Redwood Materials just announced a partnership with Toyota to recycle hybrid batteries and materials, and the deal only scratches the surface of the company’s true potential to disrupt the auto industry.

The Toyota partnership

The first Toyota Prius was sold in 1997, and I estimate there have been between 3-5m cars sold in the US since launch. Those vehicles are getting old, many of those batteries can be refurbished and others can be recycled. For those deemed reusable, Redwood pulls out the raw materials (Copper, Lithium, Cobalt and Nickel) and remanufactures them into cathodes and copper foils that can be used in new battery production. This process is closed-loop battery manufacturing.

Closed-loop battery manufacturing

Redwood is aiming to build closed-loop battery manufacturing. This approach will convert the current logistics mess of global battery production (geologic mining, copper foil and cathode production) into a vertically-integrated process that can be effectively localized in one country. In 2024, Redwood Materials proposed that Cathode Active Material (CAM) production would be near OEM’s and can cost-effectively transform materials into cells for vehicle production. Redwood’s goal is to begin CAM production in 2024.

Scratching the surface towards scale

Toyota is a unique partner to Redwood because they have mastered the art of making hybrid cars, and is one of the only traditional car makers in battery deployment. The 3-5m vehicles sold in the US dwarfs the battery output of other OEMs, which means it’s unlikely that Redwood will sign new OEM partners that can move the supply needle in the next year. Over time, that will change. Eventually all cars will be EV, and those OEMs will likely want to partner with the incumbent which—while early—appears to be Redwood.

Long-term, the Toyota partnership will help Redwood win over additional OEM partners. It follows a string of deals with other automakers such as Ford, Volvo, Panasonic and Proterra. With more partners comes more scale of batteries that can be recycled, and this can bring Redwood to its big opportunity of reimagining cathode manufacturing in the EV value chain.

The cathode is the pressure point

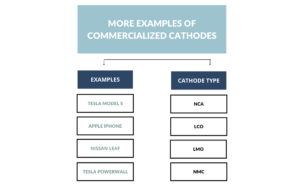

Four examples of commercialized cathode formulations.

Taking a step back, the cathode is—at a most basic level—the element that makes a battery work. It is the positively-charged part of a battery which discharges electrons used to power an electric motor. The battery in an EV is expensive, accounting for between 15-20% of the overall cost of a vehicle. For example, in a $55K Model Y, the battery accounts for about $10-$12K of costs. The cathode makes up about half the cost of a battery cell, or about 8-10% of the cost of an EV.

The biggest factor in the cost of the cathode is the CAM, which is the pressure point that Redwood plans to address.