Over the last few years, we’ve made a dangerous habit of offering a few predictions for the year ahead. Here’s what we’re anticipating in 2021:

1. Apple will be the top-performing FAANG stock in 2021. This is the third consecutive year we’ve made this prediction. In 2019, Apple was the top performer, and the stock is set to repeat in 2020. We think Apple will come out on top again in 2021 based on four factors:

- The accelerating digital transformation means more people are working and learning from home, providing a continued tailwind for the iPad and Mac businesses (about 25% of total revenue). We believe these two segments can grow at 10% plus in 2021 and 2022, compared to flat growth in the last few years.

- 5G enthusiasm will grow in the back half of the year, starting a two to three-year iPhone upgrade cycle.

- While Street FY21 revenue growth estimates of ~15% are in line with our expectations, we believe consensus estimates for FY22 of 5% y/y revenue growth are too low. We expect those estimates to inch higher throughout FY21. Ultimately, we believe FY22 revenue growth will be closer to 10%.

- Growing anticipation of new business segments that likely won’t launch until 2022 at the earliest. We expect hardware subscription offerings that build toward a 360° bundle, along with growing optimism around a massive expansion in the company’s addressable market with Apple Car.

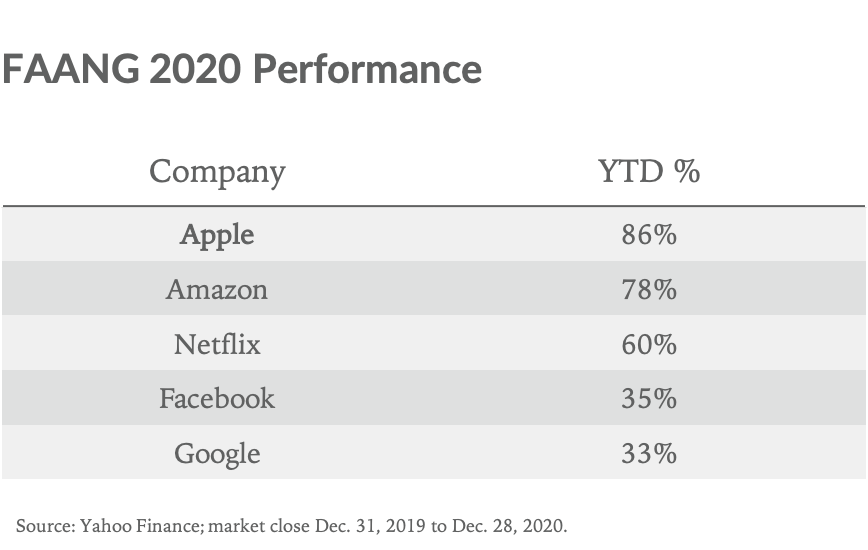

2. FAANG will fracture. In 2020, we saw the beginning of what we consider to be a separation in FAANG, with Apple and Amazon setting themselves apart. Year-to-date, Apple is up 86% and Amazon is up 78%. Netflix is up 60%, driven primarily by the stay-at-home trade. FAANG’s advertising companies, Facebook and Google, are up 35% and 33%, respectively. In 2021, we expect the strongest performance coming from Apple and Amazon, separating themselves from the rest of the group. Google’s on the fence with continued long-term gains, along with underappreciated opportunities in other bets, offset by potential regulatory headwinds next year. We have more modest expectations for Facebook’s and Netflix’s stock performance, given potential regulatory headwinds for Facebook and a reversion to the mean for streaming content consumption.

3. Tesla will launch a chaperoned robotaxi fleet. Musk has suggested FSD (full self-driving) robotaxi functionality is nearing completion, with availability dependent on regulatory approval. We believe that approval in the US will take a couple of years. Until then, we expect Tesla to ease consumers into the future with a chaperoned robotaxi fleet. By the end of 2021, we believe FSD will be ready, and the earliest versions of Tesla’s robotaxi service will require a driver to accommodate the regulatory environment (think of it as an Uber driver, in a Model 3 running FSD). In this scenario, drivers will benefit from reduced stress and fatigue, and Tesla will benefit by starting to build a ridesharing brand by easing riders into the robotaxi age with a human behind the wheel. Eventually, AVs will be approved, and Tesla, along with its third-party operators, can turn on its autonomous fleet. In the near-term, we don’t see this as a risk to Uber and Lyft, given the number of chaperoned vehicles in the Tesla fleet will not provide meaningful competition for the next couple of years.

4. Some Big Tech companies will be proactive around regulatory challenges. 2020 was a year of saber rattling from regulators that materialized in recent antitrust lawsuits against Google and Facebook. Investors are waiting to see if additional lawsuits emerge targeting Google and Facebook, along with initial claims against Amazon and Apple. We believe Google and Amazon will take Apple’s lead in proactively adjusting business practices to soften the threat of regulation. Apple’s recent adjustment to its App Store take rate showcased the company’s willingness to proactively refine its model, and we believe further refinements are likely in 2021 to stay ahead of the regulatory curve.

