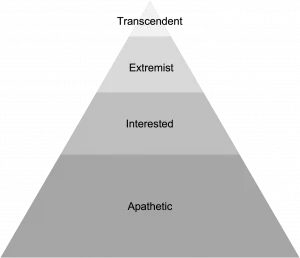

For any given topic — financial markets, individual stocks, entrepreneurship, politics — people fit into four categories: apathetic, interested, extremist and transcendent.

These mindsets fill the pyramid in inverse order:

The apathetic always make up the majority. Most people don’t care about most things. They don’t even factor into the game. They’re in the background as non-player characters (NPCs). If you care about something, you can’t be an NPC. If you are an NPC, you don’t care about the game in question.

The interested are interested. They take some initiative, but they’re not subsumed. They’re in just enough to matter to them. The interested don’t know enough to truly think for themselves; they look to the extremist and the transcendent to tell them what to think.

The extremist holds an unyielding view about a certain topic. Extremists are loud about and often get attention for their views. They will not change their minds nor will they capitulate to ideas that don’t directly support their view. Constant extremity gains attention and pushes edges. The extremist convinces the interested to follow them, since the interested aren’t often looking for complex thought or truth. They’re looking for tribes. Extremists are natural tribal leaders, religious leaders.

The transcendent mind operates with the ultimate mental flexibility. They can embrace extremes, but they’re also capable of changing their minds—often rapidly—upon new information. Unlike the extremist, the transcendent seeks truth where the extremist seeks allegiance to a cause. Transcendents have the most flexible minds. Extremists the least.

It may seem that transcendence is the best mindset because it’s at the top of the pyramid, but there are times when the extremist mindset may be better. There are more “successful” extremists than transcendents — if success involves money, attention, or power. That’s how most people define success for better or worse. Extremists make the best entrepreneurs, creators, and politicians (if the goal is winning votes). Transcendents make the best investors.

Entrepreneurs

To start a business and dedicate a career, that takes an extremist. You need to land on a new island and burn the boats. There’s no going back.

A belief that people would want to buy cloud software in 2000 or electric cars in 2004 or ride sharing in 2008 or room sharing in 2009 or digital assets in 2012 or NFTs in 2018. All those ideas seemed crazy at the time. There is something in 2022 that we will look back on and say, “that was crazy, but it worked.” What will it be?

Because of his impassioned belief in the unreasonable, the extremist entrepreneur can convince the interested to work with him. He can also attract investors. The extremity of an entrepreneur is an underrated signal for the potential of extraordinary returns that make great venture funds, and in some cases, great public market investments.

Creators

Audience is becoming the most valuable asset in the digital era. Audience builds influence, influence gives power, power builds more audience.

Audience is most easily won through extremity, per the pyramid. Extremists attract the interested. In some cases, they might even get the apathetic interested. Like the progression from audience to influence to power, extremity sparks audience. When audience is gained through extremity, it is extended through more extremity. If the audience doesn’t get the extremity that attracted it, they will go elsewhere to find it.

All attractive extremity is ideological in nature. It lends itself to cults. It requires faith in certain beliefs that may not be true. Obvious truth is never extreme because something everyone must accept cannot be extreme. Gravity is not extreme. By contrast, undiscovered or unaccepted truth and untruth must always be promoted in the extreme to gain any believers.

Politicians

Politics is necessarily the domain of disputed truth. If politics were only about undeniable truth, we wouldn’t have anything to argue about.

One of my favorite quotes is:

If you say you’re a unifier, you expect and usually get applause. I’m a divider. Politics is division by definition, if there was no disagreement there would be no politics. The illusion of unity isn’t worth having and is anyways unattainable.

- Christopher Hitchens

The best politicians attract the most attention, grow the biggest audience, and thus gain the most power. This may be axiomatic to anyone paying attention to modern politics on either side. It also means that the “best” politicians must be the ones who most effectively employ extremity.

Investors

The Hitchens quote could just as easily be about investing with a nuance: Unity is possible to attain in investing. One of my partners has a saying that successful investing is having everyone agree with you later.

The best investments eventually become consensus. Investing in Apple when everyone hated it in the early 2000s or doubted it in 2016 was non-consensus. Now everyone loves it, and the investment has been a great one.

The best investors are not ideologues but truth seekers. They must be flexible enough to change their minds lest they lose all their money by being wrong, particularly when exploring the non-consensus. Flexibility is an asset for the transcendent but a liability for the extremist where changing minds means losing power.

Consider the two classes of extremist investors: The permabull vs the permabear. Permabulls are right for long periods but when things get bad, they blow up. When they’re wrong, they can be really wrong. Permabears are the opposite. They’re wrong for long periods of time with occasional events of apparent genius. Early 2022 was permabear heaven and permabull hell.

The thing is that both permabulls and permabears can eventually find great success if they live long enough. And, most will also find painful decline if they keep living beyond that success. The optimal investor mindset is to accept when markets are dangerous and when they are opportune. They aren’t always one or the other. Or, forget markets and just look for the contrarian company or idea where everyone will agree with you later.