- Apple’s capital return framework is the 3rd of 4 pillars to our Apple as a Service thesis.

- It’s understood that Apple is committed to a $100B capital return over an undefined number of years. What’s not understood is that the company has the ability to return $40-$60B every year in perpetuity (Apple did $47.7B in FY17).

- We believe Apple can fund the $100B capital return over a two year period with cash from operations alone. That still leaves an additional $145B to return to investors if they intend to make good on their promise to be net cash neutral.

- At the current share price, that incremental $145B, if dedicated to a buyback, would conceptually increase shares of AAPL by 16%.

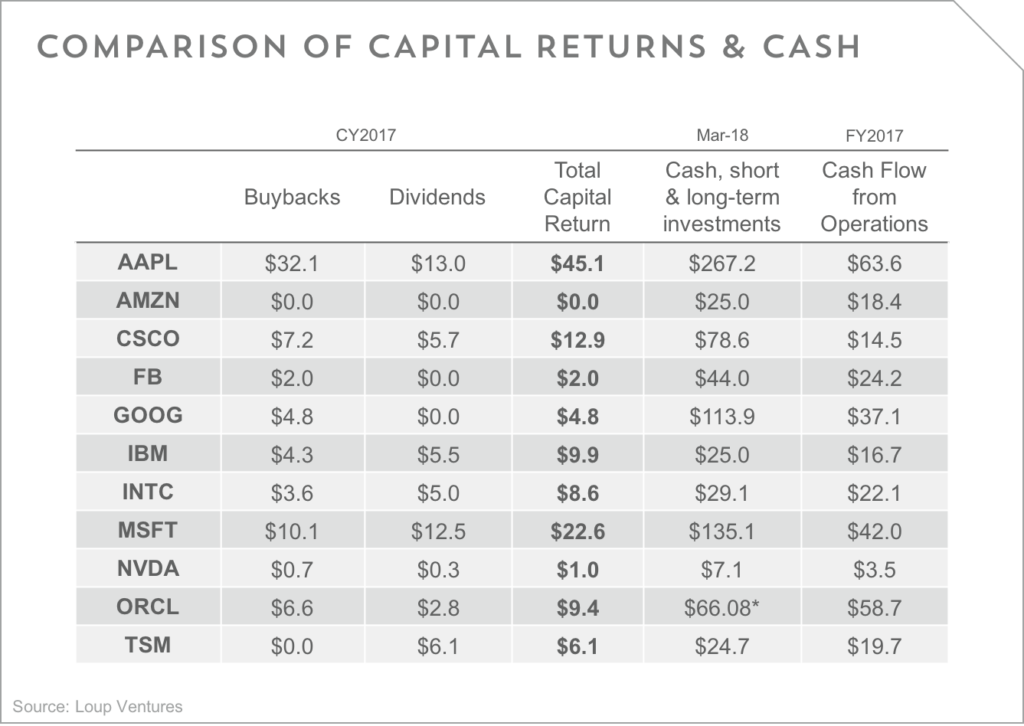

- Apple generated $64B in cash from operations in FY17. This compares to 10 of the largest tech companies that, on average, generated $25.7B in FY17. This gives us comfort that Apple has the ability to be one of the most generous companies in history in terms of giving back to its investors.

Apple can return $40-$60B to investors annually in perpetuity. Based on the stable iPhone business outlined in Part 1 of this series (here) in combination with the Services business outlined in Part 2 (here), Apple generates enough cash to return $40-$60B per year. In FY18 we expect the company to generate $64B in cash from operations. As a point of reference, the company returned $47.7B in FY17.

Apple wants to be “net cash neutral.” On the Dec-17 earnings call, Tim Cook first indicated Apple’s plans to become “net cash neutral,” maintaining equal cash and debt balances. For example, Apple currently has $267B in cash and $122B in debt. To become net cash neutral, the company would have a to distribute $145B either to investors or through investments/M&A to achieve a cash balance of $122B. While Cook reiterated Apple’s goal of net cash neutrality on the Mar-18 earnings call, the time frame is unclear; it is also unclear what the mix of capital return vs. investment will be. Historically, Apple has steered away from special dividends, but we view that option as a lever to more quickly achieve net cash neutrality. If Apple was to dedicate the entire $145B to a buyback, it would effectively repurchase 16% of the company at the current share price, which would, conceptually, increase the share price by the same 16%. Importantly, Apple can fund about $50B per year of its $100B capital return target with cash from operations. The company did not give a time frame during which it expects to complete its capital return commitment.

A lever to inch shares higher. Setting aside broader market uncertainty, the company appears to have a measurable and systematic lever to inch shares of AAPL higher. Specifically, assuming $50B in annual capital return over the next few years and 75% of the capital return is in the form of buybacks (in line with the FY17 buyback/dividend mix), implies $37B in share repurchases. At the current market cap, that would require Apple to repurchase 4% of the company in 2018. In 2019, that $37B share repurchase would likely buy back 3% of the company, and in 2020, 2% of the company. While the impact of the buyback diminishes as the stock goes up, it is a lever that the company has used in the past to impact share price.

Comparing Apple’s capital return to other tech companies. Since the inception of Apple’s capital return program in FY12, the company has returned $275.2B to investors. CNBC recently observed that Apple made $13B of net income in 2017, more than Amazon’s total net income since inception of $9.6B (Loup double-checked and their math is correct). This comparison helps illustrate Apple’s ability to generate cash. The table below compares Apple’s cash generation and capital return framework to 10 of the largest tech companies.

Disclaimer: We actively write about the themes in which we invest: virtual reality, augmented reality, artificial intelligence, and robotics. From time to time, we will write about companies that are in our portfolio. Content on this site including opinions on specific themes in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making investment decisions. We hold no obligation to update any of our projections. We express no warranties about any estimates or opinions we make.