We hear a lot about the exploding budgets that tech giants are spending on original content as consumers continue to cut the cord. In the last few years, some of the same players have started to add live sports to their platforms. We wanted to dive into some of these deals and compare them with existing TV contracts for NFL, NBA, and esports. First, let’s establish the players.

Amazon – Amazon owns Twitch, the leading gaming streaming platform. Twitch started out as an exclusive video game streaming platform but has added traditional sports in the past few years. Twitch offers esports, the NBA G-League, and beginning in 2018, Thursday Night Football.

Oath – Oath is a subsidiary of Verizon Communications. In June 2017, Verizon completed its acquisition of Yahoo and placed it under the Oath umbrella. Oath offers NFL games streamed on Yahoo Sports and go90. Verizon also manages the streaming of games through the NFL app.

Tencent – Tencent, the Chinese tech giant, has a contract with the NBA to stream games in China.

Twitter – Twitter was one of the first tech companies to stream games, winning the first NFL contract for Thursday Night Football in 2016.

YouTube – YouTube has also been competing in the live sports streaming space. They are taking a different approach, first by launching YouTube TV to stream traditional broadcast networks, and second by partnering with networks to simulcast games as opposed to negotiating exclusive rights.

Disney – Disney owns ESPN on the broadcast TV front, as well as BAMTech, a spinoff of the digital arm of the MLB. Disney recently announced ESPN+, a streaming service for live sports shown on its network channels.

Traditional Broadcast Television – FOX, CBS, and NBC offer a broad range of live sports to their viewers. These parties negotiate streaming contracts with the leagues. Lately, these contracts have included some rights to game streaming.

Methodology. In order to figure out what these companies were paying for, we broke out the contract price by year, looked at the number of games the contract included and found or estimated the number of viewers. This gave us a price per viewer per game for each contract. A few notes about the estimated average number of viewers:

- For TV viewership, we used Nielsen’s average minute audience when available.

- For streaming viewership, we used average audience numbers. Total impressions is a much higher number, but not accurate for viewership.

- We tried to be as accurate as possible for the total number of games in a season. For the NBA, this number can change as the playoffs are a best-of-series, and not a set number of games.

- Some TV contracts include streaming rights. It’s hard to quantify the exact effect that the additional streaming rights have had on contract negotiations.

It’s also important to realize the average viewership numbers aren’t always an accurate representation of each game, nor what the contract is worth.

- For example, an average of 14.8M NFL fans tune in to a game. According to Nielsen, 36.5M viewers tuned in to the NFC Championship Game in 2017. The NFL TV contract doesn’t break out regular season and playoff games, and it’s easy to understand that airing playoff games is much more valuable.

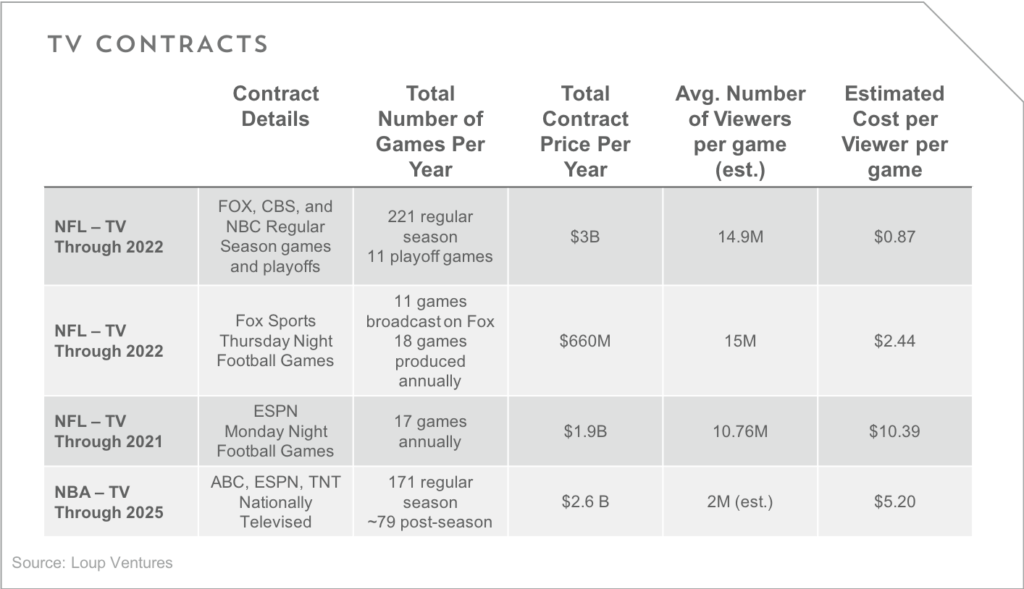

First, let’s look at TV contracts for the NFL and NBA.

Looking at the above chart, it’s clear how valuable the NFL has become for broadcast television and ESPN in particular. These contracts are in the billions of dollars annually for the ability to broadcast games. Cost per viewer per game differs based on the contract. Despite including post-season games (and the Super Bowl), the contract for FOX, CBS, and NBC appears to be the most cost-effective, despite ringing in at the highest dollar amount.

