The Inevitable AI Bubble

AI will create one of the largest technologically driven bubbles of all time, and we’re only in the early innings.

Breakthrough technologies always invite bubbles. Alistair Nairn describes the similar pattern of new technologies in Engines That Move Markets:

First, a new invention is greeted with skepticism from incumbent technology and potential new investors. That skepticism is gradually replaced with enthusiasm, as businessmen come to appreciate the sales potential of the new technology. Soon, new entrants are flocking to the market, and venture capital funding is made available. Companies are started; almost all do well (in terms of share price) in the market on a tidal wave of enthusiasm. So far, so good; but as the technology begins to mature, a sense of realism sets in. Inevitably, for some, cash runs out. Companies begin to fold, only the strong survive and naive investors lose money in the huge rationalization. Pessimism begins to pervade the marketplace and stock prices fall across the board. Eventually, the market stabilizes.

This same pattern occurred with the development of the railroads, electric light, oil, the telephone, the automobile, the radio, the semiconductor.

The pattern also followed the Internet boom in the 1990s and the crypto boom just a few years ago.

I would take the argument a step further: Not only are bubbles a common feature of new technologies, they are a necessary occurrence. Bubbles ensure that more than sufficient amounts of capital are invested into the emerging technology to give it the greatest chance of breaking out. Without “excess” capital chasing every bad idea, especially bad ideas that were actually great, we may have never enjoyed the full benefits of railroads, the automobile, or the Internet.

In this light, bubbles get an unfairly negative connotation.

Skeptics will be right about an eventual bubble popping, but they probably won’t make much money either way. Not as much as the optimists. As a rational optimist who tends slightly more skeptical than optimistic, I need to remind myself often that skeptics are right, but optimists make money. There’s infinite upside to bets on something working but only 100% upside from shorting it and 0% upside to just avoiding it. Infinity > 100% > 0%.

I have a growing belief that playing bubbles will prove better for generating alpha than fundamental stock picking for the next decade. As more assets go toward indexed strategies, the less fundamentals influence investor behavior. Bubbles necessarily influence investor behavior because they are a social phenomenon created by chasing the bubble assets. The deep value mid cap stock can languish in obscurity for longer than you can stay patient, but the bubble small cap stock will be found in record time.

So if we embrace the virtue of bubbles, then we need to figure out how to profit from them.

How to Play the Bubble

The Dotcom boom gives us a good framework for how to think about the progression of a technologically driven bubble: Hardware > Data > Applications.

I outline this framework in my Investing in AI Mental Model, but the key details are:

- Hardware booms first because you need the infrastructure to support the new technological demands before you can deal with data and applications. Hardware winners win because they drive cost efficiencies for companies supporting the new paradigm. Cisco switches enabled greater data transfer which meant more efficient Internet traffic. NVIDIA GPUs process deep learning model demands better than CPUs. If any company is to dethrone NVIDIA, it will be because they drive another level of efficiency.

- Data comes next. Data winners win by making data more accessible and usable by application creators. Oracle won the data battle for the Internet. Amazon’s AWS won it, at least so far, for the cloud era. Microsoft is aggressive in its efforts with Azure and OpenAI, while players like Databricks, MongoDB, and vector specialists Pinecone and Weaviate all also play in the AI data layer.

- Applications often boom last because they see the impact on revenue last, but companies that build the application layer often end up the biggest winners of all because they own end customer relationships at massive scale. Microsoft won the PC interface and used that position to develop Office. Google and Amazon won as interfaces to information and commerce on the Internet. Apple and Google won as the interfaces for the smartphone revolution. All remain dominant players in the areas they won. OpenAI with more than a billion users who’ve tried ChatGPT is the front runner as the big application layer winner. The company’s reported $90 billion valuation shouldn’t surprise us in that context. More on that in a minute.

