We’re bullish on esports and committed to learning more about the space. The following note is an introductory piece that ‘shows our work’ as we get up to speed.

Given the recent explosion in popularity of esports leagues, we wanted to take a look at the economics of owning of an esports franchise. As esports has grown in popularity, the model for team ownership has begun to change. 2018 marked the first year of competition for two new franchise leagues for Overwatch and League of Legends, both of which now operate similarly to traditional professional sports leagues.

Traditional Esports Organization

Traditionally, teams participating in esports were self-organized. Teams would find the necessary players to participate and join leagues and tournaments by paying an entry fee. By winning or placing near the top of these tournaments, teams would be compensated from the prize pool. As esports became more popular, more revenue opportunities presented themselves for teams. These opportunities included: sponsorships, merchandise, branded skins, and advertising opportunities on streaming platforms.

With more revenue opportunities came better ownership organization. Ownership groups began to form, owning teams in multiple games. A team owner helps set up sponsorships, creates merchandise, and helps market the players. A good example of an esports organization is Team Liquid. Team Liquid was formed in 2000 as a Starcraft news site, before expanding to other games. It signed its first esports team in 2012 after recruiting a group of Dota 2 players. Since then, Team Liquid has added more players and teams, and now operates unique rosters in the following games:

- Starcraft II

- League of Legends

- Counter-Strike: Global Offensive

- Dota 2

- Heroes of the Storm

- Super Smash Bros. Brawl

- Street Fighter

- FIFA

- PlayerUnknown’s Battlegrounds

- Quake

- Rainbow Six: Siege

How do esports teams make money?

The breakdown of income varies by organization, team, and game. The vast majority of revenue (roughly 70-80%) for esports organizations comes from sponsorships and advertising. The remaining revenue is split evenly between ticket sales, merchandising, and media rights.

Sponsorships & Advertising

This category includes advertisements shown during televised and live-streamed events, as well as revenue from brands that sponsor individual teams. Companies are flooding esports players and teams with sponsorship opportunities, and it is only going to continue to grow. In addition, players and teams can earn money from product placement and recommendations. Team jerseys are essentially billboards benefitting from rapidly growing viewership. On Amazon’s live-streaming platform, Twitch, users can scroll down to see discount codes on gaming equipment, clothing, and other products, and streamers get a cut of the sales made using their discount code.

Esports teams don’t earn advertising revenue from an individual player’s live-stream, but rather when the team is participating in an event. Esports is well-positioned as an advertising opportunity for a number of reasons. First, cord-cutters are turning to online platforms, like YouTube and Twitch, for live entertainment. Second, esports’ younger demographics are valuable to advertisers. Finally, esports franchising adds stability for teams, their sponsors, and advertisers (more on that below). With more users flocking to online streaming platforms, and the audience becoming more valuable to advertisers, media rights contracts are becoming more valuable, and advertisers are paying more money to esports leagues, teams, and players. Global brands including Coca-Cola, Mercedes-Benz, and Intel have recently begun sponsoring esports in various ways because they recognize the value and massive opportunity. This builds an attractive foundation for investment.

Ticket Sales

Traditional esports events are held at event arenas around the world. The League of Legends World Finals has been held at Staples Center, and a mid-season League of Legends event was held at Wembley Arena. Other venues have included Commerzbank Arena in Frankfurt, San Jose SAP Center (also known as the Shark Tank), and Sang-Am World Cup Stadium in Seoul, South Korea. While the audiences vary in size, large events typically have between 10-15K in attendance, with some events attracting many, many more. Still, the lion’s share of esports fans watch the events online.

For franchise league esports teams, one difference when compared to traditional sports franchises is that they lack a home arena to sell tickets and merchandise. Instead, esports events are held at neutral, league-owned locations. As a result, teams and organizers share ticket revenue. Team-owned stadiums are very much on the mind of team owners, especially with the location-based teams in the Overwatch League.

The Overwatch League currently holds all of their events at Blizzard Stadium in Burbank, CA.

NA LCS hosts events its own studio in Los Angeles, CA, across the street from Riot Games headquarters.

