For this third report in our “Battery 101” series, our goals are to outline the five most important metals used in lithium-ion battery chemistry, to identify the leaders in global production to date, and to share our outlook on the number of years that remain for global supply. We believe the basic chemistry of batteries will remain unchanged for the next 25 plus years.

The topic of metals is complex given two factors: the geopolitical dynamics and the global supply unknowns. The bottom line—China has outsized control of the global metals supply chain. As for supply, unless recycling ramps or synthetic alternatives emerge, the earth will begin to run out of nickel in 35 years and the other key metals in 100 plus years. This includes both discovered reserves along with an estimate of how much of these metals are remaining on the earth. *There is a section below that details our assumptions further.

The US is fighting to level the playing field, as is evidenced by the recent $2.8B grant from the US Department of Energy to local battery manufacturers. Once matched, this will amount to more than a $9B investment toward localizing battery cell production and battery-grade lithium, graphite, and nickel processing within the United States.

Geopolitics

One source we used in this report was The Rare Metals War: The Dark Side of Clean Energy and Digital Technologies by Guillaume Pitron.

Throughout human history, we’ve seen commodities—from tea to spices, cotton to wool—represent the pulse for financial and geopolitical wars. Case in point, in September, the Pentagon temporarily suspended Lockheed Martin’s F-35 production by banning the procurement of specialty metals from foreign suppliers—specifically, China—unless absolutely crucial for its weapons production. Also, within the last year, Tesla implied that it was left with no other choice for sourcing graphite but from China due to the lack of US-based manufacturing.

The once-booming mining towns within the United States are gone. Meanwhile, in Baotou, the largest city of Inner Mongolia (China), the rare earth reserves represent 38% of the world’s supply. (Source: China Daily)

Up until the 1970s, there were about twenty metals used globally. Today, there are about eighty-five metals being consistently consumed by our modern life. To continue to meet the demand of net zero climate strategies by 2050, the intensity of metal extraction will be more profound than ever before.

The science of metallurgy

Metallurgy is a branch of science which focuses on the physical properties of metals, as well as their production and purification. Lithium, cobalt, nickel, copper, and graphite act as the bones in everything from consumer goods (flatscreens, cellphones) to industrial applications (catalytic converters, magnets), hybrid and electric vehicles, high-speed trains, modern military technology (F-35 fighter jets), medical instruments (implants, scanners, lasers, fiber-optics, surgical tools) and energy production (wind turbines).

While abundant, these metals are challenging to mine in a good yield as they’re rarely found in high enough concentration to make the begrudging process of extraction profitable. For example, miners may crush one ton of rocks to ultimately extract only 1-5g of raw material. The energy return on investment is low in mining. In addition, the production of such metals creates a wide array of technical, environmental, and political concerns. In the end, metal output is concentrated in just a few countries which can serve as a political leverage point for those countries.

Then, there’s the need to meet growing demand for EV batteries. The electric vehicle industry itself is forecasted to grow 35% annually over the next decade. According to Benchmark Mineral Intelligence data, more than 300 new mines may need to be built in order to match this growing demand. Not to mention, it’ll take anywhere from 7-10 years to get those mines producing any meaningful output.

The five most crucial metals

While battery design will change in the years ahead, we believe that the basic chemistry will not change and remain anchored in the following: 80% nickel, 15% cobalt, 5% aluminum, along with lithium, copper, manganese, steel and graphite.

Li

Lithium is a key component in electric vehicles, smartphones, and laptops. The word comes from the Greek word lithos, which means “stone.” On the contrary, it is the lightest metal by weight.

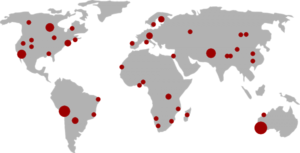

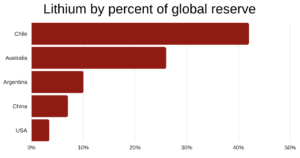

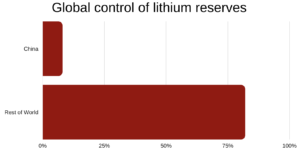

Chile has the most reserves of lithium estimated at 9.2m metric tons, versus the 0.75m metric tons found within the United States. In terms of production, Australia has been identified as the dominant producer of lithium for this decade but nearly 75% of that production is refined in China. While only 13% of lithium mining occurs within China, the country is responsible for almost 60% of all global lithium refining. Argentina is also set on developing its exports of lithium on a large scale. By 2025, Argentina should have the capacity to produce up to about 45% of global demand.