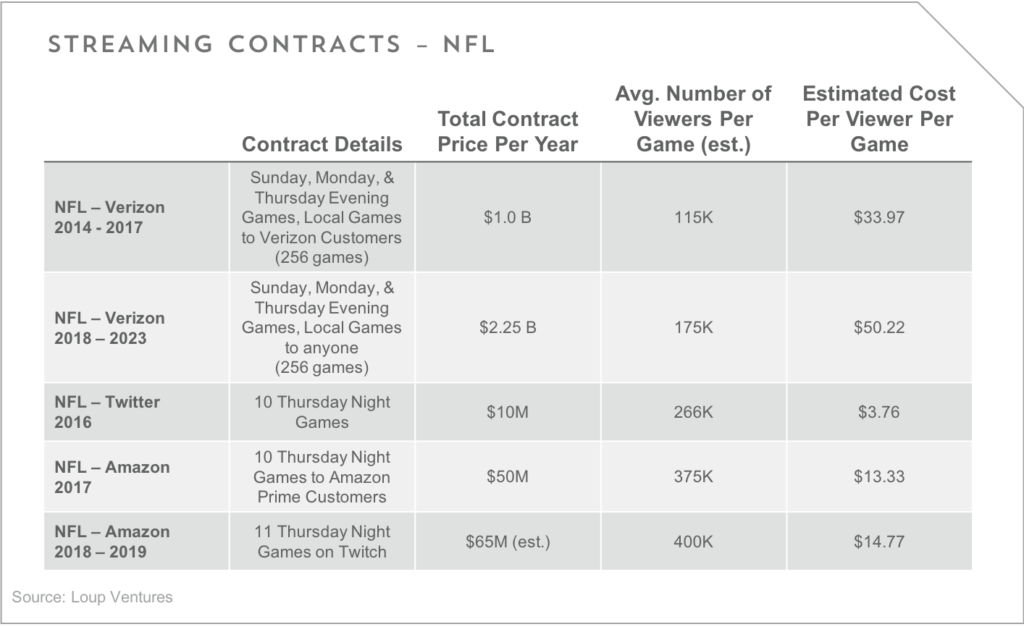

When it comes to streaming rights to NFL games, Verizon, Twitter, and Amazon have all been involved.

Verizon has paid a much higher price per year, as well as per viewer per game, than Twitter or Amazon. They have, however, been able to stream all games during the season on either Yahoo Sports, go90, or NFL Mobile. An interesting change to Verizon’s latest contract is that they are opening up streaming to non-Verizon customers. Previously, you had to be a Verizon customer to have access to the stream on any of the apps. Verizon seems more interested in increasing their viewers for selling advertisement spots than it does in earning market share in the carrier space.

Amazon has taken a similar open stream approach to their Thursday Night NFL deal. Last season, Amazon offered Thursday Night Football to its Prime customers only. Beginning this fall, Amazon will stream the games to not only its Prime customers but to anyone on Twitch as well. This move signals Amazon’s confidence that bringing more people to the Twitch site will boost Twitch’s notoriety. According to Streamlabs, Twitch’s average viewership in Q1 was 953K. This puts Twitch in the same ballpark, and by some measures, ahead, of CNN and MSNBC for daily average audience.

While the NFL remains the contract king for professional sports, the NBA has negotiated contracts with Amazon and Tencent for streaming NBA games. While the NBA, like most major professional sports leagues, offers its out streaming service for fans to watch games, they understand the importance of their content reaching different tech platforms.

In an attempt to boost international exposure, the NBA negotiated a contract with Tencent in 2015 to stream games during the season. Despite China being on the other side of the world, an average of 2M fans tune in to each NBA game. During the 2017 NBA Finals, Tencent saw an average of 12.2M unique viewers per game.

We also wanted to look at the first streaming contracts for the three franchise esports leagues we wrote about in our franchise economics note. While there is no TV comparison, the cost per viewer per game is on par with TV contracts for traditional sports but lags behind streaming contracts for traditional sports.

Who else might attempt to add live sports to their platforms?

Facebook – Facebook recently announced an agreement with the MLB for exclusive rights to 25 games this season on its platform. Last season, they simulcast some Friday afternoon games. Facebook has big ambitions in the live sports space. Adding live sports would be a great way to increase engagement on the Facebook Watch platform.

Netflix – Reed Hastings has stated before that Netflix won’t do live tv, nor live sports. Today, Netflix is focused on continuing to strengthen its original content. With Amazon, Netflix’s biggest rival today, making a big push into live sports, it will be interesting to see if Netflix breaks away from its tradition of original and on-demand content.

Apple – Apple has made an effort to incorporate live sports streaming onto its Apple TV platform, but to this point, has not negotiated any exclusive rights to stream any games. Apple will likely focus on building out its original content offerings in the near future before it explores negotiating streaming contracts.

What does this mean? It’s clear that tech companies are willing to make large investments in original content, and we expect this to extend into professional sports. This is good news for professional sports leagues, as their product will be able to reach more people. While cord cutting continues, more and more people are able to access the internet each day. As professional sports leagues seek to expand internationally, having partners who can reach these parties will be important.

Traditional network television and cable television giants might be in trouble. Live sports are one of the most compelling reasons for cable television subscriptions. as these products are available at a lower cost and through a more easily accessible platform, cord cutting will further accelerate. This is good news for tech companies, who can increase engagement on their platforms and attempt to reach new users by adding more live streaming content.

Disclaimer: We actively write about the themes in which we invest: virtual reality, augmented reality, artificial intelligence, and robotics. From time to time, we will write about companies that are in our portfolio. Content on this site including opinions on specific themes in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making investment decisions. We hold no obligation to update any of our projections. We express no warranties about any estimates or opinions we make.