AWS growth looking for a trough

AWS is important. In March, the company reported operating income of $4.3B, which was made up of a loss of $1.2B in International, a profit of $900m in North America, and $5.1B in AWS. In other words, while only 17% of revenue, AWS accounted for 118% of the company’s operating income. The segment’s growth rate has steadily declined over the past six quarters from up 50% y/y in December of 2021, to up 16% in the recent March quarter. That pace was still faster than Amazon’s other reporting segments with North America up 10% and International up 1%.

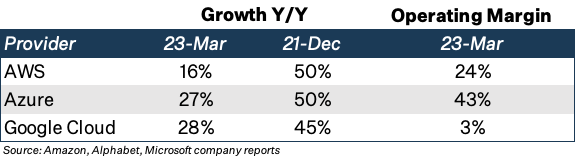

Putting AWS growth into perspective, Microsoft’s Azure growth slowed to 27% in the quarter, down from 50% growth in December of 2021. Google Cloud growth also slowed to 28% compared to 45% in December 2021. In other words, Azure and Google Cloud businesses are gaining market share on AWS.

From an operating income standpoint, Azure is the most profitable, followed by AWS, and Google Cloud turning profitable this March. Two trends to point out:

- Azure’s profitability is the highest of the group at 43%, unchanged over the past year.

- AWS appears to be discounting, as evidenced by its operating margins declining from 35% in March 2022 to 24% today.

Adding concern was commentary from Amazon management that AWS customers have been “evaluating ways to optimize their cloud spending in response to tough economic conditions.” This likely translates to more price cuts and lines up with commentary that the AWS business is tracking up 11% y/y in the month of April, down from the 16% reported growth in the March quarter.

The bottom line is AWS is Amazon’s profit engine today and is seeing the effects of greater competition from Azure and Google that will likely further pressure margins in the June quarter.