We’ve written about the imminent electrification of everything and the crucial role of the battery before. New segments are being disrupted by electrification, from homes to recreational vehicles to construction equipment. Essentially, anything powered by gas today will be electric in the future.

Electric vehicles (EVs) have been the focal point of investor thinking on electrification given that we’re seeing more and more of them on the roads. While the EV segment has an impressive forecasted growth of a 35% annual run rate, we believe that the growth in battery minerals and components will—within the next ten years—exceed EV growth.

This report on the cathode is the first of our five “Battery 101” reports.

What is a cathode?

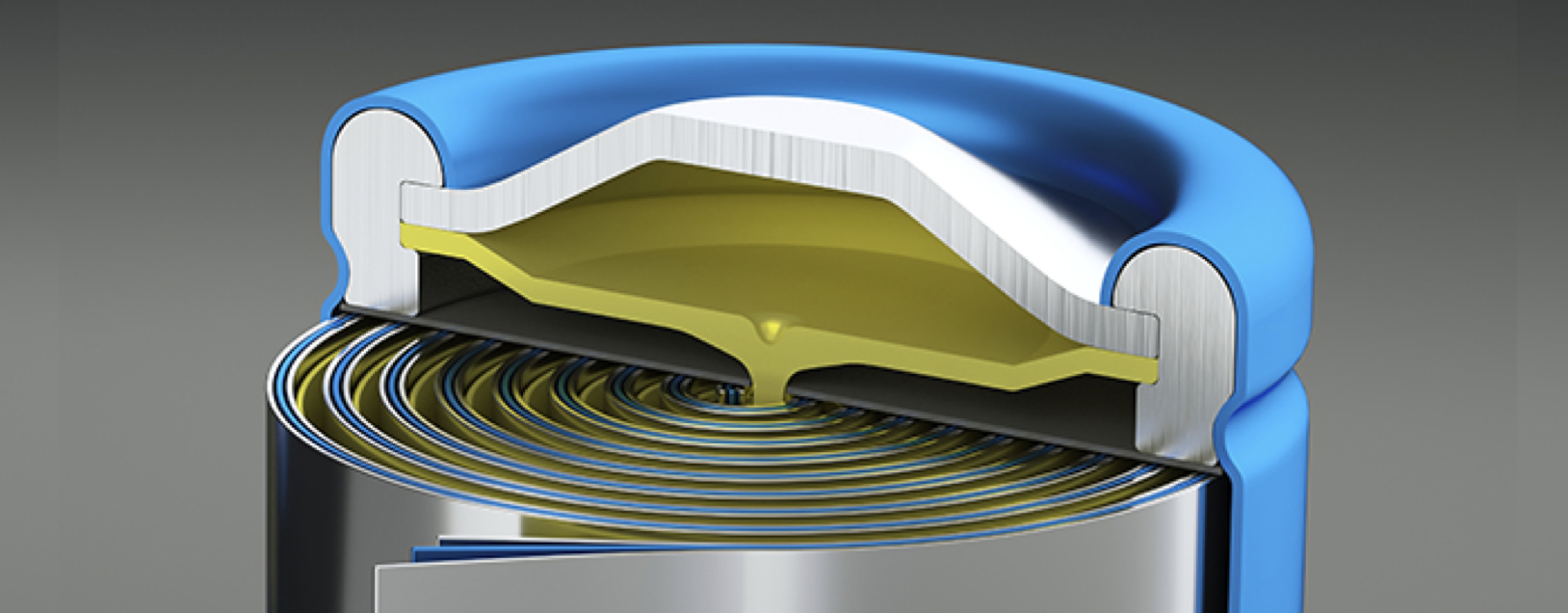

The cathode is one component of a battery cell and is one of two key elements that make a battery work, along with the anode. The word “cathode” was derived in 1983 from the Greek word, káthodos, which means “descent” or “way down,” referring to the flow of energy through a battery. The development of cathodes for lithium-ion batteries began in the early 1980s, so the underlying architecture has been around for about 40 years.

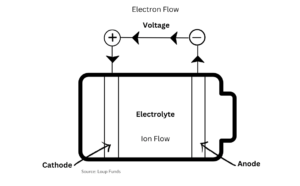

Here’s how it works: During a battery’s charge, lithium ions (electrons) flow between the cathode and anode repeatedly which creates an output of energy (mechanical). The cathode plays an important role in the four workings of a battery cell, which include:

- Ions flow from the cathode to the anode internally.

- As ions flow, the anode builds up an excess of electrons.

- Through an external circuit (conductive path), ions flow from the anode to the cathode which balances out the charge and gives power to the vehicle.

- When this transfer of ions eventually stops, it signifies the end of the battery life.

Cathodes are expensive

The battery in an EV is expensive, accounting for between 15-20% of overall vehicle cost. For example, in a $55K Model Y, the battery represents about $10-$12K. The material contents of the cathode make up about 50% of the battery cell cost. In other words, the Cathode Active Material (CAM) makes up 8-10% of the cost of an EV. CAM is so expensive due to the high costs of mining and refining materials, along with the global supply chain needed today to transport the CAM to battery cell manufacturers.

What companies make cathodes?

Cathodes are “made” by battery cell manufacturers including CATL (China), Panasonic (Japan), and LG (South Korea). We estimate that 90% of the cost of a cathode lies in the cost of the CAM. The primary material in the CAM is lithium, alongside a secondary metal which could be cobalt, nickel, or manganese. If you’re curious, copper is a key battery material that is used in the anode. The key CAM suppliers include L&F (South Korea), Kansai (Japan), POSCO (South Korea), EcoPro BM (South Korea), Mitsubishi Chemical Holdings (Japan), Umicore (Belgium), BASF (Germany), and soon-to-be Redwood Materials (US).

Proud to Be an American Cathode Producer

With continued geopolitical tension and supply chain constraints, the focus of the US government on localizing supply of rare materials for EV batteries has become increasingly apparent. The Inflation Reduction Act offers financial incentives and tax breaks for companies who comply with guidelines set for new materials, including sourcing from within the US or from countries with whom the US has a Free Trade Agreement. These new sourcing guidelines come when China is the leading force in global electrification through its Made in China (MIC) 2025 initiative.

In the coming years, we expect an increased emphasis on localized battery component manufacturing. At last count, 22 companies made announcements committing to investment and expansion of US-based battery production. More recently, from February to August 2022, the following OEMs and manufacturers announced additional plans to scale US facilities, including:

- CATL: The Chinese-based, world’s largest battery manufacturer has paused announcements on its plan to expand battery production to the US (potentially in South Carolina and Kentucky). We expect CATL to make its plans for US manufacturing official within the next two months.

- Toyota: Committed to an investment of up to $3.8B with a portion allocated to EV battery production. Production capacity will be increased to 40 GWh.

- Honda and LG Energy: Announced a joint venture to invest $4.4B toward a US-based battery production facility, with lithium-ion battery production to start by 2025. Annual production capacity will match 40 gigawatt hours.

- GM and LG‘s Ultium Cells LLC: The Department of Energy’s Loan Programs Office announced a $2.5B investment into the company battery cell manufacturing facilities located in Ohio, Tennessee and Michigan.

- Ford: Announced a new battery capacity plan to localize 40 GWh annually and direct source raw materials from the US, Australia and Indonesia.

- Hyundai: Committed an investment of $5.5B for its first dedicated EV plant and battery manufacturing facility in Georgia, with production set to begin in 2025. Annual capacity will reach up to 300K units.