Market volatility clusters. It always has and likely always will.

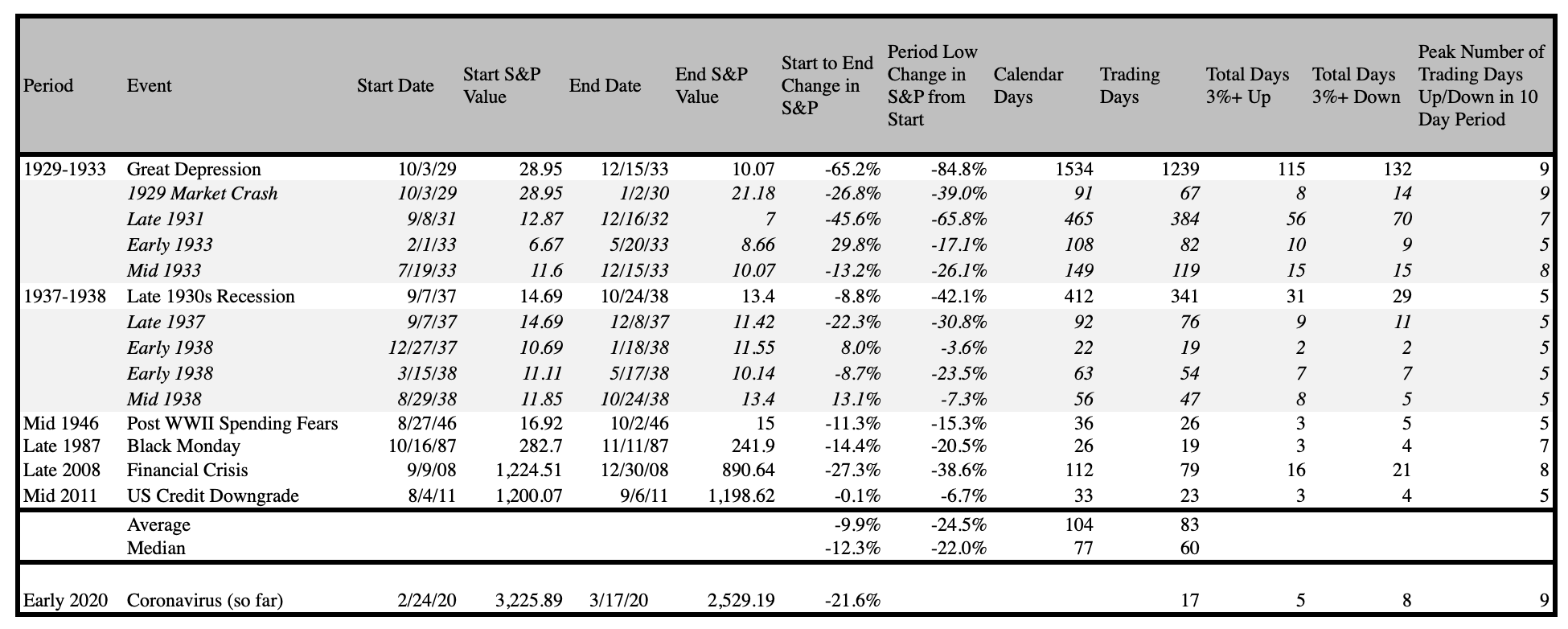

When we wrote about the recent market volatility last week, we had just lived through a period where seven of 10 trading days had a move of +/- 3% in the S&P 500. At the time, we noted that only six other periods in history had even had five days in 10 with a move of +/- 3%:

- The Great Depression from 1929-1933 (multiple times)

- The 1937-38 Recession (multiple times)

- The 1946 Post-War Correction

- The 1987 Black Monday Crash

- The Financial Crisis in 2008

- The 2011 US Credit Downgrade

After the continued wild ride over the past few days, we’ve now reached nine days in the past 10 with a move of +/- 3% in the S&P 500. The only other time we’ve seen that consistency in volatility over a 10-day period was in the market crash of 1929 at the beginning of the Great Depression.

For those interested in more history, we’ve seen four straight days of +/- 6% moves in the S&P 500, something that’s only ever happened before in the Financial Crisis. We’ve also seen seven straight days of +/- 4% moves. The only other prior period close was six days of +/- 4% at the beginning of the 1929 crash.

We don’t make these comparisons to suggest we’re entering a severe economic downturn on the scale of 1929 or 2008, as that doesn’t seem a likely scenario still. We make these comparisons to suggest that the volatility we’re seeing is unprecedented and may not be simply explainable by uncertainty. The current period of volatility appears to be feeding on itself more than in times past. Today’s market has the smallest daily influence from active fundamental trading in history with the rise of both algorithmic trading and passive investment allocation. In other words, the effect of those who set prices based on fundamental prospects of a business have less say than ever before, and it may be contributing to more volatility than in past periods of even greater uncertainty.

In uncharted waters, it’s hard to know when the volatility might calm, but I’ll reiterate a message my partner Andrew recently sent to our limited partners: “Patience, conviction, and humility have always served us well, particularly in times of uncertainty.” We don’t know when the markets will calm, but we’re certain that those with a patient and long-term perspective on investing in great tech companies will be happy with the results in time.