Merchandising

A major revenue contributor in the merchandising category are in-game skins. A “skin” is simply different design or color scheme for a playable character or in-game item. Think about giving Mario an astronaut suit instead of his famous red hat and blue overalls. While skins are cosmetic and offer no competitive advantage, they are a major source of revenue for game developers because players enjoy the customization, and are willing to pay for it. In fact, in-game purchases (which skins contribute to) generated more than half of Activision-Blizzard’s revenue in 2017, amounting to $4B. Developers of esports-compatible games have tapped into this digital goods market and begun to create team-specific skins for major pro teams. Fans can purchase these skins to show support for their favorite team or player. League of Legends and Overwatch are the two major games that have esports-specific skins, but games with smaller competitive scenes like Halo 5 and Gears of War 4 have them as well. We believe the adoption from the OWL and the LCS is an indication that this is a market future esports organizations will want to target.

- League of Legends. Riot also creates skins for their league’s teams. When a world champion is decided at the end of each season, Riot makes a skin for the winning team. These are available for a similar price of about $5 worth of Riot Points, LoL’s in-game currency. The team receives 25% of the revenue from these skin purchases.

- Overwatch. Blizzard essentially created “jerseys” for each Overwatch League team and made them available for fans to purchase for $5 per skin via in-game tokens. See an example of playable Overwatch heroes wearing the team “jerseys” below. The competing teams also “wear” these skins during each and every OWL match, making it the esports equivalent of wearing your favorite team’s jersey. The revenue generated from this goes into a communal pot that is split evenly amongst the 12 teams.

Similar to other revenue sources, game publishers share revenues for skins with teams and organizations that create and promote them. Fans of specific esports teams can sport their favorite skins in-game. This is akin to wearing a Stefon Diggs jersey while pretending to catch game-winning touchdowns.

Media Rights

While the concept of watching others play video games may seem foreign to some, there are a surprising number of people that tune into esports events. Because of this, esports franchises have recently been able to benefit from broadcasting contracts, just as traditional sports. While some esports events reach cable television, the vast majority of viewership happens online.

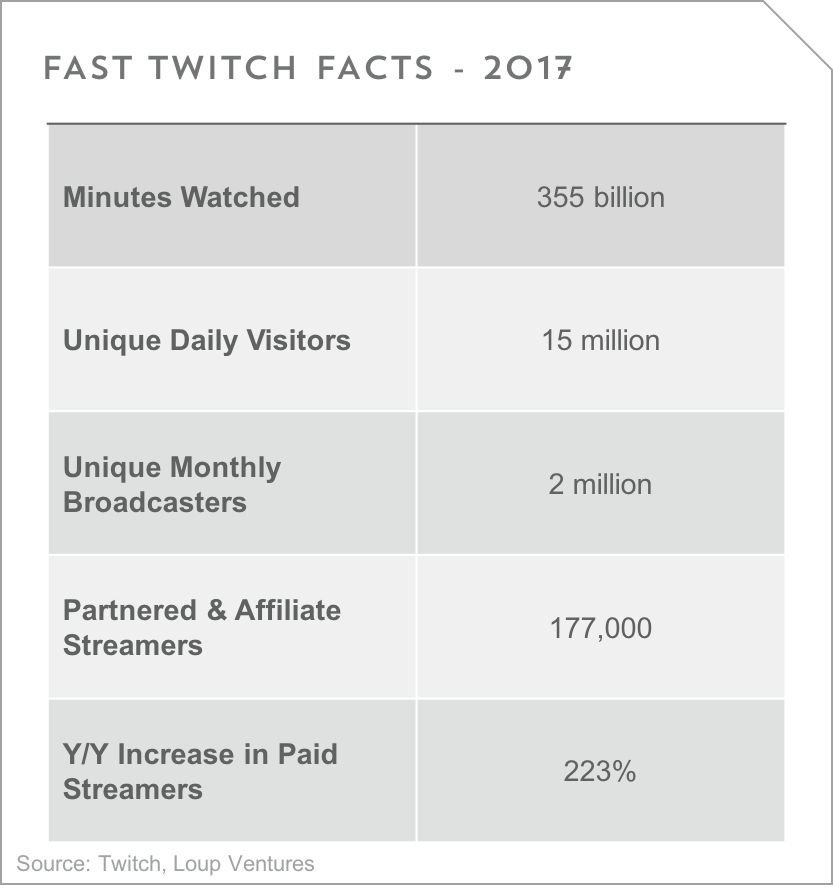

One of the most important players in the esports market is the Amazon-owned streaming platform Twitch. Acquired for $1B in 2014, Twitch had 355 billion minutes of content viewed and over 15 million unique daily visitors on its platform in 2017 and strong growth continues. More on Twitch’s metrics below:

On Twitch, gamers are able to stream their gameplay to viewers around the world. Believe it or not, one can make a living streaming gameplay on Twitch, and a fairly comfortable one at that. The revenue sources for streaming come from three main sources: advertisements, donations, and subscriptions.

