2021 was a challenging year to invest in disruption. November and early December, in particular, have been a bloodbath for frontier tech investors.

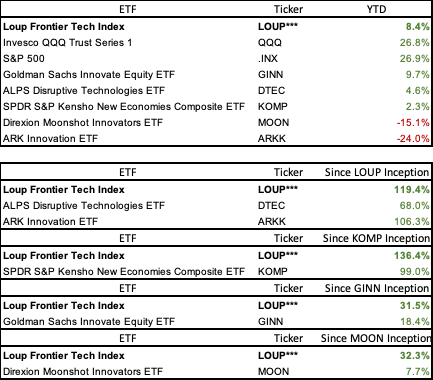

Major disruption funds performed below the broader markets for the year, as indicated:

As of 12/31/21

***The Loup Frontier Tech Index is licensed to Innovator and informs their LOUP ETF. Returns listed in the graph represent those of the index. For ETF information, visit Innovator’s site (note disclaimer below).

While the high-growth tech pullback narrative has been about those types of companies being more susceptible to higher interest rates, we believe that the bigger issue has been a realization by many market participants that valuation matters again. The growing respect for value has proven to be a tailwind for mega cap tech. We estimate that the Top 10 Holdings in the QQQ generated almost 90% of the fund’s return YTD weighted by market cap. FAANG did well in 2021. Not only was it hard a year to invest in disruptive tech — it’s also been hard to do it without participating in the strong tailwind from mega cap tech.

Our Loup Frontier Index was up 8.4% in 2021. The LFTI informs Innovator’s NYSE-listed LOUP ETF. We aim to beat the market over the long term with every product we offer and, while our index performance is disappointing to us, we are more convinced than ever that our strategy to invest in disruption at a reasonable price is the superior strategy for investing in disruption over the next several years as the market exits many thematic bubbles.

Ways to Invest in Disruption

Disruption-focused funds including the ones listed above, and many beyond, tend to come in three clear flavors in accordance with our four investor archetypes:

- Gunslingers: Disruption at any price. These funds represent disruptive technology well, but they ignore rational consideration of generating future cash flows to justify current prices. Instead, gunslinger funds optimize for the most disruptive companies in the most attractive disruption themes. There’s nothing wrong with the gunslinger approach. As we describe in our archetype overview, gunslingers that understand technology and get in early can do quite well if they also accept supply and demand. Eventually, all equity assets need to rationalize on cash flow generation, so the trick for the gunslinger is to get out when demand for the asset is highest. Few time this correctly.

- Indexers: Indexing all disruption at any price. Index approaches to disruption come in two types. First, many disruption indices take significant positions in the FAANG (plus MSFT, NVDA, and TSLA) names. While those mega cap tech favorites are driving disruption, nearly every investor already has significant exposure to those names just by owning the QQQ or SPY. Funds that optimize around the inclusion of FAANG names are closet indexing the most popular funds and serve more to increase investors to mega cap tech than expose them to disruptive technologies. The second index approach to disruption is to hold hundreds of companies that fit into the disruptive category without consideration for valuation. These funds offer exposure to disruption, but they don’t optimize for the most attractive companies on a price/technology basis.

- Concentrators: Curated disruption at a reasonable price. Valuation-aware disruption investors combine a deep knowledge of emerging technologies with a respect for how much growth is priced into companies pursuing such technologies. This is Loup’s approach, and we’ll describe it in more detail here:

Disruption at a Reasonable Price

The mantra at Loup is to invest in disruption at a reasonable price so we can sleep well at night.

We’ve done internal case studies on the stock performance of several of the most successful tech companies in the world — the ones that now make up a significant part of the S&P 500 and QQQ. Those studies demonstrated that if investors paid prices that accurately reflected the tremendous future growth of such companies throughout history, the returns from those investments would have trailed the broader market despite the disruptive power of those companies.

Paying any price for a company simply because it’s disruptive doesn’t work. If you pay for all the disruptive power of a company upfront, you’re likely to be disappointed by the long-term result.

Investing in disruption helps us sleep well in the midst of a rapidly changing world, but paying any price for disruption makes us sleep poorly. We believe that a company eventually needs to justify its price through future cash flow generation. To be a great investment, an equity asset needs to generate far more in cash flow than is implied in its price. The point of any investment strategy should be to generate attractive returns, not just to bring exposure to a category.