5. Peloton will launch new exercise hardware. No surprise here, given the company’s plans to acquire Precor along with commentary in Sept. that “strength is an important vertical for us to put a flag down on.” We believe that Peloton’s next product is most likely a strength machine (similar to Tonal). Outside of strength, Peloton still needs to lower the entry price for its bike category, which currently starts at $1,895. By the end of 2021, we expect that the company will have a bike available for less than $1,500. This is more difficult than it appears, given Peloton needs to provide equipment that is more durable than conventional home exercise equipment to reduce customer support and warranty claims. The company’s recent acquisition of Precor will give Peloton the manufacturing capability to scale output and launch new products. Peloton is on a mission to grow its ~2m subscriber base by converting the pre-pandemic 175m global traditional gym members into workout-at-home subscribers. Peloton’s current content offerings are working, as evidenced by 90% annual subscriber retention rates, nearly double industry averages.

6. Apple will launch AirTags and new services in 2021. First, AirTags; the rumor mill has been spinning for the past year that Apple will launch an attachable device to help keep track of your belongings. We think 2021 is the year. AirTags would compete directly with Tile and have the obvious advantage of being integrated within Apple’s Find My software, iCloud services, and hardware ecosystem. And, speaking of services, we believe 2021 is the year Apple will take a page from Spotify’s playbook and bundle premium podcasts (Podcasts+) with Apple Music and Apple One, at no extra charge for paying subscribers. Good news for podcasters, who may see Apple as another avenue to monetize their listener base.

7. 5G coverage and performance will quicken. We’re long-term believers in 5G and have been disappointed by carrier advertisements that have recently overplayed current 5G coverage and download speeds. By the end of 2021, we believe improvements will be made, and 200Mbps download speeds will be more common, representing a step up from current 4G average download speeds of 35 Mbps. There is a caveat: while we believe all carriers will show an improvement in the latter half of the year, performance will vary based on provider.

8. The work-from-anywhere trend will continue. Today, we estimate roughly 90% of US knowledge workers (about 1/3 of the US workforce) are working from home. Even with vaccinations and a return to greater normalcy in 2021, we believe 20% of these knowledge workers will continue to work either part- or full-time from anywhere, up from about 7% pre-pandemic. This will be driven by greater employee and employer comfort with remote work, as well as a sustained step down in business travel given video conferencing has been validated as an alternative to many in-person meetings. To best measure our prediction, we expect Zoom revenue growth in CY21 will outpace the current Street estimate of 38%.

9. Video game streaming viewership will grow. According to TwitchTracker, more than 18.3B hours have been spent watching Twitch streams in 2020, up 68% from 2019. For a point of reference, we estimate about 185B hours have been spent watching Netflix in 2020. We believe total hours watched on Twitch will grow 25% plus in 2021, to more than 22.8B hours. Said another way, video game streaming will gain share of time spent on Netflix next year. This phenomenon is not limited to Twitch, with YouTube and Facebook Gaming small in comparison to Twitch but gaining ground.

A look back at our 2020 predictions

1. Apple will be the top-performing FAANG stock in 2020 👍

- With three trading days left, it’s a bit too early to say definitively, although Apple currently holds the lead:

2. Tesla will exceed street deliveries estimate of 463k 👍

- While we won’t know until the first week in January, the likelihood is high that Tesla will exceed the 463k target. The company delivered 139k vehicles in the Sep-20 quarter, bringing 2020 global deliveries through Q3 to 319k. Tesla must deliver at least 145k vehicles in the Dec-20 quarter to surpass the Street’s estimate.

3. Direct listings become a well-accepted alternative to an IPO 👎👍

- This one’s debatable. While there were fewer direct listings than we expected (Palantir was the most notable direct listing in 2020), we believe first-day IPO pops for Airbnb (+100%) and DoorDash (+80%), as well as IPO delays from Affirm and Roblox, give credence to our prediction that direct listings will continue to gain interest as an accepted alternative to an IPO. The emergence of SPACs also offers an alternative to the traditional IPO process, the popularity of which we expect to continue in 2021, although at more measured levels than in 2020.

4. Amazon will add 30 Amazon Go stores 👎

- We missed this prediction. There are currently 26 Amazon Go convenience stores in the US, up from 24 at the end of 2019. Amazon took its foot off the gas rolling out new Go stores; however, we accurately predicted that Amazon would open a full-size grocery store utilizing its Go technology.

5. Netflix will meet paid net add expectations 👍

- The Street expected paid net adds of 26.6m in 2020. Spurred by everything that 2020 was, Netflix exceeded this target in just three quarters, adding 28m paid net adds through the Sep-20 quarter. Further progress in the Dec-20 quarter will extend the beat.

6. 2020 will be a year of reckoning for micromobility 👍

- The mobility space consolidated in 2020, led by Amazon’s acquisition of Zoox in June. Bird acquired Circ and Helbiz acquired Skip. That said, there was also a trend of divestitures that we didn’t foresee: Uber divested its self-driving and flying taxi divisions to Aurora and Joby, respectively, and sold its Jump bikes and scooters to competitor, Lime.

7. No AR glasses from Apple or Facebook 👍

- At its annual AR|VR event, Facebook outlined its vision to build consumer AR glasses in the next 5-10 years. No news from Apple.

8. Oculus Will Release a New Quest with Hardware Improvements 👍

- Facebook released the Oculus Quest 2 in October with graphics and processor improvements.