- Advertisements. Streamers can have video ads play before their actual stream is shown (just like on YouTube), earning money passed on the number of impressions their channel gets. They also often have endorsements and advertisements on their Twitch pages from, for example, companies that make gaming equipment and computer parts. This creates a similar effect to traditional sports equipment endorsements where fans and amateurs want to use the equipment the best does, and having a well-known player use your equipment adds value and drives sales.

- Donations. Another source of revenue is donations from viewers. The amount and frequency of donations are up to the donor, some as low as $2 but some up into the tens of thousands. Here’s a video of a streamer receiving $62,000 in donations. Spend some time watching a popular streamer and you would be baffled by how often they’re getting donations, whether directly via PayPal or by “cheering” with Bits.

- Subscriptions. Finally, streamers earn money from viewers subscribing to their channel. A subscription lasts for a month and costs $5.00, and the streamer will usually take about half of that money per subscription. Twitch operates on a revenue sharing model with top streamers on its platform. The more popular the streamer, the higher percentage of revenue they are able to negotiate. Subscribing to a channel offers benefits like ad-free viewing and special chat privileges like emotes and additional features. Note that viewers re-subscribe every month. Some streamers have 0 subscribers and some have managed to amass over 100,000.

Esports teams and organizations are able to stream as well. The structure is exactly the same as explained above for individual streamers, the money is just given to the collective group as opposed to one person. Many times, though, a player on a particular pro team will have a stream more popular than his overall team’s. It’s an example of how important personal brands are in esports. Teams, however, don’t make much from having a player with a large Twitch following. Sure, they have the team’s logo and name on the page/video and the streamer is clearly representing that organization with merchandise and even the name they go by online, but teams won’t see any money from one of their players’ streams. The popularity, and therefore most of the money, comes from viewers being drawn to the content the individual is producing. Media rights for tournaments, and the revenue shared with the teams from those deals, is where actual esports teams will be able to cash in on this trend as individuals don’t stream tournaments, organizations do.

When it comes to tournaments themselves, massive audiences tune in to events online. The League of Legends World Championship amassed 60 million unique viewers. To help put that number in perspective, the 2018 Super Bowl reported just over 103 million viewers. While esports still has a long way to catch-up, it’s not dwarfed to the extent that some may think.

Tournament Winnings

For players, competition is what esports is all about. Players and teams compete to win tournaments and the associated prize pools. While these pools can be massive, such as the $24M+ pool for Dota 2, few players in the overall esports community take home winnings. Positively, most winnings are distributed directly to the players. While there are some large tournament pools, the vast majority of esports players and teams earn most of their income through the other sources we’ve talked about.

Esports Franchise Leagues

In 2017, three different franchise leagues were put into place, with competition beginning in the 2018 season. While the franchise leagues operate with similar game rules to previous leagues and tournaments, they require teams to pay a franchise fee in order to participate. By paying a franchise fee, leagues benefit from stability of teams and players, and operate the entire league’s advertising, sponsorship, streaming, and merchandising opportunities. This format is similar to the way major professional sports leagues operate. This shift toward franchising is a huge step for the legitimacy of esports, in both the eyes of the public and investors. Thus far in its young life esports has been plagued by a lack of stability, making it difficult to land sponsors. Before the franchising announcement last year, teams that placed poorly in the League of Legends Championship Series were relegated – similar to the English Premier League – where the teams that finished at the bottom were sent down and had to had to grind their way back to competing against top teams. The possibility of being dropped to a lower league with far less viewership and no certainty of promotion made companies very hesitant to inject money into something that could very easily lose its relevance. With the stability of franchises in leagues with multi-year broadcasting deals, the investors and sponsors are pouring in.

