We publish our annual predictions around New Year’s and, per tradition, do a mid-year check-in in July. Here’s how our predictions for 2021 are tracking.

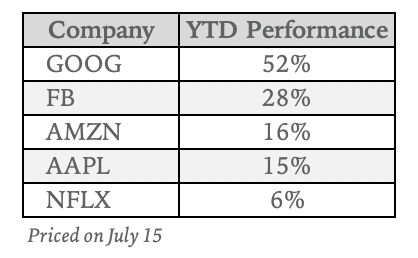

1. Apple will be the top-performing FAANG stock in 2021.

Mid-year update: AAPL is meaningfully behind Google and Facebook year-to-date:

The headline here is we will likely be wrong on our prediction that AAPL will be the top-performing FAANG in 2021. We look forward and ask the question, which FAANG will be top-performing through the rest of the year, and stand by AAPL. This is based on our original thesis that shares will benefit this year from:

- The accelerating digital transformation will provide a continued tailwind for the iPad and Mac businesses (about 25% of total revenue). This is playing out as expected, with demand for these segments outpacing supply. Apple is unlikely to reach demand supply equilibrium for Mac and iPad until the September quarter, which leads us to believe the best days are still ahead for Mac and iPad.

- 5G enthusiasm will grow in the back half of the year, starting a two to three-year iPhone upgrade cycle.

- While Street FY21 revenue growth estimates of ~28% are in line with our expectations, we believe consensus estimates for FY22 of 4% y/y revenue growth are too low. Ultimately, we believe FY22 revenue growth will be closer to 8%.

- Growing anticipation of new business segments that likely won’t launch until 2022 at the earliest, including hardware subscription offerings that build toward a 360° bundle, along with growing optimism around a massive expansion in the company’s addressable market with Apple Car.

2. FAANG will fracture.

Mid-year update: We predicted Apple and Amazon would set themselves apart from the rest of FAANG in 2021 in terms of performance. Again, we’ve been wrong on the companies that have led FAANG year-to-date, yet we have seen a fracturing in FAANG. We should have seen this coming. Google and Facebook have led the way because their ad businesses have enjoyed a double benefit this year of increased spending from brands to capture the surge in demand, along with a rise in ad pricing to reflect inflation. Both of these revenue increase factors fall to Google and Facebook’s bottom lines.

3. Tesla will launch a chaperoned robotaxi fleet.

Mid-year update: This is still a coin toss. On one side there is elevated regulatory scrutiny around Tesla Autopilot and FSD functions given a handful of fatal accidents this year. On the other end, chaperoned robotaxi is driven by humans (think of it as an Uber driver, in a Model 3 running a light version of FSD), so the regulatory environment should not be a factor. We continue to believe Tesla wants to participate in the robotaxi business, and a staged approach to build its brand in the space is most logical. Eventually, fully autonomous vehicles will be approved, and Tesla, along with its third-party operators, can turn on its autonomous fleet. In the near term, we don’t see this as a risk to Uber and Lyft, given the number of chaperoned vehicles in the Tesla fleet will not provide meaningful competition for the next couple of years.

4. Some Big Tech companies will be proactive around regulatory challenges.

Mid-year update: Using Apple’s adjustment to its App Store take rate for small developers as a signal, we predicted some Big Tech companies would make further proactive refinements in 2021 to stay ahead of the regulatory curve. This has not happened to date, as most Big Tech companies have been on the defensive as they face various antitrust lawsuits. In the end, these legal cases will take years to sort out and will likely require some Big Tech companies to make minor adjustments to their business practices.

5. Peloton will launch new exercise hardware.

Mid-year update: No updates here, and we continue to believe new exercise hardware is coming from Peloton by year’s end, most likely a strength machine (similar to Tonal).

6. Apple will launch AirTags and new services in 2021.

Mid-year update: This box has been checked with the introduction of AirTag in April, along with a podcast marketplace that gives creators another avenue to monetize their content. We see AirTag adding up to $3.3B in revenue in 2025, contributing just under 1% to Apple’s overall revenue by 2025. We estimate the new podcast offering could add more than $600m in high-margin revenue in FY26. Individually, these new segments are unlikely to move the needle for Apple, and in aggregate they continue fortifying Apple’s ecosystem.

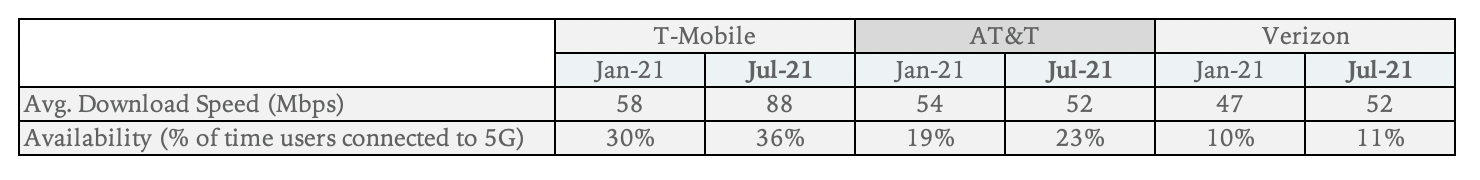

7. 5G coverage and performance will quicken.

Original prediction: By the end of 2021, improvements will be made, and 200Mbps download speeds will be more common, representing a step up from current 4G average download speeds of 35 Mbps. There is a caveat: while we believe all carriers will show an improvement in the latter half of the year, performance will vary based on provider.

Mid-year update: On track. Per Opensignal’s latest 5G Experience report, availability and speed have increased and performance varies by carrier, with T-Mobile continuing to lead the way. Long term, we continue to believe 5G will be a transformational technology as it will unlock new businesses.

8. The work-from-anywhere trend will continue.

Original prediction: With broader vaccinations and return to greater normalcy in 2021, 20% of knowledge workers will continue working either part- or full-time from anywhere, up from about 7% pre-pandemic.

Mid-year update: Directionally correct and underestimated. Year-to-date we underestimated the durability of the work-from-anywhere trend, as around 70% of knowledge workers are still working either part- or full-time remote. We’ve readjusted our thinking and believe long-term this number will settle around 40% given the greater employee and employer comfort with remote work, along with a sustained step down in business travel because of Zoom. As a proxy measure of our prediction, we expected Zoom revenue growth in CY21 would outpace Street estimates of 38% growth. The Street has since increased its estimate to 50%, which gives us confidence this will prove correct.

9. Video game streaming viewership will grow.

Original prediction: Total hours watched on Twitch will grow 25% plus in 2021, to more than 22.8B hours.

Mid-year update: On track. According to TwitchTracker, through the first six months of the year, 11.6B hours were spent watching Twitch, on pace for 23.2B hours for the full calendar year and in line with our prediction. We believe video game streaming will continue to gain attention share from video streaming platforms such as Netflix.