As long-term tech growth investors, we’re more interested in the downstream impacts of how our recent period of social distancing changes the way consumers act permanently vs temporarily. To think through some of the opportunities and things to avoid, we’ve been using the following framework. This note is a complement to and expansion upon How to Think About Change in a Post-Coronavirus World, which dives into the effects on specific themes and markets.

There are four core market effects that we’ve identified:

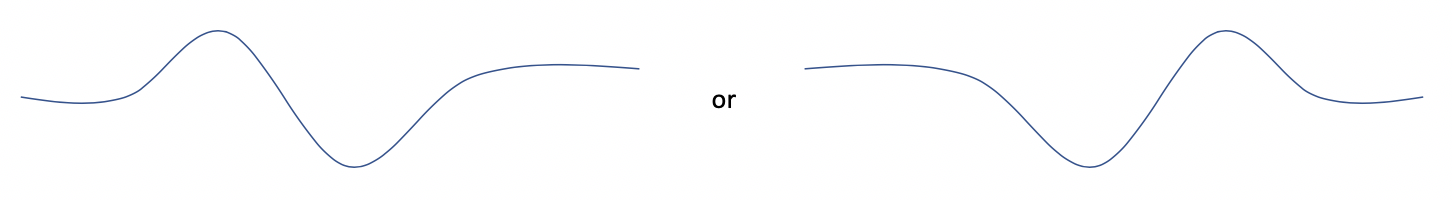

1. Type A market effects are where a market sees an inflection up or down, then a bounce-back inverse inflection before returning to the same trajectory it was on before the economy shut down. Type A effects will look something like this:

(Note for the market effects that appear to inflect then return to flat, the flattened curve just signifies a return to the market’s prior relative rate of growth, not an absolute flattening of growth).

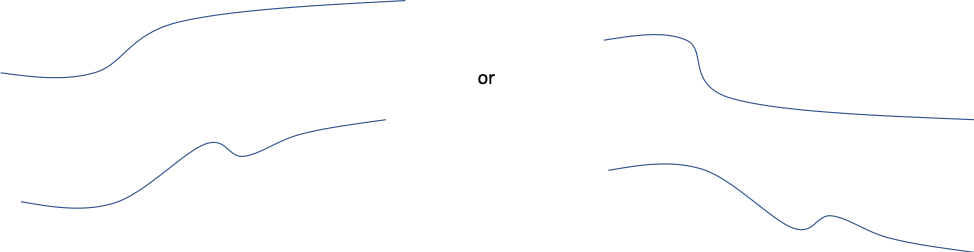

2. Type B market effects are where a market sees an inflection up or down and that inflected trajectory roughly continues after the economic recovery. There may be some temporary bounce in the inflection, but type B effects will look something like this:

