At its Spring Loaded event, Apple announced redesigns of the iMac and iPad Pro, along with updates to Apple TV and two new products: AirTags and a podcast subscription service. Taken individually, these announcements do little to move the company’s top line, but, in aggregate, they are material and could add an incremental 3% to overall revenue. Other good news, reading between the lines of price changes suggests demand for Mac and iPad remains favorable and margins will trend flat to higher. Below are our takeaways:

iMac

Baseline: We estimate iMac represents 2% of Apple’s overall revenue and is growing 10% plus.

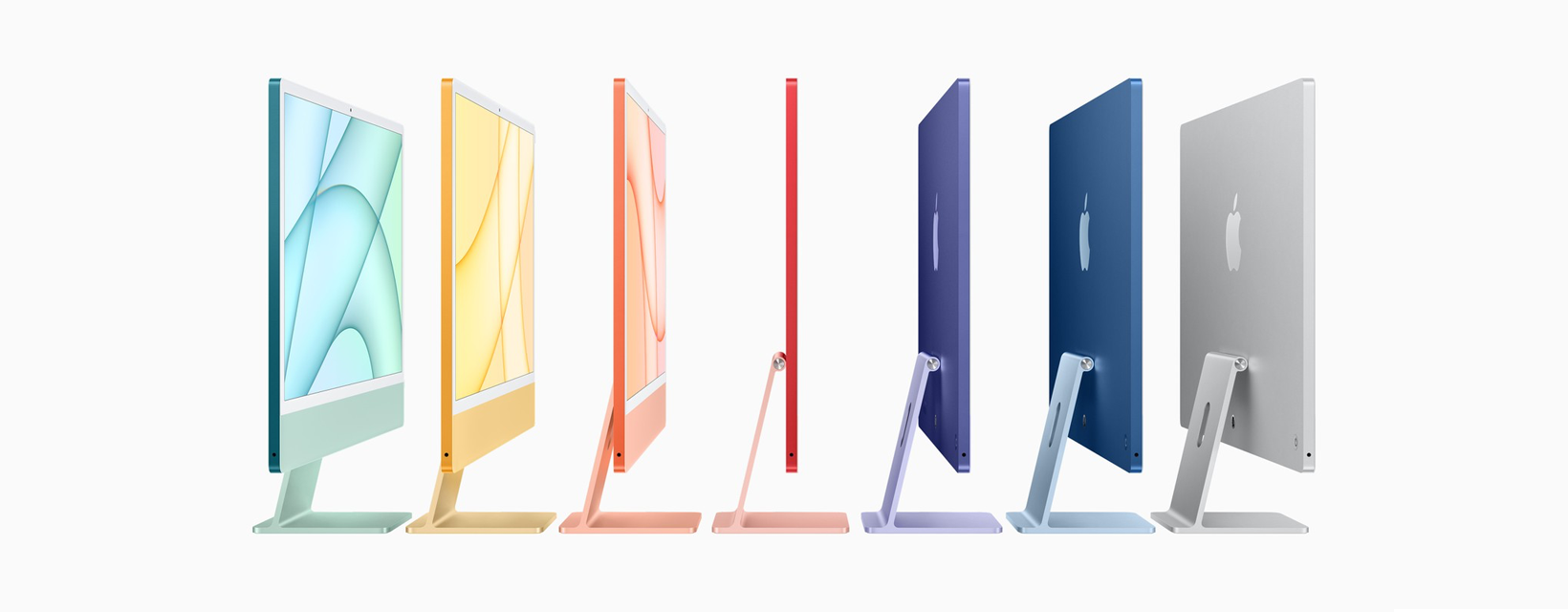

Updates: The new iMac received the M1 chip, six new color options, a 24-inch display (previously a 21-inch display), and an 18% price increase. The first tier of the new iMac comes in four colors and starts at $1,299, versus $1,099 for the previous base model. The second tier of the new iMac comes in three additional colors (yellow, orange and purple) with an additional GPU core and a starting price of $1,499. The 27 inch iMac is still available and was not refreshed.

