The Deepwater Frontier Tech Index provides investors with exposure to transformational tech themes that we expect to breakout over the next 3-5 years. Go deeper.

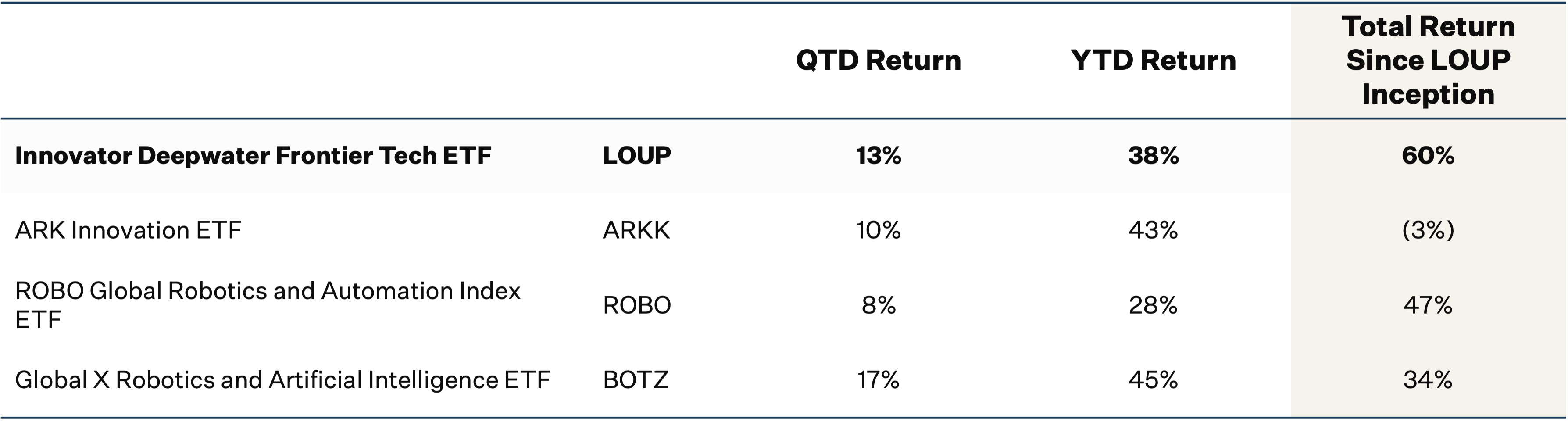

Performance Update

What is On Our Mind?

We recently shared our mental model for Investing in AI:

The run in AI-related stocks will prove overdone in the near term, but AI will prove even bigger than people think in the long-term. That’s a high bar given the hype.

Contradictory beliefs can signal contrarian investment opportunities. AI is the next Internet, but markets often front run the impact of new technologies before they translate into financial benefit.

Stock prices are supposed to represent all future cash flows an asset will generate discounted back to the present, but we’ve never found the market to function as such. Stock prices in the short to medium term are more influenced by flows, liquidity, and the next 6-18 months of fundamental performance, not the rest of time. That’s what creates opportunities to invest in persistent growth companies — markets lose faith in the ability of companies to grow faster and longer than reasonable because of near-term headwinds in the 6–18-month range.

As the market realizes that meaningful AI revenues are further off for many companies, AI premiums should wear off and these stocks trade down.

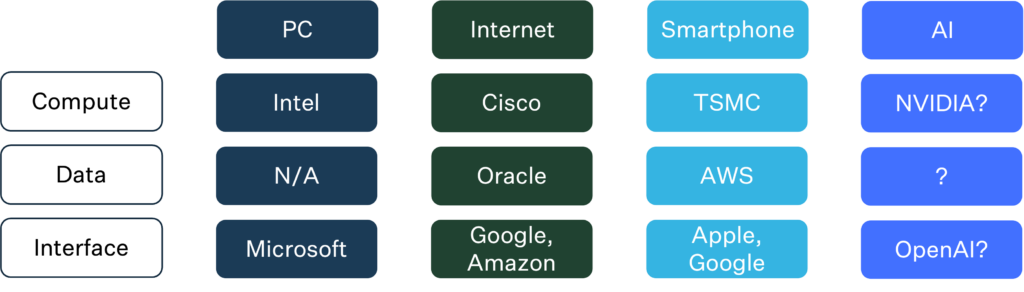

This is not a bearish view, only a rational one. AI will create great long-term investment opportunities just like other computer-driven paradigm shifts before it. To assess the longer-term real opportunities in AI, not just recent hype, we use a mental model for investing in paradigm shifts inspired by the PC, Internet, and smartphone.

Every computer-driven paradigm shift depends on the convergence of three elements: compute, data, and interface.

Compute is where calculation is done by machines to create value for customers. Data is the information available for the system to calculate. Interface is how end users interact with the system.

Identifying these elements of a technology paradigm shift is not some profound insight, but it is useful to form a framework for investors to consider from first principles what enables companies to win big from the shift. The enabling technologies of our model paradigm shifts are different, but the demands from each element of breakthrough are not. Companies that successfully addressed the specific needs of their category in prior paradigm shifts have become some of the biggest companies in the world and the best persistent growth investments in history.

The piece continues here.

Among the five themes in the Deepwater Frontier Tech Index, AI is the largest at almost 40% of the holdings. We’ve utilized our mental model to understand where we believe the real long-term opportunities exist in AI. Here are few compute layer companies in the index:

- AMD – a provider of CPUs, GPUs, and FPGAs for datacenters.

- Arista Networks – a provider of high-performance network switches for datacenters. Training of AI models places additional demands on east-west traffic within datacenters.

- Vertiv – offers critical infrastructure, including thermal management solutions, for datacenters. AI racks generated 5-6x more heat than traditional CPU racks, this requires more advanced cooling solutions to dissipate heat.

How Can I Invest in the Index?

Deepwater partners with Innovator ETFs to offer the NYSE-listed Innovator Deepwater Frontier Tech ETF. The ticker is LOUP.

To learn more about how to invest, visit the Innovator website.