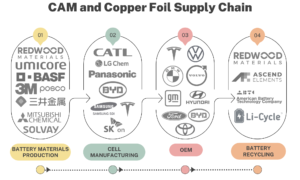

By 2030, the Biden administration is aiming for 50% of all new passenger vehicle sales to be electric. That’s worth saying again. In 8 years time, half of all new cars sold within the US will be EVs from about 5% today. The mass adoption of EVs will, of course, drive demand for raw and recycled materials (Ni/Co, Cu, Li) along with components and cells. Today, more than 95% of EV battery critical parts come from Asia, with around 70% from China. That dynamic will change given that global trade will fade and be replaced by onshoring, hoarding of technology/raw materials by national governments and the opportunity to lower battery costs by moving production to the US.

As the landscape of EV battery manufacturing shifts away from Asia to the US over the next decade, some traditional companies will benefit and new companies will emerge targeting parts of the battery value chain. We believe that the new companies, built from the ground up and targeting US and Western Europe production, will be the biggest beneficiaries. It’s a similar dynamic to the EV-first auto companies having a competitive advantage. The shortlist of potential winners today includes Ascend Elements and Redwood Materials.

I’ll be writing more about those companies in the months ahead.