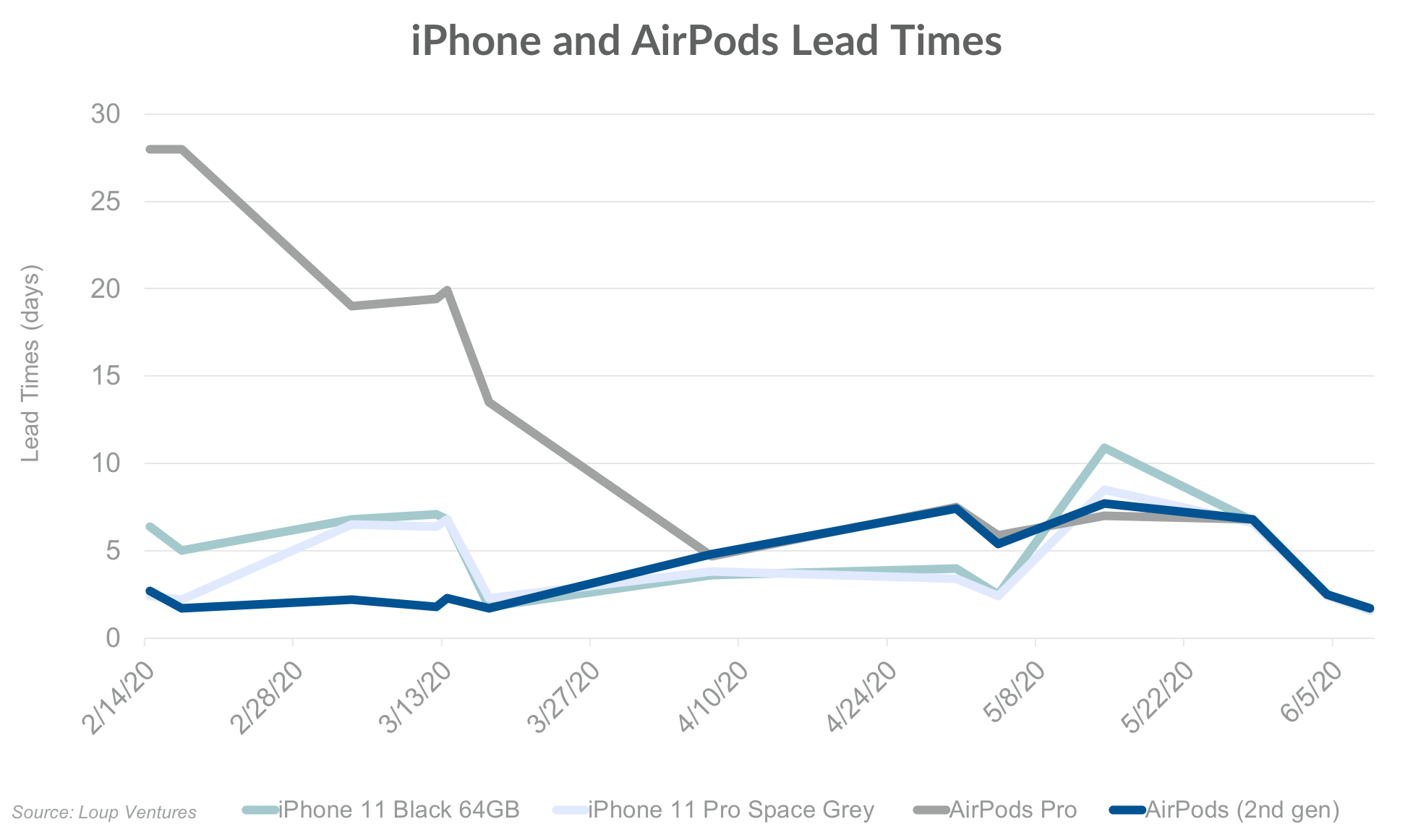

While interpreting lead times is not a science, it still provides useful insights. We’ve been tracking lead times of iPhones and AirPods in 13 countries since mid-February 2020. As of mid-June, Apple’s supply chain and production appears to have returned to levels consistent with early January 2020. We believe this is evidence that Apple’s supply chain is back to full strength. Since the future contours of the pandemic remain unknown, we will continue to track lead times for iPhone and AirPods.

Recent Changes to Availability

- iPhone (~52% of revenue) supply, as measured by the lead times of iPhone 11 64GB and iPhone 11 Pro 64GB, is now (June 8) an average of 1.6 days compared to a peak of 13.6 days on March 13 and 9.7 days on May 14th.

- AirPods (~4% of revenue) supply, as measured by AirPods Pro and AirPods 2nd gen lead times, is now (June 8) an average of 1.7 days compared to a peak of 15.4 days on Feb 14th.

AirPods Pro lead times show a measurable improvement related to four factors:

AirPods Pro lead times peaked when we first started gathering data (Feb 14) with an average of 28 days. Lead times have shown continuous improvement over the past four months and are now (June 8) an average of 1.7 days. We attribute the improvement to four factors, in order of importance:

- AirPods Pro launched at the end of October 2019; similar to the launch of the original AirPods, production was slow for the initial few months.

- Demand for AirPods Pro was high during the holiday quarter, and the seasonal decline in demand in the first half of the year has played a role in improving lead times.

- Manufacturing in China has restarted and gain capacity over the past two months.

- Demand has softened due to the broader economic picture.

Interpreting Lead Times

- We’ve tracked online lead times for Apple products over the past decade, sensitive to the reality that drawing insights from the data is tempered by the unknown supply, demand dynamic. Despite the shortcomings of the method, historically, it has been a useful tool. For example, following an iPhone launch, longer lead times have been an accurate measure of higher demand. The opposite is also true; the least successful iPhone cycles have been telegraphed by shorter lead times. This held true for Airpods Pro in the Dec-19 quarter that saw more than a 4 week lead time. In the same quarter, Apple reported record revenue in its wearables segment and we estimate the AirPods category grew at 75% y/y.

- In the case of the supply of Apple products over the past four months, we believe the key variable in Apple’s business was the closure of manufacturing and assembly in China. In the days following Apple’s announcement that the March quarter would be below expectations on February 17, we saw lead times extend. In the days following reports of the restart of manufacturing in China, we’ve seen lead times to improve.

We remain optimistic regarding Apple’s future

Our long-term view on Apple is unchanged. Apple’s combination of hardware, software, and services yields a competitive advantage not fully reflected in Apple’s earnings multiple. Additionally, the upcoming rollout of 5G will be a 3-year boost to iPhone revenue. Wearables, digital health and wellness, and augmented reality will be foundational to both expanding and monetizing Apple’s addressable market over the next decade.