In a recent interview with Ron Baron, Elon Musk said it’s likely Tesla will get into the mining and refining business in order to secure the critical elements needed for batteries. This is another reminder that demand for battery metals will exceed supply in the coming years, and that companies building battery-operated products will need to be strategic about how they gain access to the most basic building blocks. In short: Not every company that wants these metals will get them.

Based upon calculations we published in a previous note, metals demand is estimated to grow at an annual CAGR of 35% for the next decade — similar to the growth to the EV market. We forecast that, without the discovery of new reserves or the impact of recycling, the world has approximately 35 years left of nickel reserves and up to 100 years left of lithium, cobalt, copper and graphite reserves. Since the timeframe is short, we expect there will be financial incentives for miners to discover new methods of extracting metals and for recycling initiatives to ramp up in the years ahead.

Despite Musk’s suggestion that Tesla may acquire mining companies, or the mines themselves, in effort to vertically integrate its supply chain, the business of mining has its own long-term challenges. The leading challenges include rising production costs due to direct labor and the price of land. This note explores the alternative to mining: the EV battery recycling market. We outline the process of recycling, the opportunity of vertically-integrating the process and the companies that are best positioned to benefit from doing so.

The State of Recycling

Over the next 15 years, mining will account for the majority of metal sourcing. Beyond that point, recycling will play a more important role in the battery supply chain and should hit an inflection point around 2040.

While it doesn’t seem as though melting down end-of-life batteries would yield a good amount of reusable metals, some of the leading global recycling companies claim that their processes can recover 95% of the metals needed to manufacture new batteries.

By 2023, we expect about 7% of EV batteries in the US will be recycled and believe that number will increase by 15% annually, accounting for half of the metals used in new batteries in 2037. Hybrid batteries from 7m Toyota Prius vehicles will be one key source of battery feedstock over the next 15 years. Then, in 2037, we will begin to see Tesla’s 2018 Model 3 deliveries become feedstock for battery recyclers as well, at which time the market will hit an inflection point.

Around 2040, we expect that battery recycling will be the cheapest source of metals due to a combination of a rising supply of end-of-live EV battery feedstock, rising mining costs and declining global metal reserves.

The Six Steps of Recycling

1: Handling or safely transporting end-of-life batteries: The issue with handling lithium batteries is that they are considered hazardous due to their high voltage electrolyte contents which can result in the release of flammable and toxic gases if overheated. They are so dangerous that when consumers make the mistake of trying to recycle lithium batteries with paper, plastic and glass, fires can result. Given this risk, recyclers must comply with regulations when transporting old batteries across state lines and safely convert the hazardous materials. Once the batteries are delivered to the recycling facility, they’re often stored outdoors or in special warehouses that have precautionary fire suppression systems.

2: Discharging or removing the charge from the battery: There are additional safety hazards in disassembling lithium batteries in air or in water due to release of heat and the generation of explosive hydrogen gas. One non-toxic solution for electrochemical discharge is using a salt solution (NaCl) though its efficacy is debated by some who claim it can accelerate the corrosion of metals.

3: Dismantling or removing the casing, and shredding: In order to dismantle the discharged battery, the plastic separator is removed from the copper anode and cathode by passing through a shredder and hammer mill, which breaks the battery down with blows from little hammers. The contents are then separated on a shaker table for sorting, which reveals a “slurry,” the mix of non-hazardous plastics and valuable mixed metals. The powder-like substance of carbon and mixed metal oxides that remains is referred to as black mass.

4: Filtering to separate the metals, Part 1: The black mass passes through a brine filter press which separates out unique compounds like lithium, copper, nickel and cobalt.

5: Refining to further separate the metals, Part 2: The remaining black mass is put into a furnace for smelting at high temps to purify the metals or is submerged in a leaching tank which contains a water solution to recover metals. Some producers use both processes for refinement. The mix can then be further melted and separated into standalone copper, cobalt, nickel and aluminum.

6: Reselling or getting paid: If the recycler is not vertically-integrated, they sell the now-refined metals to EV battery cell manufacturers like Panasonic, LG Chem, Samsung SDI and SK Innovation.

The real money is vertical integrated recycling

We believe a standalone recycling business will yield mid-teens operating margins. Recyclers will have an opportunity to build a higher margin business by vertically integrating recycling into battery component manufacturing. The idea is for recyclers to take the renewed metals and manufacture the basic parts of a battery including the cathode and anode. Then, they’ll sell those components to battery manufacturers.

The reason why manufacturing components are higher margin than the basic recycling business is that those components are some of the most expensive parts of an EV. The cathode, for example, makes up about half of the cost of a battery cell which accounts for 8-10% of the total cost of an EV. This is a juicy upsell opportunity for recyclers who are able to build a vertically-integrated supply chain.

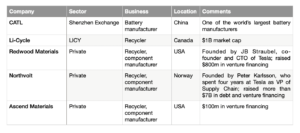

What companies are leading the way?