Our take: The iMac got overhauled, slimming the design and adding colors for the first time since its launch in 1998. The ability to use color to motivate people to dollar up is a way to maintain and even raise margins. Notable new features include better cameras, mics, and speakers for Zoom calls, along with a Touch ID keyboard option. A question remains as to who buys an iMac? We continue to see it as a central computer in homes and schools, and believe it makes up about 20% of total Mac revenue. Over time, iMac revenue is declining as a percentage of sales as it’s replaced by portables. On the pricing side, Apple’s flexing its color-as-a-feature muscle with the $200 upcharge, essentially for the yellow, orange, and purple models. This of course is good for margins. Outside of the iMac, there were no changes to Mac pricing, which likely means Apple feels good about current Mac (about 10% of revenue) demand. We believe the Mac will have a multi-year tailwind driven by the accelerating digital transformation, including work and learn from anywhere.

iPad Pro

Baseline: We estimate iPad Pro accounts for about 1% of revenue and is growing at 20% plus.

Updates: The iPad Pro lineup received the M1 chip, and the 12.9-inch Pro’s starting price increased 10% to $1,099, which coincidentally is the same starting price as the now-retired 21 inch iMac. Pricing remaining unchanged for the 11 inch iPad Pro at $799.

Our take: It’s official, the iPad Pro is more of a Mac than an iPad with the introduction of the M1 chip. While essentially the same price as a Mac, an iPad Pro with the right keyboard gives the flexibility of being both laptop and tablet. Like the Mac, the broader iPad family did not have any price increases, which is an indication that demand for the segment remains favorable. We continue to expect the overall iPad business (12% of sales) will have a multi-year tailwind from the accelerating digital transformation.

AirTag

Announcement: We’ve been waiting for this for a year, and Apple announced AirTag, an attachable device that helps keep track of your belongings, fulfilling one of our 2021 predictions. AirTag will compete with Tile, the market share leader in Bluetooth tracking devices. AirTag is priced at $29.

Our take: AirTag has the potential to be a sleeper hit. When AirPods came out in 2016, many investors viewed the potential as limited. In fact, AirPods have been a runaway success, and we now estimate the segment accounts for 5% of overall revenue. Similar to AirPods, we expect over the next five years that AirTag will become a must-have and ultimately account for 1%-2% of overall revenue. For perspective, the New York Times reported in April that Tile has sold more than 26m trackers lifetime to date, claiming some 90% share of the Bluetooth tracker device market. Priced around $25-$30 each, this implies $750m revenue to date for Tile. While the Bluetooth tracker market is small today, we believe Apple will expand that over time.

The bottom line is AirTag is an example of Apple leveraging its ecosystem to create a more compelling product than what is currently in the market. Specifically, AirTag will have better navigation and discovery features, along with a billion-plus device network that can be utilized to help locate lost items.

Apple TV

Significance: Apple TV is about 1% of revenue and we estimate it’s growing at around 5%.

Updates: Apple TV got a new A12 chip, which means faster video streaming and more robust gaming. Notably, the remote has been redesigned, which is the second major redesign since Apple TV launched in 2007. Pricing remains unchanged at $179 to $199.

Our take: A nice update with the remote but overall a non-event. Apple did what it needed to keep demand for its premium-priced product (6x more than Amazon Fire TV) growing at 5%. We believe the active install base for Apple TV is around 60m units and estimate 20m will be sold this year.

Podcast subscription service

Announcement: Apple announced a marketplace to allow podcasters to offer free, monthly subscriptions, or ad supported content. The monthly pricing and or ad load is determined by the podcast provider. A paid podcast service was also part of our 2021 predictions. Currently, Apple has “millions” of podcasts on its platform with thousands being added daily.

Our take: This is a significant announcement given Apple now has the first global podcast marketplace. It’s reminiscent of when Apple announced the App Store in 2008, giving developers a mobile monetization platform. We estimate Apple has around 200m global monthly podcast listeners. As a loose point of reference, Spotify’s has 345m free music/podcast users, including 155m paying subscribers. Apple’s marketplace approach is different than Spotify’s exclusive content for one flat monthly fee approach. As for the business model, it’s likely Apple will adopt a sliding scale subscription take rate model, with Apple keeping 30% in the first year and 15% in subsequent years. Big picture, from a revenue perspective, this is too small to move the needle, but an important category to maintain leadership in given podcasts will play an increasing role in consumers’ lives as they allow users to consume media while multitasking.