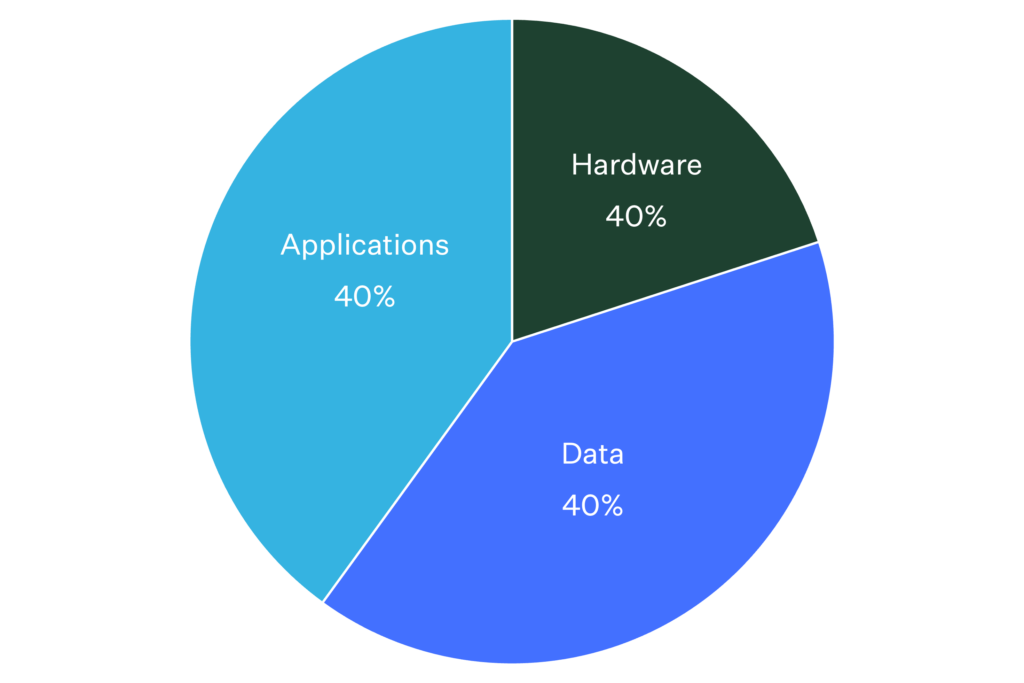

To play an AI bubble, I’d favor a distribution of investments something like 20% to hardware, 40% to data, and 40% to applications.

Hardware has already run. It will probably run more in a bubble, but there’s a case to be made that the upside is greater in the other categories, and max upside is what we want if we’re playing for bubbles.

Data feels relatively less appreciated, although many of the most pure-play AI data companies are still in the private markets. The same can be said of application companies outside of the mega cap tech stocks, and the application side comes with the largest outcome potential.

As for what actual stocks to invest in through these categories, the Deepwater Frontier Tech Index that powers the Innovator LOUP ETF also has more than 40% of its portfolio tied to AI stocks. My Intelligent Alpha AI Average also tracks 30 public AI-related stocks. It’s beaten the Nasdaq 100/QQQ by 150 bps since inception. Layering private companies into liquid public exposures gives the AI bubble surfer even more options for a dynamic portfolio.

But suggesting one buy a portfolio of AI-related stocks to play the AI bubble is obvious and easy. The harder part of a bubble playbook is timing: How do you know when to get in and when to get out?

Timing the Bubble

Many think we’re already in an AI bubble. Concerned bubble watchers point to the incredible performance of the Magnificent 7 tech stocks which have propelled the Nasdaq up 38% YTD. NVDA alone is up over 200% YTD. Those same skeptics will also undoubtedly point to OpenAI’s rumored financing at a $90 billion valuation.

History suggests AI bubble watchers are premature.

In 2000, the Nasdaq peaked at a P/E of 200. It trades in the 30s today, so the Nasdaq would have to increase almost 6x from here to trade at the Dotcom peak. NVDA trades at roughly 35x forward earnings. In 2000, CSCO traded at around 100x forward earnings. So, NVDA would have to increase another 200% from here to get to CSCO-level craziness.

