Apple TV+ has fallen under most investors’ radar, but that should change starting late next year.

We expect Apple TV+ to have a measurable impact on FY22 net income growth

This November marks the one-year anniversary of Apple TV+. Apple has not reported user adoption metrics, only commenting in April that it has “contributed” to overall Services growth. Undoubtedly, the positive macro impact of stay at home orders that yielded 64% paid member growth for Netflix in March is also benefiting Apple TV+ growth. The stay at home tailwind may be short-lived, but the long-term growth outlook for streaming services remains favorable.

We estimate that, at the November one-year anniversary, Apple TV+ will reach 40-50m active free subscribers and less than 5m paid subs. In terms of quality of content, Rotten Tomatoes and IMDb both currently rank Apple TV+ in-line with other streaming services. While Apple TV+ has added only fractional revenue to date, we see more measurable revenue commencing in the December 2021 quarter as the initial wave of free trails comes to an end along with a more appealing offering with an expanded content library. For FY22, we believe Apple TV+ could add between $850m-$1.7B or about 2% of total net income. More importantly, the service should account for about 20% of net income growth during that period.

Bundling lifts free subscribers

Last November, Apple TV+ launched in over 100 countries with nine original titles, which has grown to 26 shows and movies today. Apple is taking the fewer, higher VC-quality title approach with a library that is dwarfed by Netflix’s 13,941 overall titles and almost 1,500 original titles. Apple’s monthly pricing of $4.99 compares to Disney+ at $6.99 and Netflix at $8.99. We believe the vast majority of Apple TV+ subscribers are currently getting the first year free based on the company bundling the first year free with the purchase of an Apple device.

Critical Reception

From a high level, over the past 8 months, Apple TV+ content has had similar reception to the original content from other streaming services based on reviews from Rotten Tomatoes and IMDb. Rotten Tomatoes’ Tomatometer reflects the percentage of professional critics’ reviews that are positive for a given film or television show. Currently, the Apple TV+ Tomatometer rating is 78%, which compares to HBO Now at 85%, Disney+ at 83%, Hulu at 77%, and Netflix at 73%. IMDb ratings are a reflection of the views of thousands of registered viewers worldwide. Individual votes are aggregated and summarized as a single IMDb rating, serving as a useful indication on the ranking of a movie or TV show held by the overall public. Apple TV+ holds an average of 7.2. Netflix, Disney+, Hulu, and HBO Now hold 6.8, 7.1, 7.2, and 7.3, respectively. Once again, Apple TV+ is in line with its competitors if not even ahead in the IMDB rankings. The last metric, awards, tells another story. Apple TV+ is relatively new, so its number of awards will obviously be lower. It was, however, the first streaming platform to pick up Golden Globe nominations in its first year of launch. Overall, Netflix has received over 430 award nominations and over 70 awards for its original content. Apple TV+ will be vying for more of these awards in the coming years.

Content slowly gaining momentum

Apple has not indicated the target number of shows and movies for the services and has been adding marquee content monthly. For example, Apple won a competitive bid for the rights to stream the upcoming Tom Hanks WWII film Greyhound. Given Hanks’ successful track record of producing content with HBO (Band of Brothers and Pacific), the move to Apple is another sign its content library should gain critical mass. In the future, we expect similar high profile content wins for Apple.

