Last month, Zillow CEO Rich Barton commented, “When you’re used to legacy business models it’s hard to imagine how much things will change when liquidity increases by reducing friction and increasing transparency.” We’ve seen liquidity transform other markets like Uber and Lyft turning every car into a potential taxi. We believe adding liquidity to residential real estate means making it easy to buy and sell homes through iBuying, and in turn, reversing a mobility pattern that has been trending downward for the last seven decades. Loup is an investor in Zillow and Opendoor.

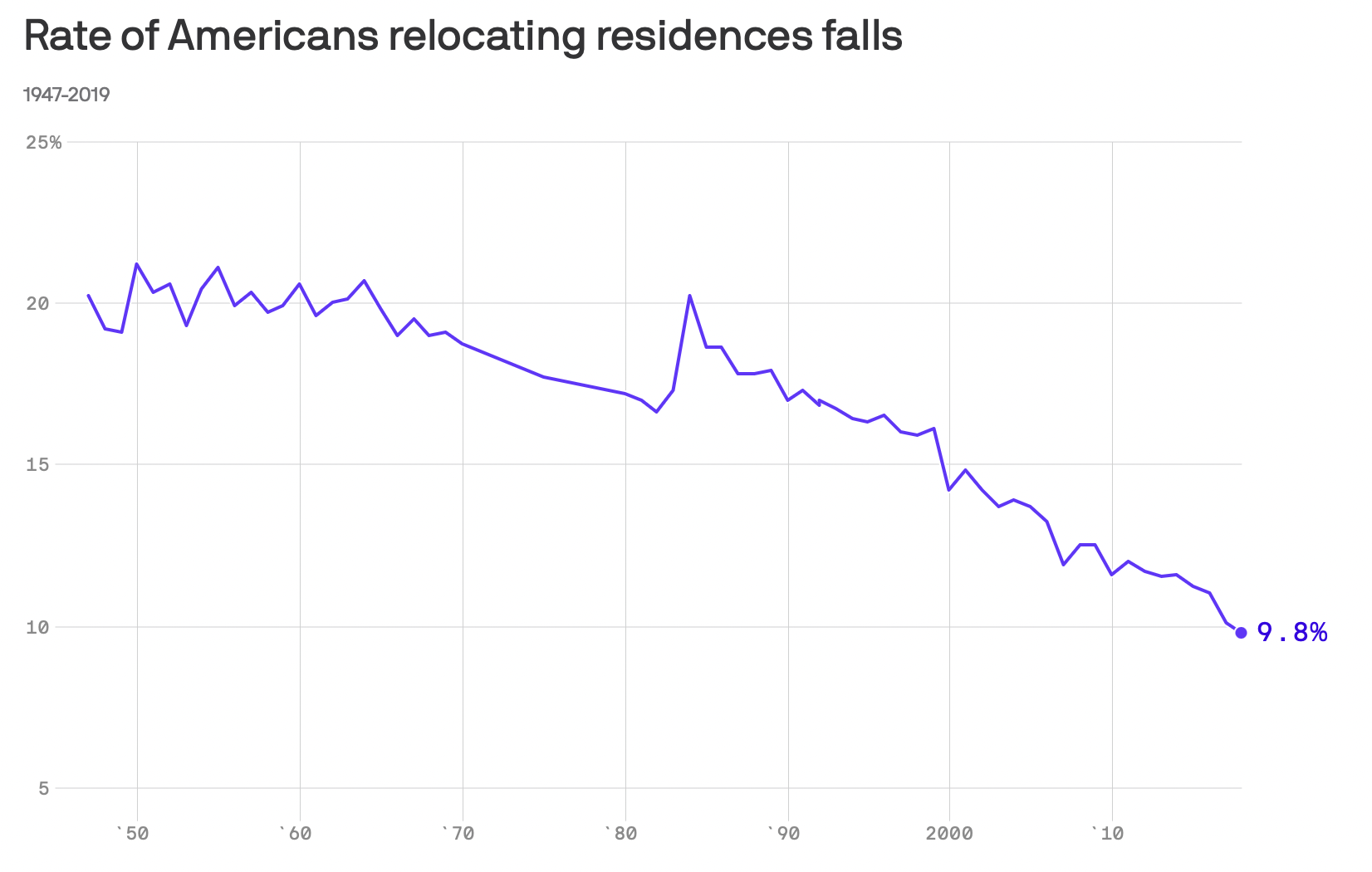

Liquidity has slowed over the past 30 years

As a starting point, it’s important to note that friction has increased when it comes to moving. The data is clear: the share of Americans moving annually continues to decline and is about 10% today compared to 20% in the mid ’80s.

