From Doug’s blog, The Deload:

There are 1,170 unicorns and more than half of them probably won’t make it.

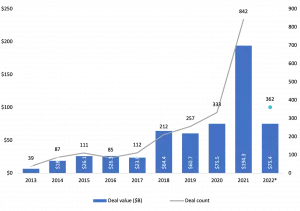

It’s no secret that 2021 was a boom time for all forms of capital, but late-stage venture was particularly strong. In 2021, a total of 842 companies raised more than $100 million in a single financing round, up 153% y/y.

Source: Pitchbook NVCA Monitor

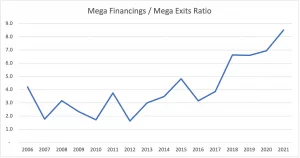

Meanwhile, large scale exits also grew. In 2021, the number of $500 million+ exits was 99, up 106% y/y. However, the pace of big exits doesn’t seem to be following the pace of big financings.

One way to consider this is to divide the number of $100 million+ financings per year by the number of $500 million+ exits. That ratio was 8.5:1 in 2021, the highest of the past 15 years. Mega financings/mega exits averaged about 3:1 between 2006 and 2017.

Source: Pitchbook NVCA Monitor

If 2021 had adhered to a ratio inline with the average of the past 15 years, we would have seen 55% fewer $100 million+ financings in 2021.

There’s half of your unicorns disappearing.

Of course, number of mega exits is a trailing metric but I do think it’s telling. Allocators — VCs and LPs — need to see a path to monetize the vast amount of capital earmarked for large private financings.

Some of the large increase in late-stage capital shifts what had previously been returns captured by public markets (small and mid cap tech) to private markets. But more of it seems to be inefficient capital allocation to companies that will never generate fundamental performance to generate great returns given high private valuations. In a way, private investors are capturing returns that used to go to public investors, but they’re also destroying alpha in the process by over-financing losers as well.

The new world order in late-stage capital creates three kinds of companies:

The Good

A handful of late-stage companies will raise new money at modestly lower to modestly higher valuations. These are the Good. They are true unicorns — companies with outstanding progress, outstanding founders, and outstanding addressable markets.

Of the 1,000+ unicorns, only a few dozen fit this class. Maybe less.

Companies like Stripe (despite their internal markdown), Anduril, Epic Games, SpaceX. There are few surprising names on this list. These are the FAANG companies of the private markets.

The Bad

Hundreds of private companies will raise money at meaningfully lower valuations (40%+) or through structured financings that delay a firm value assessment.

The Bad are not foregone winners like the Good. These companies don’t have dominating command of their markets (yet), markets may be more limited, management likely has less of a golden track record, and progress may be impaired by the prospect of a recession. Picking on Klarna again — sorry Klarna — revenue growth already slowed to 20% y/y in Q122 and would get worse if the economy weakens.

The thing about the Bad is that it’s not all bad. In a world where capital is tighter, the Bad can still access it, and that matters.

The Bad are being chosen as potential survivors and even winners in the longer run, despite exceedingly elevated valuations that never reflected reality. Many of the companies that suffer massive markdowns will still disappoint investors. Some will prove to be great and generate great returns.

The Ugly

Klarna’s raise wasn’t ugly. Ugly is not being able to raise at all. Ugly is being left for dead.

Probably half of the unicorns created last year deserve this bucket.

I don’t take joy in predicting the failure of so many companies. I do take joy in the efficiency of capital markets. Many of the Ugly companies never deserved to raise so much capital at such lofty valuations. In many cases, the excess capital will end up killing the companies.

When young, fast growing companies have too much capital, they can become permanently bloated and inefficient. They rely on broken and unprofitable pricing structures to allure consumers. They over staff with the wrong kinds of players. Sometimes founders even cash out early and lose the drive to lead a great organization.

All these phenomena are direct and dangerous outcomes of generous venture subsidies. Those subsidies are now dead. Many companies will follow.