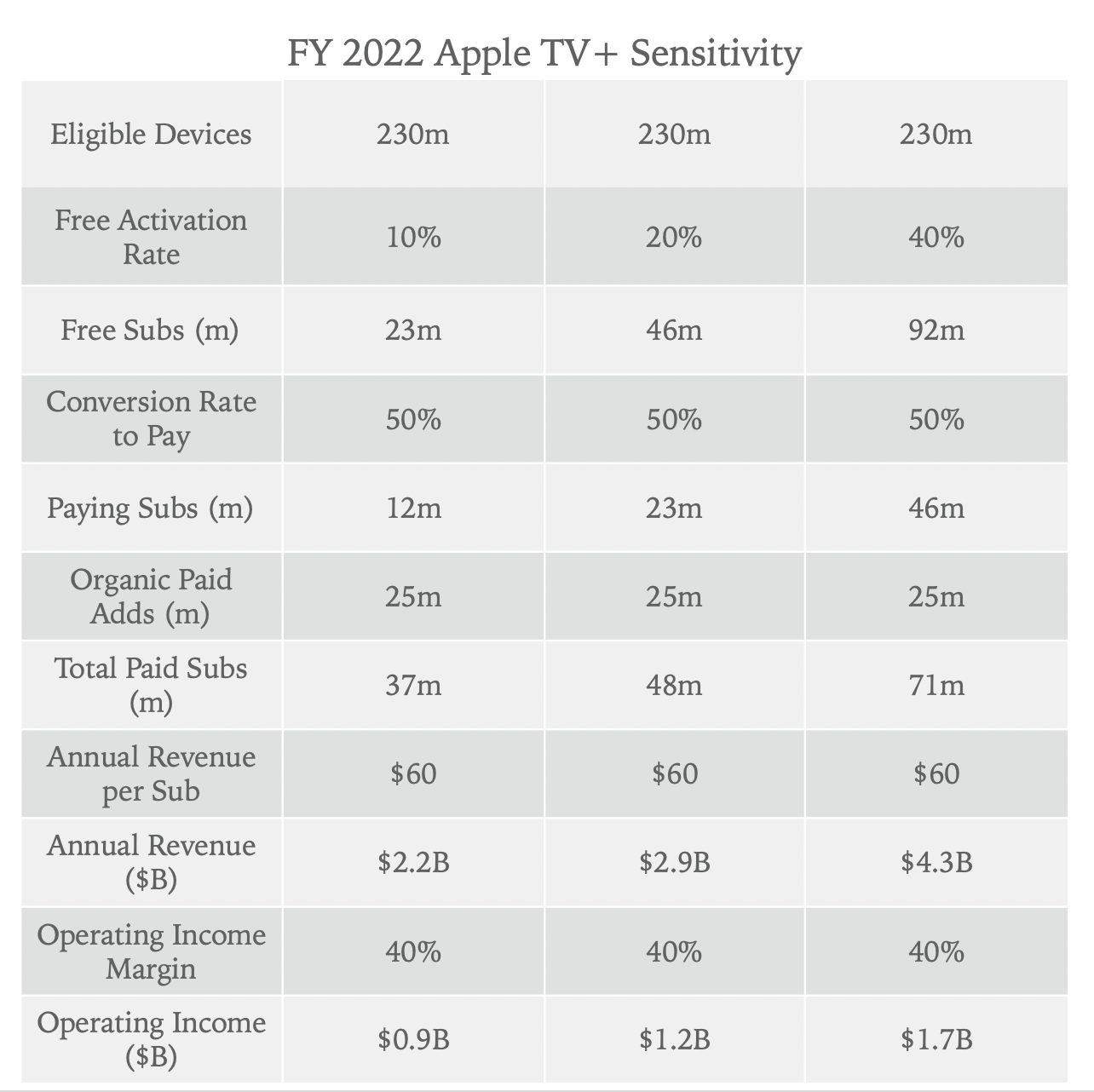

Sensitivity to Apple model

Below is our sensitivity model for Apple TV+ adoption. As mentioned, Apple TV+ currently offers a free one year trial through the purchase of a new iPhone, iPad, iPod touch, Mac, or Apple TV. We estimate Apple will have sold 230 million devices in the first year since the launch of Apple TV+.

We believe awareness of the service remains low, and the majority of Apple device consumers that are eligible for a free year have not activated the service. Our sensitivity analysis looks at the impact of a 10%, 20%, and 40% free trial activation rate. Furthermore, we assumed 50% conversion of free to paid subscribers. Additionally, our most aggressive assumption calls for 25m annual organic paid adds based on our belief Apple has about 1B active addressable customers for the service. This implies 2.5% of its user base adopts Apple TV+ annually. As a point of comparison, Netflix will also add about 25m paid subs this year. Lastly, we estimate a 50% Apple TV+ gross margin (and 40% operating margin), which is below the service’s gross margin of 64%.

The take away: Using the midpoint of our assumptions (20% activation rate), in FY22, we expect Apple TV+ revenue of $2.9B (less than 1% of total revenue) and net income of $1.2B (1.7% of total net income). More importantly, Apple TV+ will account for about 20% of net income growth during that period.