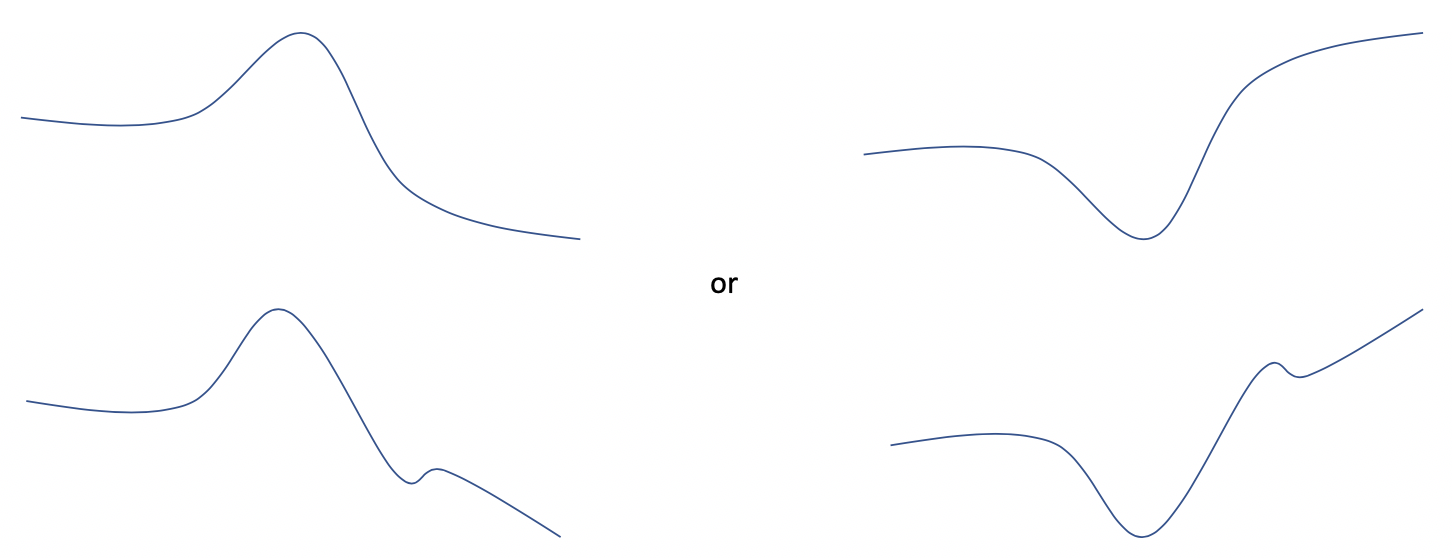

3. Type AB market effects combine type A and type B effects. A market inflects up or down, then reverses and continues the reverse trajectory. Type AB effects will look like this:

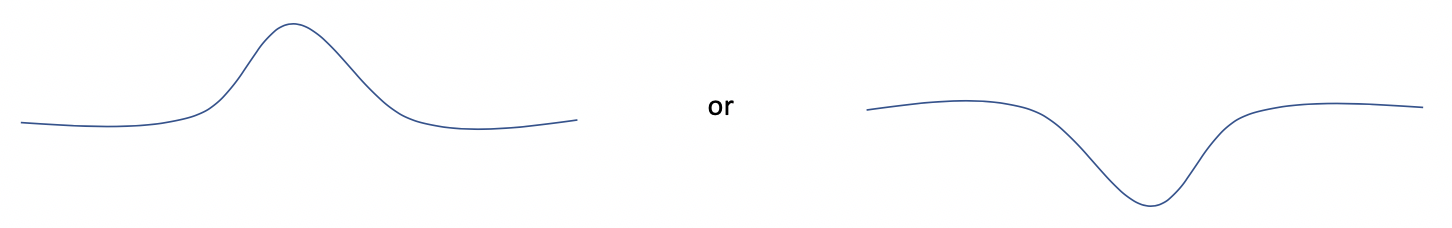

4. Type C market effects are where a market sees some temporary inflection up or down, then returns to something close to the same trajectory it was on before the economic shutdown. We expect these to be relatively rare in comparison to Type A effects. They will look something like this:

The question is: which markets fit into which categories? Given our long-term perspective, we ideally want the positive type B and AB markets that maintain a positive inflection; however, we suspect that these types of markets will be rarer than many people suspect despite a lot of talk about how the economic shut down may force rapid consumer adoption of new technologies. We’re technology optimists, but consumer behavior realists.

The Bounce Back Effect

Our current hypothesis is that many markets will be Type B markets. There is either a tailwind today that may turn into a headwind and vice versa. The core belief behind this is that there will be a bounce back effect of people wanting to do things in person instead of digitally for some period of time when the coronavirus fear subsides. Any time you take someone’s ability to do something away, that thing becomes more attractive, if only temporarily. On top of that, if the fear subsides in the next two to three months, we would have a cloistered population with rediscovered freedom and seasonally favorable weather, a combination that could augment a bounce back to in-person activities.

The bounce back thesis is relevant for several industries, but consider restaurants and food delivery as an example. The use of food delivery services has spiked as people avoid going out. When business returns to normal, it seems logical to expect some period where friends and family who have been FaceTiming and Zooming for the past two months to want to get together in person. This should result in a rebound in going to restaurants, likely even above the prior baseline trajectory, which gives us a Type A market effect.

