Written by guest author Thomas Paulson, Principal at Inflection Capital Management.

Disney+ Fast Start

It’s early days for Disney+ given that we are only two months in; however, pre-sales, first-day subscribers (10m), and the stability in the weekly downloads have all been well above expectations. Third-party research on the consumer interest in the product and content has been glowing. Anyone can be a naysayer and critic and opine that the early momentum is sure to fade; however, what happens if the Disney+ momentum continues unabated? What might a “home run” look like? What does a home run mean for Disney’s overall business and the stock price?

The Disney Flywheel

What is clear, Disney+ adds momentum to the “Disney Flywheel” of:

- Great Content > Drives Greater Fandom > Drives Greater Consumption of the Parks/Consumer Products

- Greater Affinity for Disney’s Characters and Stories > Drives more Attendance & Subscriptions

- More Dollars for More Great Content > Repeat Cycle Again

What Might a Disney+ Home Run Look Like?

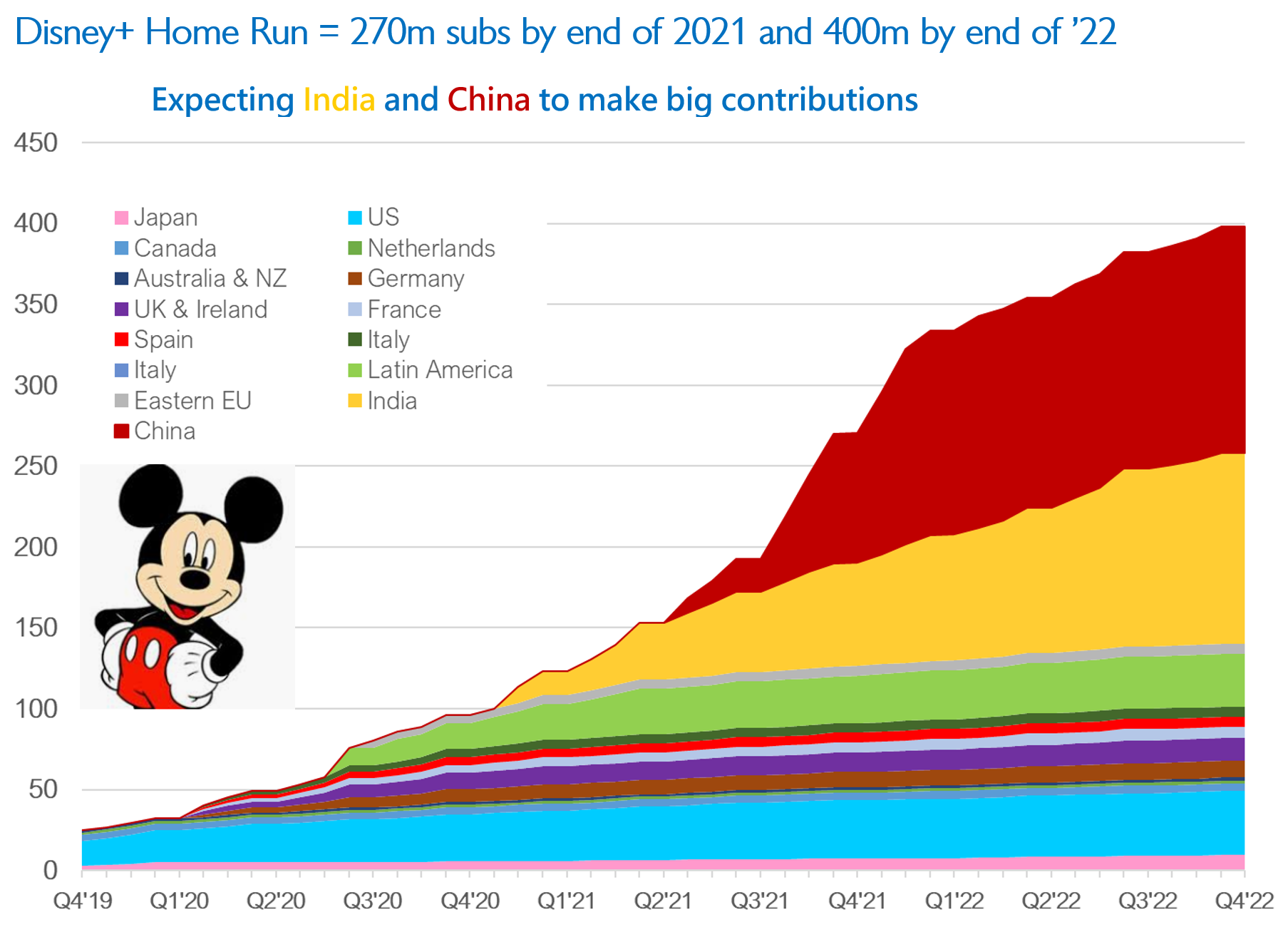

Given the rapid pace of Disney+ subscriber growth, the product’s performance, favorable reviews, consumer survey data, and the Disney+ geographic expansion schedule, we suspect that subscriber numbers could be far above bullish expectations and guidance. In this home run scenario, Disney+ exceeds 270m subscribers and breakeven profitability by the end of 2021 based upon our modeling of a country-by-country (here) roll-up (here). Additionally, this scenario envisions first-year subs approaching 100m versus the Wall Street expectation of 35m. The 270m number (here) likely seems aggressive given that it took Netflix five years to go from 14m (2014) to 165m (2019). However, Netflix was the pioneer and they laid the groundwork for the SVOD industry and Disney+. Moreover, awareness of Disney’s IP is nearly ubiquitous in the developed and developing world.