Today, there are three franchise leagues:

- League of Legends North American Championship Series – by Riot Games

- Overwatch League – by Blizzard Entertainment

- NBA 2K League – operated by the NBA, game developed by Electronic Arts

League of Legends North American Championship Series (NA LCS)

League of Legends, a multiplayer online battle arena (MOBA) game, was released in October 2009 by Riot Games.

While the League of Legends Championship Series has been around since 2012, they organized into a partnership with their 10-teams last fall, requiring owners to pay franchise fees. In order to participate, six existing teams paid a franchise fee of $10M, while four new teams paid $13M.

Many of the prominent esports teams have received support from professional sports owners or athletes. Of the four new teams to NA LCS, are all wholly- or partially-owned by NBA franchises: the Cleveland Cavaliers (100 Thieves), Houston Rockets (Clutch Gaming), Golden State Warriors (Golden Guardians), and Milwaukee Bucks (OpTic Gaming). The new teams aren’t the only teams with ties to professional sports. Echo Fox was formed by ESports Group, led by former NBA player Rick Fox. Team Liquid, one of the original esports brands, was acquired in 2016 by a group led by Jeff Vinik, owner of the Tampa Bay Lightning.

NA LCS began its season on January 20th, 2018. Games are streamed on its own website, YouTube, and Twitch. The prize pool for the league is $200K.

Overwatch League

Overwatch, a team-based, first-person shooter, was released in May 2016 by Blizzard Entertainment.

Blizzard Entertainment announced the Overwatch League in 2016, and established 12 teams in cities across the world. 9 teams are based in the US, with the other 3 teams based in Seoul, Shanghai, and London. Each team paid a franchise fee of $20M to join the league. There are already rumors of further expansion and increased franchise fees due to the early popularity and success of the league (10m viewers in its first week of matches).

The Overwatch League began its season on January 10th, 2018. Matches were initially streamed on the OWL website as well as MLG’s, but in January Blizzard reached a two-year, $90m deal with Twitch to broadcast Overwatch League matches on the streaming platform. The prize pool for the league is $3.5M.

NBA 2K League

The NBA 2K league is the first esports league to be operated by one of the four major pro sports leagues in the United States. The 2K league hosted open tryouts for hopeful participants in February, and has scheduled a draft to be held on April 4th at Madison Square Garden. 17 NBA teams will have a team in the 2K league. Players drafted to each franchise will live in the city they represent. For the first season, all games will be played at one or two central locations.

An interesting part of this league, is that viewers will not see current NBA players in the game. Instead, NBA 2K League participants will have their own created players that they will represent in the league.

The NBA 2K League begins competition in May. The NBA is currently in media rights negotiations to determine where the games will be broadcast.

What Does the Future of Esports Look Like?

We are big believers in the future of esports and gaming. While we are excited to see where the industry goes, the concept of owning a team in a franchise-based league poses a unique challenge.

Major professional sports have all been around for 100 years or more. If you ask fans of these sports, they believe that the games will exist in some form or another 100 years from now. Specific esports games on the other hand, eventually give way to newer options. On top of that, in esports, there is an entity that owns the game and has complete control over it, something traditional sports don’t have to deal with (no single entity “owns” the sport of basketball).

While there are some outliers that have remained in the spotlight for a long time, there are concerns about long-term interest in games from a competition standpoint. 10 years ago, some of the most popular esports games were Starcraft: Brood War, Halo 3, and Counter-Strike: Source. While some of these franchises are still seeing success with new releases of the games, there are new games that have dominated the scene as of late. League of Legends was released in October 2009, Overwatch was released in May 2016, and our office-favorite, Fortnite, was released early access in July 2017. There will always be new games to come along, which poses a unique challenge for esports owners of franchise fee paying teams. The owner of the Toronto Maple Leafs doesn’t need to worry about whether fans will want to watch the team play in 50 years. There is confidence in the long-term interest of the game. For esports, the question about long-term interest is harder to answer.

Disclaimer: We actively write about the themes in which we invest: virtual reality, augmented reality, artificial intelligence, and robotics. From time to time, we will write about companies that are in our portfolio. Content on this site including opinions on specific themes in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making investment decisions. We hold no obligation to update any of our projections. We express no warranties about any estimates or opinions we make.