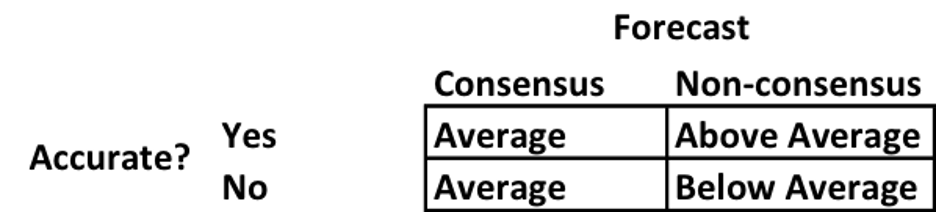

Howard Marks described the investing game better than anyone: To generate extraordinary investment results, you must do something different than everyone else. If you act according to consensus, you’ll get the same result as everyone else — regardless of whether consensus is right or wrong. If you do the non-consensus thing, and you’re wrong, you get terrible results. If you do the non-consensus thing, and you’re right, you achieve the extraordinary.

The most contrarian viewpoint in investing in disruption is to emphasize future cash flows — not technologies, market sizes, or optionality. All those aspects of disruptive investing only matter to the extent that they generate incremental cash flow above and beyond what’s already priced into a stock.

A respect for valuation is intentionally built into how we construct the Loup Frontier Tech Index so that we create exposure to disruption at a price that gives us a chance to generate strong returns.

Variant Perception

There’s a persistent interest in disruptive companies because disruption is exciting. Disruption has the potential to create the next FAANG 10-40x returning stock, the next Tesla, the next Bitcoin. Those returns are intoxicating.

The problem is that most of what’s considered disruption consists of things that are obviously disruptive. Tesla was a great investment when no one believed in electric vehicles. Now everyone sees EVs are the future. That doesn’t mean Tesla still can’t generate attractive returns, but it’s mathematically and economically harder for them to do so compared to their valuation many hundreds of billions of dollars ago.

With a market full of investors seeking disruptive tech, there are three contrarian ways to find disruption at a reasonable price:

- Be earlier than everyone else.

- Understand a much bigger opportunity than everyone else.

- Look where others aren’t looking.

Each of these strategies can be effective when applied appropriately, and we use each in our investment approach.

Being early works not only because you benefit from the tailwind of excitement that benefits the gunslinger but also because future cash flows may not be fully priced into emerging disruptive tech. Understanding an opportunity bigger than everyone else has been the story of global e-commerce for much of the last decade with AMZN, MELI, SHOP, BABA, etc.

But the excitement around disruptive tech means that it’s hard to get ahead of a trend for very long, and it’s hard to find opportunities that aren’t fully appreciated.

Looking where others aren’t is the most difficult of the three options. It often requires consideration of companies that appear to be obvious candidates for being disrupted by the disruptors. One of the best performing stocks in our index over the past year was Ford, up over 130% in 2021. Telsa was up almost 50% in the same period.

At the beginning of last year, most people had written off Ford and the other auto OEMs as DOA to Tesla and the other EV innovators. Our view was that Ford still had great brands and an aggressive electrification plan that wasn’t priced into the stock. That proved true, and now the stock seems to reflect a much fairer view of Ford’s future.

We won’t always be right, and we won’t always be different. But when we see an opportunity to be different with good odds of being right, we take it. That’s the only sustainable way to invest in disruption.

Additional disclaimer:

The link to Innovator ETFs’ website may contain information concerning investments, products or other information. Loup, LLC is not responsible for the accuracy or completeness of information on non-affiliated websites and does not make any representation regarding the advisability of investing in any investment fund or other investment product or vehicle. Importantly, Loup, LLC is not compensated for linking you to any non-affiliated website and instead is only compensated with an asset-based fee in the limited capacities as either a licensor of intellectual property or a sub-adviser to an investment adviser. The material available on non-affiliated websites has been produced by entities that are not affiliated with Loup, LLC. Descriptions of, references to, or links to products or publications within any non-affiliated linked website does not imply endorsement or recommendation of that product or publication by Loup, LLC. Any opinions or recommendations from non-affiliated websites are solely those of the independent providers and are not the opinions or recommendations of Loup, LLC, which is not responsible for any inaccuracies or errors. THIS INFORMATION IS NOT AN OFFER TO BUY OR A SOLICITATION TO SELL ANY SECURITY OR INVESTMENT PRODUCT. SUCH AN OFFER OR SOLICITATION IS MADE ONLY BY THE SECURITIES’ OR INVESTMENT PRODUCTS’ ISSUER OR SPONSOR THROUGH A PROSPECTUS OR OTHER OFFERING DOCUMENTATION.