Solid state today

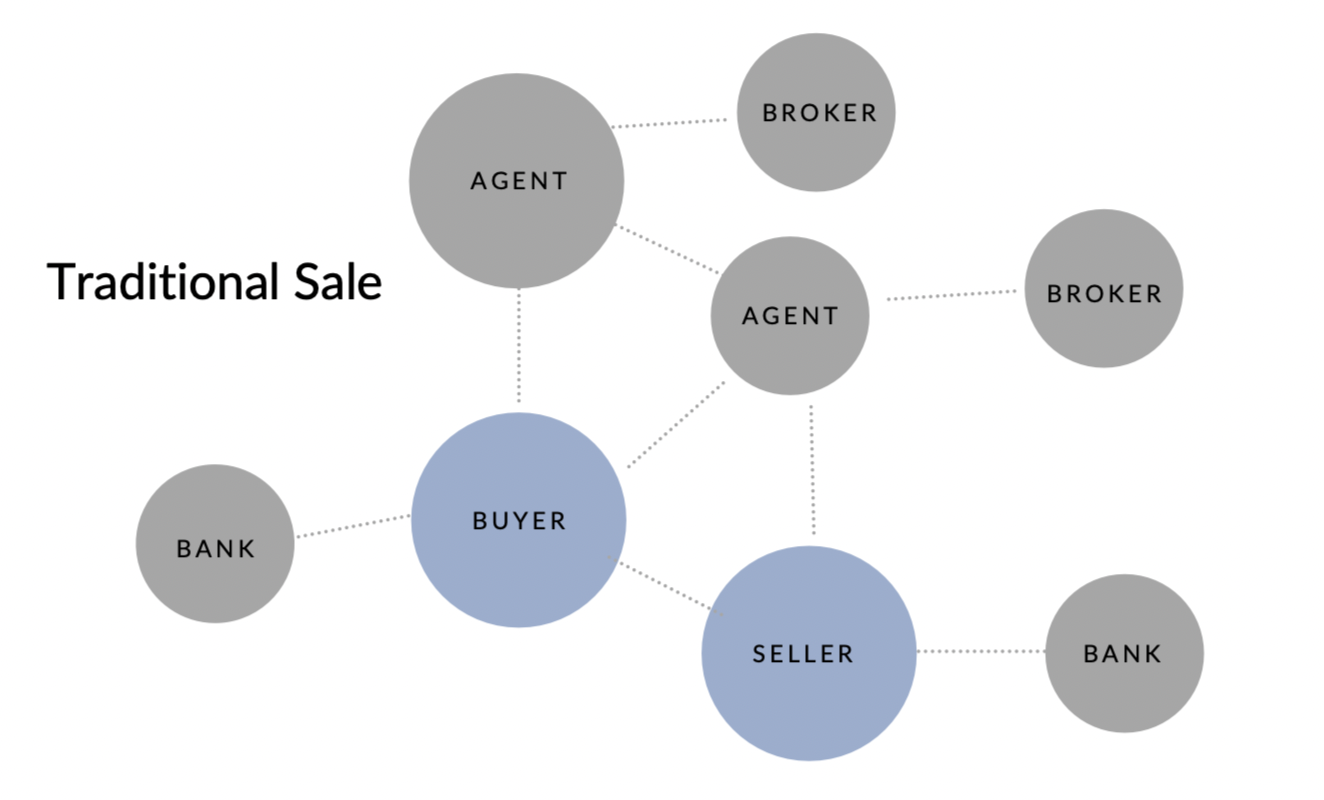

In a traditional home sale, which is about 99% of sales today, sellers must work with multiple parties including a buyer, agents, brokers, and banks. Then the seller in turn becomes a buyer, and the process repeats. This can lead to time and coordination inefficiencies, along with misaligned incentives between involved parties as each brings their own interests to the table. The bottom line is that inefficiencies, complexity, and fees increase the more transacting parties involved, ultimately hurting the consumer.

Semisolid to liquid phase

Over the past 5 years, Zillow 1.0 has driven liquidity through better search and discovery. In providing the best and most transparent consumer-facing database of homes, Zillow helped homeowners and real estate agents more quickly market their home and find a new one. But that isn’t enough.

Today, we liken the US residential housing market to a semisolid, meaning slow-moving and full of friction and complexity. Much of this is attributable to a legacy model that involves too many transacting parties in every home sale. Zillow 2.0 aims to liquifying the housing market by removing unnecessary friction, which will increase the ease of moving and add home inventory, speeding up the home buying and selling flywheel.

Cash, the liquidity that starts the flywheel

Zillow and Opendoor are doing this by offering sellers all-cash bids, providing adjacent services such as mortgage, title, and escrow, along with giving sellers the choice of a closing date to optimally time their move and avoid overlapping costs. Additionally, Zillow is beginning to introduce the Zestimate as a live initial cash offer in some markets.