When Netflix blazed the trail and laid the first tracks, consumers had little understanding of the service and its content, as such the purchase friction to signing up was very high. In contrast and as one example of many, Disney+ will have its content and service aggressively and broadly marketed by the Indian platform Hotstar (Disney-owned) to its 700m monthly viewers and Star India (also Disney-owned) to its 800m monthly viewers leading into the launch in India. Moreover, Disney+ is likely to launch in India at a very low price; we forecast around $1.00 per month or 71 rupees. Netflix started at 500 rupees which was too high for most households in India; Netflix subsequently launched a mobile-only plan for 200 rupees.

Separately, Disney+ will use every available distributor to blast out its product in every market like it has done with Verizon in the United States and Canal+ in France. In contrast, we are not aware of any distribution partnerships used by Netflix for their launches. Separately, Netflix’s growth in many markets was hindered by limited broadband. Given the much higher levels of fixed and mobile broadband penetration in 2020, Disney+ will face no such hindrance. Lastly, in Netflix’s Q4 results, commentary, and Q1 guidance, there are no signs of growth saturation in any of its international segments.

Based upon the above market and pricing assumptions and the guidance provided by management last spring, we have formulated a revenue build model for Disney+ (here) and from this, we reach the conclusion of Disney+ reaching breakeven by the end of 2021 (here). We have also stress-tested our model for higher churn and SAC and still see subscriber counts and profitability (here) far ahead of Street consensus and management guidance.

What Does a Home Run Mean for Disneys Overall Market Cap?

We believe little is priced into Disney’s valuation in the long-term for significant success in Disney+. In this home run scenario, Disney+ may produce over $9B in after-tax cash flow by 2029 and generate $1B in annual cash flow growth thereafter. $1B x a 25x valuation multiple is $25B/year, or demonstrable value creation. This increase in value will be influenced by Disney’s film release schedule which is published through 2022. That schedule suggests a flat global box office for Disney in ‘21 and 20-30% growth in ‘22 (here). Given that Disney hasn’t published the releases beyond this period, we just flat line our estimates for future periods. Our modeling does not take a pollyannish view of linear-TV or ESPN, and it assumes that ESPN linear-subs get cut in half by the end of ’27 (here).

