Continuing our pursuit of understanding the new normal and how to think about lasting change in a post-coronavirus world, we conducted a survey about one of the most obviously and heavily affected markets: travel. With global demand for travel at a near stand-still, the fundamental questions are: How will travel rebound and what will be the new normal?

We surveyed 365 US consumers with a focus on the timeline to “normal” travel and perceived safety. There are three main takeaways from the survey:

- Confirming the obvious, recovery in the travel space will take time. Even after it is deemed safe to travel, safety concerns and overall caution will likely last longer than optimistic views of the industry may hope.

- Frequent travelers will return to relatively normal travel habits quicker than infrequent travelers.

- There is an opportunity for travel-related brands to associate themselves with cleanliness and safety.

Recovery

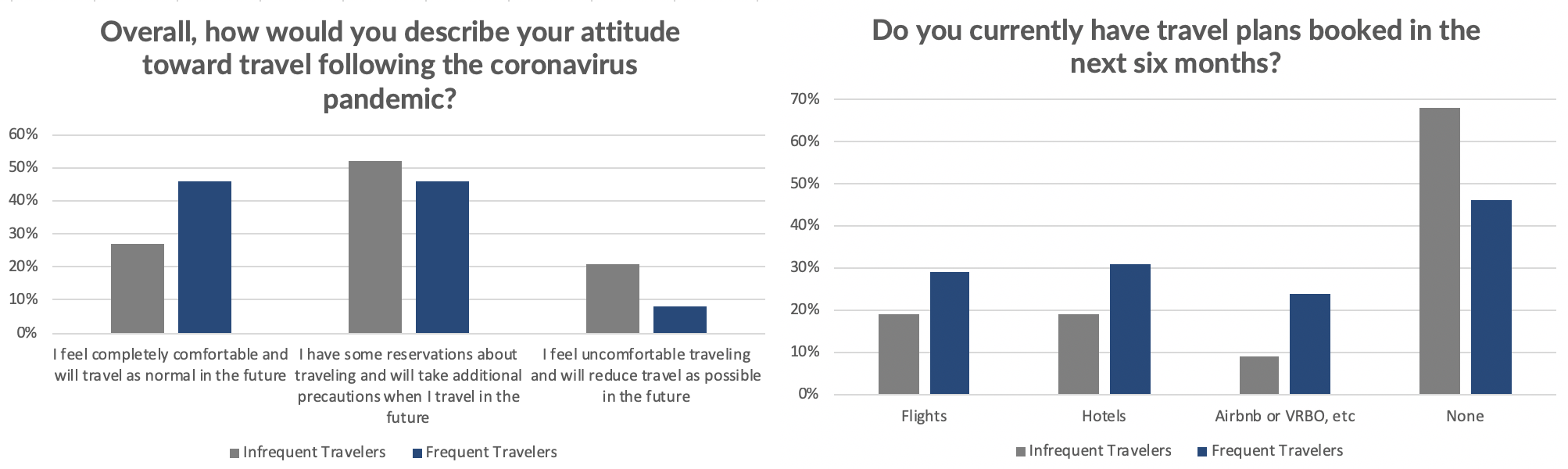

When we asked if consumers have any travel (flights, hotels, Airbnbs) booked in the next six months, 65% of survey respondents said they don’t have any travel plans in that period, although 88% said they usually travel at least twice per year, suggesting that normally a large part of that group likely would have plans in a six month period. Of the 35% that do currently have travel booked, 21% had hotels, 21% had flights, and 11% had Airbnbs (overlap as multiple answers were allowed).