There are converging forces that all work to bring liquidity. In Zillow’s case, it starts with the Zestimate as a live offer, which increases price transparency. The resulting cash offer increases seller time certainty, which frees them to move on to purchasing a new home. Further, bringing adjacent services under one roof decreases the number of transacting parties, simplifying the process.

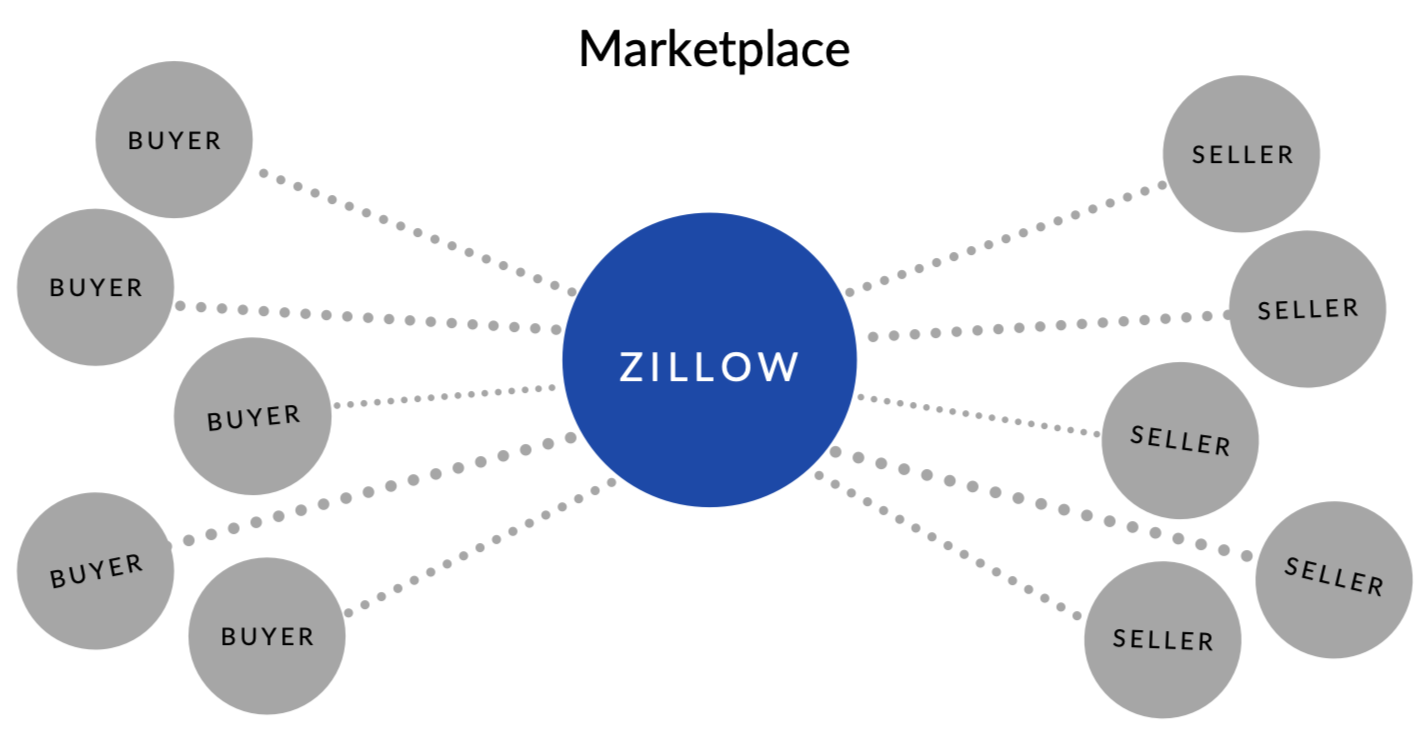

Marketplace as ultimate liquidity, Zillow 3.0

Zillow 2.0 is in its early days and should be viewed in the context of the company’s ten-year road map, that will eventually center on Zillow 3.0. This means, in the long term, an iBuying marketplace that provides a whole new level of simplicity, convenience, and liquidity. In this scenario, Zillow has enough inventory that you can simultaneously sell your house to Zillow and buy another home from their supply, essentially an exchange, with financing, title, and escrow seamlessly transitioning. On Zillow’s most recent earnings call, Barton referred to this as “one-click trade-in nirvana.”

A Zillow 3.0 marketplace is compelling because it would further reduce the number of transacting parties, leading to simpler, more convenient transactions, and ultimately, lower fees for consumers.

There are of course other factors beyond convenience and liquidity that are considered when people move. That said, we’re believers in the power of liquidity to expand and transform existing markets beyond what it is imaginable today.