Zoom is off to a fast start trading as a public company, up 83% since its IPO two weeks ago. One reason is the company’s efficiency in gaining new customers. Slack, which will start trading in the next few weeks, looks like it also has high efficiency, although not quite to the same level as Zoom.

Zuora CEO Tien Tzuo established a concept he calls the Growth Efficiency Index (GEI), which is basically the cost to acquire a new customer divided by the amount of annual revenue you expect a new customer to add. We think of it more simply as payback — how long until you earn back your investment in sales via revenue. A smaller GEI is better.

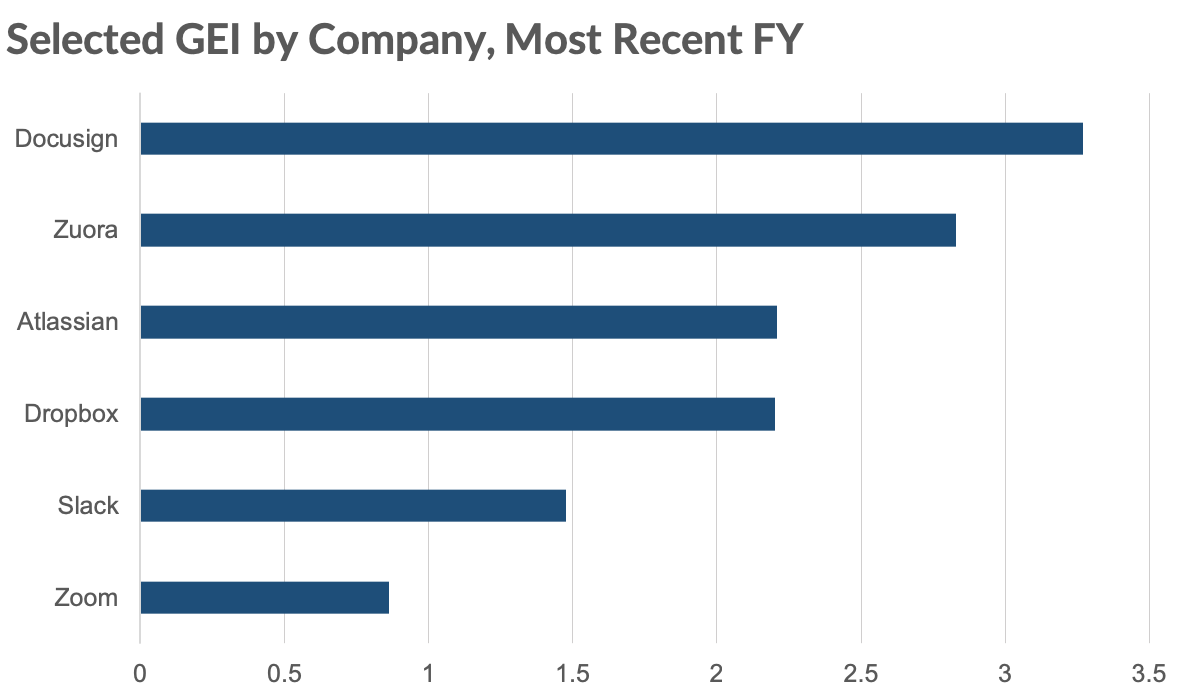

Based on our assessment of several subscription-based software companies, a GEI of around 2 seems to be good, anything between 1 and 2 is very good, and anything below 1 is excellent.

Zoom’s GEI was around 0.86 in FY19, while Slack’s was 1.48 (both have January fiscal year-end dates). These GEI levels compare favorably to other recent IPOs and strong SAAS businesses.

Note: Atlassian is for CY18. Some companies report customer-specific metrics (e.g. number of customers with more than 10 employees, or number of customers with contracts over $100k). In the absence of a pure customer number, we used those reported metrics as a proxy for the overall business.

We also believe the GEIs of Zoom and Slack compare favorably to Salesforce when it went public. In CRM’s FY05, the year of its IPO, Salesforce had a GEI of 1.39. More impressively, Salesforce was able to sustain a sub 2 GEI until its FY11 report, or six years after going public. As most subscription companies mature, the efficiency of their growth decreases as customers with the biggest need adopt early and customers beyond those with the greatest need require more effort to convert. Salesforce’s long history of growth efficiency is a testament to the power of the network that the company’s software created as additional customers in an organization directly increase the value of the product. In other words, Salesforce’s product had a real network effect within a given organization that made selling the product easier.

Zoom and Slack will rightfully get credit as public companies with strong growth efficiency. Whether they can maintain strong efficiency will tell the story of each stock as an investment over the next several years.

Disclaimer: We actively write about the themes in which we invest or may invest: virtual reality, augmented reality, artificial intelligence, and robotics. From time to time, we may write about companies that are in our portfolio. As managers of the portfolio, we may earn carried interest, management fees or other compensation from such portfolio. Content on this site including opinions on specific themes in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making any investment decisions and provided solely for informational purposes. We hold no obligation to update any of our projections and the content on this site should not be relied upon. We express no warranties about any estimates or opinions we make.