In the home run scenario, we are forecasting total company annualized growth of +13% EBIT, +18% EPS, and a 2026 price target in the $555-$600 range (here). That price range works out to a ~25% CAGR, suggesting a year-end 2020 value of around $188 per share. Additionally, we expect Disney to evolve into a significant technology-platform company beyond that period which will allow for a larger addressable market and over $1T (here) in additional value creation ($600/sh) above what Disney+ and the other business will deliver. Historical parallels to this type of business transformation include that of Netflix, Apple, Microsoft, and Adobe.

What if Disney+ is Not a Home Run

- Neutral scenario (here) of ~$252 per share should the business not-transform and Disney+, Hulu, and ESPN+ (i.e. DTC) only achieve breakeven profitability.

- Downside scenario of ~ $176 (here) should the Disney media domestic further worsen, along with a 30% cut to Studio profits, modest growth at Parks, and DTC only breakeven.

The Streaming Wars Fallacy

Even in this home run scenario, we expect no material “crowding-out” between the various new streaming services. There is ample enough consumer interest to go around (here). We reject the term “streaming wars” and believe that the expression is a sensationalizing tool invented by journalists to foster drama that steals attention to create temporary audiences. The existing margin structures of Netflix and Hulu are likely to continue their improvements. Additionally, we see no reason to moderate our subscriber estimates for either company.

We did observe that Netflix’s Q4’19 domestic subs missed guidance and that net adds were only 420K vs. 1.5m in Q4’20 due to higher churn and potentially fewer gross additions. We are not surprised that some households economized on their streaming services and tested Disney+ as a substitute. However, we expect these consumers to return to Netflix while keeping Disney+ as consumers are likely to view both services as offering strong value relative to other entertainment services and offerings (theatrical for example). Consequently, we expect Netflix to grow domestic subscribers in ’20 and ’21 by ~2.5m/year. However, to do so, Netflix pricing will be relatively restrained at +2-4% per year. Additionally, Netflix may choose to more aggressively police account sharing which by some estimates could add up to 14% of its domestic subscriber base (+8.5m).

Iger Autobiography Insights

Bob Iger published his autobiography in November of 2019, which allows the reader significant insights into his business perspectives and his longer-term aspirations for Disney, which informs the above view of Disney becoming a technology-platform company. Additionally, Iger and Disney have changed the incentive compensation structure for executives with the amounts based upon Iger’s own assessment of how an executive was/is contributing to DTC’s success. Said differently, in Disney’s upper-level management the number one priority is DTC. Consequently, given the largely singular focus of Disney on Disney+ (and despite its enormous size and divisional structure) we are very confident that the focus and alignment, along with its nearly unlimited influence and resources are going to propel Disney+ subscriber growth far beyond internal and external expectations, as we have just shared.

Material Moving Parts

The following can be material to both earnings and Disney+:

- The Twenty-First Century Fox (21CF ) acquisition and integration process damaged the 21CF domestic studio assets. The 21CF TV Studio and Film businesses appear to have been milked and starved during the 18-month acquisition process. The outlook for their profit contribution looks to have significantly eroded and there may be impairments on both businesses. Profit forecasts for this segment ($1.2B) are “guestimates” at best.

- Disney wants to rebalance domestic park attendance into less popular time periods. One such tactic to do so is to raise prices for the more popular periods and lower prices for the less popular periods. The goal of this tactic should be flat to higher attendance, not declines which is what has happened for the last two quarters. Parks are a critical part of the Disney Flywheel.

- Iger is retiring at the end of December 2021. Given Disney’s prior successor practices, they will elevate Kevin Mayer or Bob Chapek to COO in the back half of this year. On January 1, 2022, the COO will become the next CEO. Should the home run scenario come to fruition, Mayer will get the role.

Thomas Paulson has been an industry analyst and professional investor at AllianceBernstein, Cornerstone Capital, and Inflection Capital Management for US large-cap equity products. His focus is global consumer and TMT.