According to USGS (United States Geological Survey) and DERA (Diesel Emissions Reduction Act) data, there should be more than 150 years of reserves depending on the growth rate of global production. We believe that this number reflects the estimated global supply related to undiscovered reserves. According to Benchmark Mineral Intelligence data, the world will require 74 new lithium mines to meet forecasted demand by 2035.

One alternative to lithium-ion batteries in hybrid vehicles is lanthanum-based NiMH batteries, which are less common.

Co

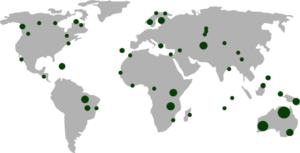

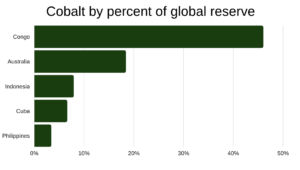

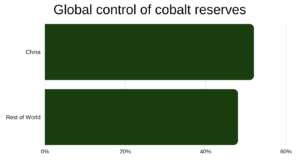

Cobalt has been identified by the US, EU, and Japan as a critical raw material prioritized ahead of graphite and lithium on the spectrum of economic importance and supply risk. Last year, the price of cobalt doubled as a result of strong demand for EV battery cell manufacturing. This was the first time that EV demand for cobalt exceeded that of smartphones.

The Democratic Republic of Congo (DRC) has 3.5m metric tons worth of global cobalt reserves and remains the leading producer with a global output of 74%, which increased about 90% from 2020. According to Benchmark Mineral Intelligence data, recycling is expected to have the largest impact on the mining of cobalt. With forecasted recycling volumes, 50% less cobalt would be required to meet global demand at the end of 2035 (from 62 new mines needed to 38 new mines).

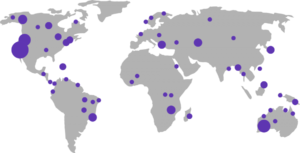

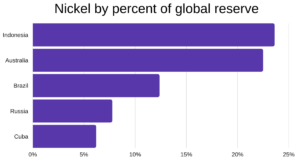

Ni

Nickel—considered the most important metal by weight in the battery cathode—constitutes a market size of over $20B. It can be found in most prolific supply in Indonesia, with 21m metric tons worth of nickel reserves. Comparatively, the US only has about 110K metric tons of localized supply.

According to USGS and DERA data, we have an estimated 13-35 years left of global supply depending on whether production increases +10% over the next decade. According to Benchmark, expected global demand will require an additional 72 nickel mines to meet battery demand for refined nickel.

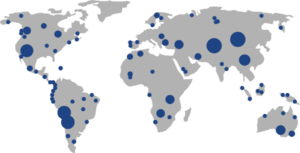

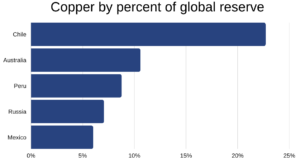

Cu

Copper is another key component related to the battery anode. As of 2022, Chile has 200K metric tons of copper reserves. According to USGS and DERA data, global supply of copper should last for another 14-37 years pending the growth in production rates.

According to ICSG (International Copper Study Group), Europe’s copper use is made up of about 50% of recycled copper. While copper is one of the few metals that doesn’t sacrifice performance in the process of recycling, smartphones contain such a small amount of copper per gram that it makes isolating the metal an arduous process.

C

Graphite, the purest form of the element carbon, is the most common material in the anode chemistry. It makes up 20-30% of the EV battery by weight. While graphite is often reduced to an incredibly fine material called graphene, it is considered to be twice as strong as steel. In addition to the EV sector, natural graphite is a crucial ingredient in the aerospace and nuclear industries.

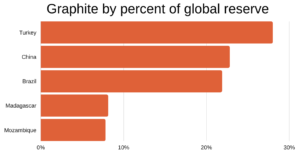

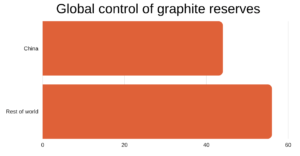

The most dense global reserves of recoverable graphite can be found in Turkey, China, Brazil, Madagascar, and Mozambique. While graphite mining is geographically diversified, we estimate that almost 90% of total graphite supply is directly or indirectly controlled by China given China’s influence over African suppliers. Within the United States, there are three small public companies targeting graphite mining, which include: Syrah Resources Limited (SYAAF), who signed a 4-year exclusive deal with TSLA, as well as Graphite One (GPHOF) and Wastewater Resources (WWR).