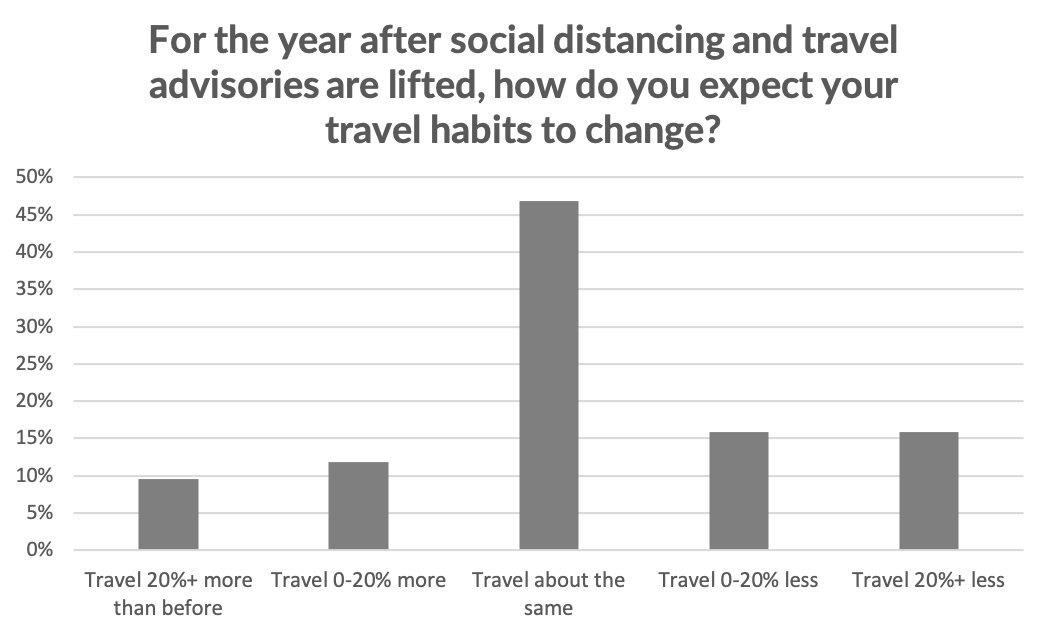

In the year after travel restrictions are lifted, nearly half (47%) expect their travel habits to be about the same as before the pandemic. However, 36% expect less travel, but only 22% expect increased travel. While there may some pent up travel demand after extended isolation, as demonstrated by 38% of respondents stating they feel a greater desire to travel since spending more time at home (45% no change, 17% less desire), we expect that net travel demand over the next year-plus will be negatively impacted due to uncertainty about safety. We would expect at least a few percentage point headwind to travel compared to pre-pandemic levels will persist in the year after the world returns to the new normal.

Frequent Travelers

If we filter the survey results to only include frequent travelers (those who travel six or more times per year), it paints a slightly more optimistic picture of the recovery. Almost 46% of frequent travelers said they feel completely comfortable and plan to travel as normal in the future compared to 25% of infrequent travelers. Conversely, 20% of infrequent travelers said they feel uncomfortable and will reduce travel in the future vs less than 10% of frequent travelers. Additionally, more than half of frequent travelers already have some travel booked over the next six months.

The Safety/Cleanliness Question

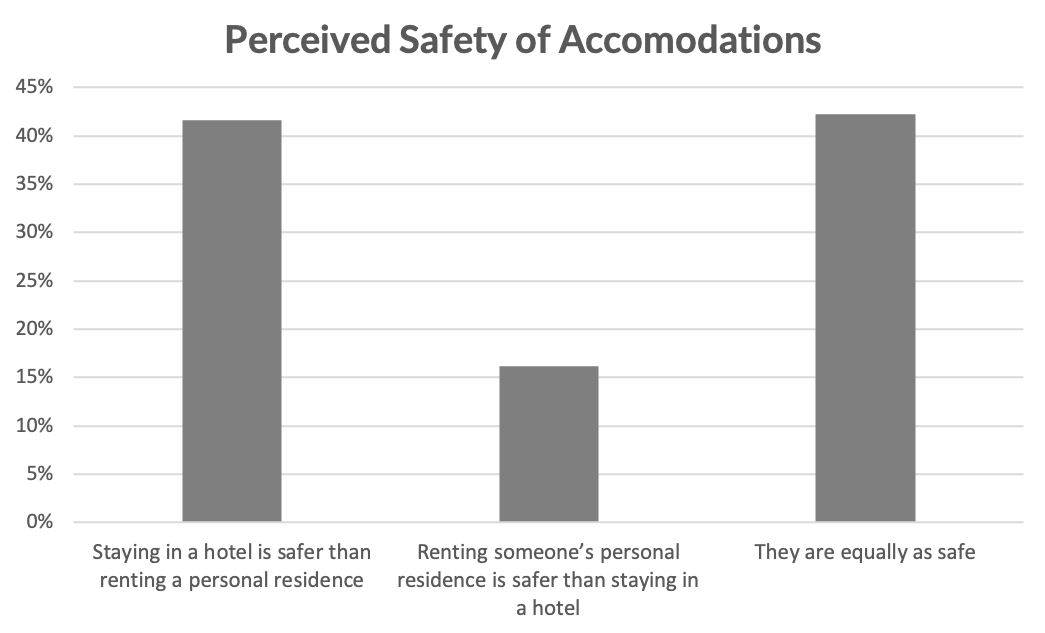

We also asked consumers for their opinion on the safety of hotels vs rentals in a post-coronavirus world. Hotels were viewed as the safer option by 42% of respondents, while 42% viewed the hotels and rentals as equally safe. Only 16% of respondents viewed rentals as safer than hotels. However, the data here may be skewed by a high percentage of respondents that stated hotels or motels as their preferred accommodation when traveling (68% of respondents). When looking at the respondents who claimed Airbnb or VRBO as their preferred accommodation, 34% still viewed hotels as the safer option vs 31% for rentals.

Logically, a hotel seems to be a higher-risk environment with respect to the pandemic because there are shared common spaces, a much higher volume of people, and closer quarters. The advantage for hotels, and perhaps the reason they appear safer to many travelers, is that cleaning is very visible in a hotel environment. You see cleaning staff in the hallways every day, and you come back to a clean room when you return at night.

We think the perception of safety post-coronavirus is a major opportunity for travel brands, particularly Airbnb and other rental companies. Airbnb needs most obviously to convince dedicated users that rentals are safer than hotels, but if the company can convince travelers who typically stay in hotels that rentals are safer, it could result in a nice tailwind for the rental space that yields a return to “normal” faster than the rest of the travel industry.