Performance Update

After a strong first quarter, frontier technology has seen challenges over the past six weeks. You can read more about our approach to curated disruption here.

This is the second in a series of monthly posts providing an update on performance and sharing what’s on our mind in frontier technology.

What’s On Our Mind?

Google IO

Google hosted its annual developer conference this week, sharing long-awaited details about the company’s plan to make AI the backbone of its products. The most significant announcement is the company will overhaul the search results page, making it an important consumer AI starting point. The company refers to this as Search Supercharged or SGE (search generative experience). This means you’ll go to Google search to interact with Google’s generative AI. Spoiler alert: the search experience you know well is going to meaningfully change over the next year. SGE will be available in Google Labs in a few weeks by invitation, which means it may be months before we start to see it in our daily search results.

Both Google and Microsoft are making search a launch point of generative AI because searching is a daily touchpoint for over 2.5B people. That’s a starting point for Google and Microsoft to increase time spent with AI, and eventually increase revenue per user.

The new search results paradigm will have a greater distinction between types of search queries. Information queries (who is Abraham Lincoln) will look the most different with a tiles-based approach. Commerce queries will be a mix between tiles and some buy links. Navigation queries will have the least amount of change. At the bottom of the results will be buttons to go deeper on a topic or activity with the goal of keeping you in search.

While investors will have concerns about the upcoming decline in Google’s advertising blue links, we believe the opportunity for Google to increase their reach into our lives through AI outweighs the near-term ad revenue risks.

The Facebook Case Study

When we think about the upcoming change to Google’s search results from links to tiles, we are reminded about Facebook’s shift from desktop to mobile. In 2012, shortly after the company went public they informed investors that usage on Facebook was quickly moving to mobile. Management highlighted the shift would have a near-term negative impact on revenue as they experimented with how to sell ads in a news feed format. Within three months shares of FB declined by 50% as investors reduced their revenue growth outlook. It took 15 months for the stock to return to its IPO price, a sign that investors were comfortable that the mobile opportunity was on par with the desktop. Over the next five years, shares of FB inked a steady upward trend, gaining almost 450% over the IPO price.

The lesson we learned: business model transitions are scary for investors. They will sell first and wait to see evidence of stabilization. As soon as that’s reached, they rush back in. We expect shares of GOOG may endure a decline in the coming year when investors see firsthand the new search results page. While it’s hard to predict the depth and duration of that decline, we believe it will be short-lived because those 2.5B daily users will be spending more time on SGE than on the previous version. More time spent means more opportunities to make money from the users, and Google has proven over the past 19 years they know what they’re doing when it comes to monetization.

How Can I Invest in the Index?

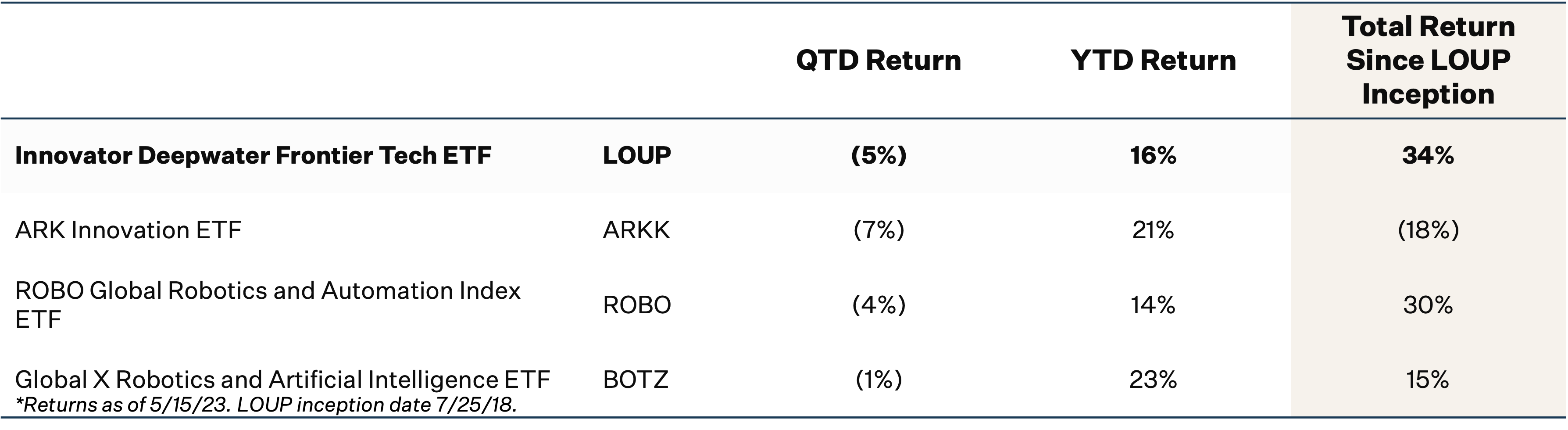

Deepwater partners with Innovator ETFs to offer the NYSE-listed Innovator Deepwater Frontier Tech ETF. The ticker is LOUP.

To learn more about how to invest, visit the Innovator website.