We should logically assume that this spike in going to restaurants post social distancing will create some level of subsequent demand headwind for food delivery services. That could result in a Type A market effect inverse from the one we saw with restaurants if ordering delivery turns out to be a temporary change in consumer behavior in response to coronavirus. Alternatively, it could result in a type AB market effect with some small blip that inevitably comes from the bounce back of sit-down restaurants reopening, but a better trajectory than we saw before coronavirus.

If food delivery happens to end up in the latter scenario with a sustained change in trajectory, it would mean that faster adoption would have to come at the expense of some other food use case. Restaurants may be one candidate to be replaced by food delivery, so after the bounce back, restaurants might see a sort of double AB market effect:

Or they might not. Restaurants could also go back to their normal baseline and food delivery could maintain its inflection if it replaces cooking at home or picking up food. Therein lies the challenge of figuring out which markets will exit the coronavirus shut down on a new trajectory and which go back to normal.

The potential restaurant/food delivery market dynamics represent roughly the same argument you could make for many physical vs digital pairings that have been topical because of social distancing: physical retail and e-commerce, gyms and in-home fitness, in-person meetings and teleconferencing, doctor visits and telemedicine, and several other categories.

The second part of our framework can help us think through what the most likely sustained market effects will be for any and all of these pairings.

Replacements and Social Value

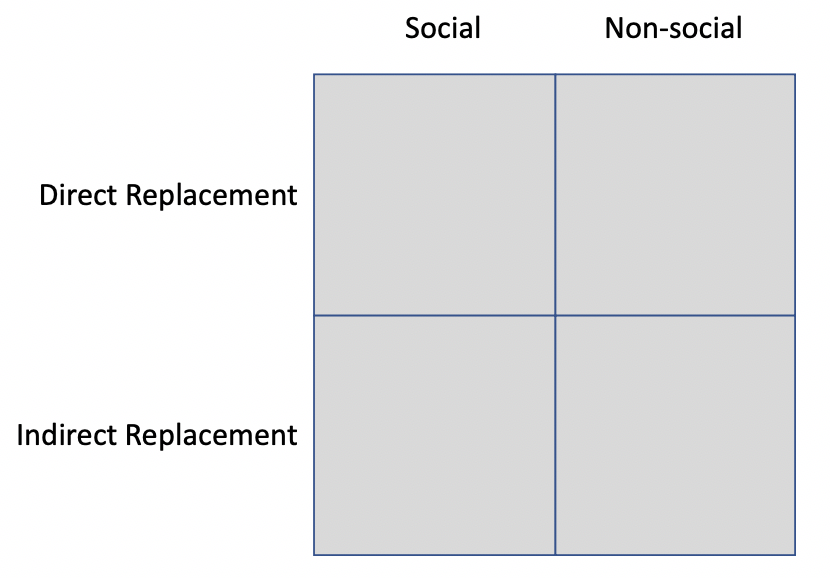

There are two sets of two general categories that each of these market pairings fall into. The first is that the market pairings are either are fairly direct replacements for one another, or they are only partial or indirect replacements. The second is that a social element is either an important part of the offline member of the pairings or that a social element doesn’t matter at all. The four possible combinations yield a grid that looks like this:

For any direct replacement category, the market effects must reflect one another as zero-sum. Any essential products you can easily get delivered by Amazon are products that you don’t need to go to Walmart to get. Indirect replacements don’t necessarily mean less of the other. Food delivery might replace a night out at a restaurant. It might also replace cooking at home or picking up take out yourself.

For any category where social elements matter, there is an inherent advantage to the in-person variant of the pairings because digital variants, for all the things they do well, can’t yet replace the in-person context. Meeting a person gives you more context about that person and carries more weight. Some situations don’t have a definite social element. You could argue some physical retail is social, but the majority of retail falls in this category. The online replacement experience is just as good as the offline. Market pairs where the offline component has a strong social element should see a bounce back as described above. Markets without a strong social element may see a bounce back or it may not.