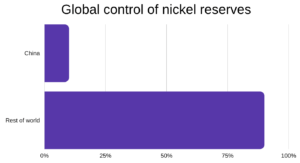

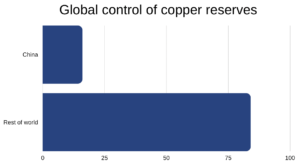

China’s dominance in metals export

The charts above don’t tell the whole story of who really controls these metals. Put simply by former Leader of the People’s Republic of China from 1978-1989, Deng Xiaopeng: “The Middle East has oil, China has rare earth metals.”

It’s important to note that China’s influence travels far beyond its own geological borders. Many of China’s former presidents and prime ministers have backgrounds in engineering, geology, and chemistry including prime minister Wen Jiabao, who served between 2003-2013 and was a geologist by trade.

While many countries in the emerging world like Chile, Peru, Bolivia, and New Caledonia are bursting with abundant reserves of lithium, copper, and nickel, China has built many paths to poorer countries to sustain its own domestic demand. Apart from Russia and many regions in Africa, this includes mining in Australia, Peru, and Vietnam. According to Africa-China Reporting, China “built a railway line” in 2014 “to open up access to the cobalt-rich southern region of Katanga” in the Republic of the Congo.

While America’s contribution to the mining industry is low today, it was once considered a leader in metals mining. Between 1965-1985 it had the capacity to produce up to 50K tons annually at the Mountain Pass mine in California. Over time, the mine struggled to navigate regulatory challenges after many contaminated spills. Ultimately, the Molycorp Corporation-owned mine closed its operations in 2002. As the US lost much of its production capacity, China began slashing its metals production costs.

In 2012, President Obama warned that the US needs to regain control of “our energy future, and [it] cannot let that energy industry take root” in another country. (Bloomberg) The message to the Western world was intended to be that China is winning, and the US was allowing it to happen. In 2017, when Mountain Pass was acquired by MP Mine Operations, it also became partially owned by a competing Chinese mining group, Shenge Resources Shareholding Co. In February 2022, MP Materials received a $35m grant from the Department of Defense to process heavy rare earth elements (HREE) for magnet production. To date, the DoD has invested a net $100m to improve America’s rare metals supply chain—a drop in the bucket—in our opinion.

China wants to own the supply chain

“The French don’t sell grapes, do they? They sell wine. The Chinese feel like rare earths are to them what vineyards are to the French.” —Dudley Kingsnorth, Non-Executive Chairman of Australian Rare Earths and Executive Director of the Industrial Minerals Company of Australia

From the profits made in refining rare metals to dominating the entire magnet/battery supply chain, the value chain for technology has made its home in China.

When we factor in the geopolitical dynamic including China’s influence on Russia and Africa, we see the control of these metals segmented as follows:

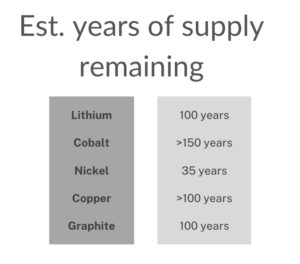

How many years do we have left?

Our calculations are based on USGS 2022 data and the projection that metals demand will grow at the same pace as the demand for batteries (est. 30% per year).

Our estimates reflect the entire estimated global reserves (which includes discovered mines as well as what is estimated to be left on earth). For example, while USGS reported global supply of lithium to be 22m reserves, the total estimated global reserves of 89m include undiscovered reserves estimated to be on the earth.

While many mines are currently being used for production, there are also countries that have abstained from using their reserves. Then, there’s the black market for rare earth production which reportedly accounts for about a 1/3 of global supply. Based on the rate of production for illegal mining, reserves could face depletion even sooner.

The chart above illustrates that the world will start to run out of these metals in about 40 years, starting with Nickel. The earth has 10o plus years of supply of the other key battery metals.

Because the timeframe is short, there will be economic motivation for miners to discover new ways to extract these metals from the earth as well as chemists to discover new synthetic options. Much like the case of genetically modified organisms (GMOs) introduced in factory farming, the metals industry may begin to embrace more synthetic alternatives. Separately, recycling will become increasingly important given that the cost of recycling will likely be lower than the cost of next-generation mining or the invention of synthetic replacements. As far as companies advancing the theme of recycling, Redwood Materials has generated the most interest and to a lesser extent companies like Li-Cycle.

Source: United States Geological Survey, 2022

Loup Graphics