OpenAI is on a $1.3b annual run rate. Assume they hit $1.5b in revenue next year, that’s 60x forward revenue for a company growing solid triple digits y/y. A 60x forward multiple is not far off from what MSFT paid for FB in 2007 when it invested at a “crazy” $15 billion valuation.

AI might be frothing, but objective comparison to a bonafide bubble says we’re nowhere near roaring insanity. The current AI bubble is closer to 1995 than 2000 using the Dotcom boom as a comparison.

The macro setup for the AI bubble is eerily similar to the backdrop of the early 90s too, which creates the hardest part of timing when to get aggressively long AI.

In 1994, the US economy was a few years into recovery from the 1991 recession, but inflation was elevated at 3%, and the economy was hot. The Federal Reserve started raising interest rates in ‘94, taking rates up ~3% in about a year. The result was a “soft landing” for the economy that slowed growth and avoided recession. Sounds a lot like 2023 as economists debate the possibility of a soft landing in the face of rapid interest rate increases over the past year plus.

The similarities in economic backdrop between the 1990s and 2020s highlight two important things relative to the coming AI bubble.

First, zero rates help form widespread asset bubbles like the Everything Bubble of 2020-21, but they are not a necessary condition for a technologically driven asset bubble. Between 1995-2000, the lowest 10-year yield was around 4.4%, not far from where we are now. The 10-year spent much of the early-to-mid part of the Dotcom bubble above 5.5% and even spent some time around 7%.

Rates might feel oppressive now vs the zero we’re used to, but mid-single digit rates won’t stop an AI bubble.

Second, a soft landing in ‘94 provided fertile economic ground for the formation of the Dotcom bubble. Counterfactually, it’s hard to say whether or not the Internet boom would have happened the same way if the US economy went into recession in the mid-90s. Perhaps the Internet bubble would have been delayed or temporarily crushed. It would not have been avoided.

Placing Bets

So, here we stand in 1995 of the AI bubble, economic questions abound but bubble certainty on the horizon. What do we do?

There are two obvious paths: patience or aggression.

The patient approach would wait to see what happens with the economy. If we get a soft landing, the patient approach misses the start and may be part of the middle of the bubble, but bubbles last longer than rational minds can fathom. There is still opportunity even in patience. If we get a recession, the frothing early AI bubble may temporarily unfroth, giving great opportunity to the patient follower.

The aggressive approach goes all in now, and the outcomes are the inverse of the patient approach. If we get a soft landing, the aggressive participant gets the benefit of still being early to the AI bubble, maximizing upside. If we get a recession, the temporary cooling of the bubble will result in paper losses, perhaps dramatic, although it won’t stop the bubble. If the aggressive player can withstand pain, he can still win in the long run of the AI bubble.

There are always middle paths in markets too, although middle paths usually mean middle results vs extremes. The middle path might be to load up on Magnificent 7 stocks that seem to be relative safe havens for a recession as well as AI beneficiaries. One might even argue that this middle path is the consensus playbook for the AI bubble now given the performance of those stocks.

No matter which path one chooses to play the AI bubble, the greatest danger is always in being swept up in the mania. It is in telling oneself Templeton’s most dangerous words in investing: “This time is different.”

AI won’t be different. It will boom into a bubble just like the Internet because that’s what must happen for the technology to reach its potential. AI valuations will get beyond silly, and they will come back to earth. The alpha-seeking bubble rider must sense the peaks of insanity, which can only be felt through intuition, not logic.

Peaks happen when a common narrative suggests that traditional ways of valuing assets are no longer relevant. Peaks happen when the landscaper is making more money from day trading than mowing lawns. Peaks happen when alcoholic beverage makers add the bubble term of the time to their company name to juice their stock.

When we see those signs, then it’s time to start doubting the continuation of the bubble.

In the meantime, we should celebrate the coming AI bubble because it means we’re going to get a life-changing technology and an opportunity for life-changing investment results – if we can keep our heads.