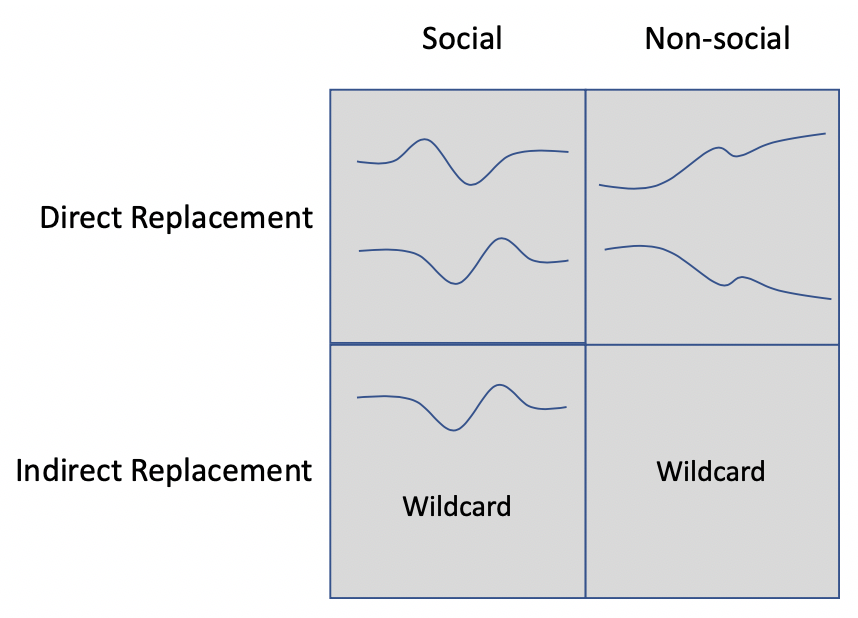

These assessments give us most likely scenarios depending on the combination of direct/indirect and social/non-social:

For market pairings that are a direct replacement for one another and have a strong social element, we should see opposing type A effects. The online market will see a spike up then a dip and return to its previous trajectory, while the offline market will see a dip then a spike up and return to its previous trajectory given the importance of the social element. Gyms and in-home fitness would seem to fit into this category.

For market pairings that are a direct replacement for one another but without a strong social element, we should see opposing type B effects. The online market will most likely see a spike with a sustained higher trajectory even if there are some minor dips as the world returns to normal. The offline market will see the inverse. Physical retail and e-commerce would seem to fit in this category.

For market pairings that are indirect replacements for one another and have a strong social element, we should see the offline component demonstrate type A effects. There will likely be a bounce back for the offline market and then back to normal as social norms return. The online component will likely show one of two effects. It may demonstrate an opposing type A effect and then return to a normal trajectory, or it could show a positive type B effect with a sustained tailwind as it takes share from other adjacent markets. Restaurants and food delivery or in-person meetings and teleconferencing both seem to fit in this category.

Finally, market pairings that are indirect replacements for one another and have a weak social element are wildcards. In-person doctor office visits and telemedicine seem to fit well here. In-person doctor office visits are not completely replaceable by telemedicine, and doctor visits don’t have a strong social component, the relationship between the two is less connected than in our other categories. We could make a case that doctor office visits return to their normal trajectory or enter a declining trajectory after the coronavirus situation subsides. We could also make a case that telemedicine returns to its normal trajectory or enters an accelerating trajectory.

Most Likely Sources of Long-term Growth

Putting our framework together, our strongest conviction is that the gym and in-home fitness markets will go back to their normal trajectory, while e-commerce may see a more sustained tailwind, and traditional retail sees a more sustained headwind. Of the other categories we mentioned, we think telemedicine is the next best to see a sustained higher trajectory because it is also benefitting from a more favorable regulatory environment out of necessity, in addition to greater use out of necessity. We expect the favorable regulatory view on telemedicine to last even beyond the end of the pandemic.

Food delivery and teleconferencing we are more cautiously optimistic about. We think the most likely scenario is that both have slightly better forward trajectories in terms of growth going forward, but that current usage levels are well above wherever the new, reasonable forward trajectory lands that the markets may be overestimating that long-term potential.