Residential real estate represents one of the largest markets that is virtually untouched by technology today. There are about 140M homes in the US, with a combined value of $33.6T. Each year there are roughly 5.4M residential real estate transactions, triggering an exchange of $1.9T in value.

The real estate transaction, which is really the hub of a group of transactions, including items like mortgage, title, escrow, and moving, is a byzantine, outdated, and inefficient process that ultimately hurts the consumers involved. We believe iBuying, which involves a company buying homes directly from sellers as is, making improvements, holding them as inventory, and re-selling them to eventual buyers, promises a radically simplified solution to this process and a potentially transformational investment area.

We are investors in both Zillow and Opendoor based on our belief that over the next ten years, these companies will reinvent the process of buying, selling, and financing residential real estate. From 0.5% of homes sold in the US in 2019, we believe iBuying will account for about 10% of all transactions by 2030. We believe that shares of Zillow and Opendoor are well-positioned to triple over the next five years, as economics improve and the ultimate opportunity is more fully appreciated by investors. The writing is on the wall that younger generations prefer digital solutions optimized for user experience. Millennials and Gen Z account for more than 40% of the US population, and over the next decade will be the prime segment of home buyers and sellers.

Why Zillow: Zillow owns the top of the real estate funnel, and is leveraging its brand and gaining on Opendoor in iBuying. For the first three quarters of 2020, we believe Zillow accounted for about 25% of homes bought and sold online. We believe in 5 years, Zillow will surpass Opendoor in the number of homes sold online. Today, Zillow is a $37B market cap.

Why Opendoor: Opendoor is the market share leader in iBuying, accounting for about 50% of homes bought and sold online in 2020. Today, Opendoor is a $15B market cap.

iBuying 101

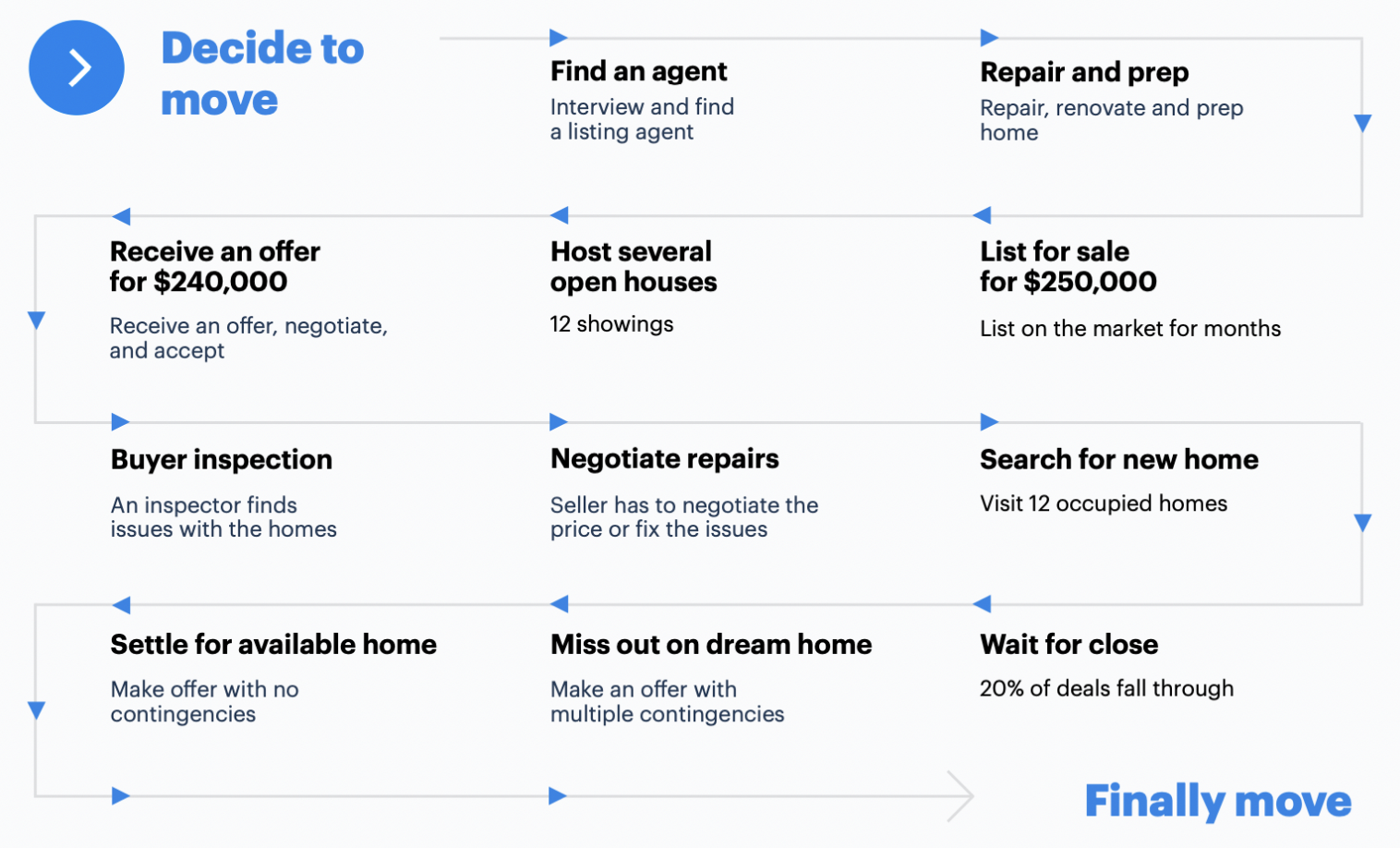

In a traditional sale, the seller will hire one of the more than two million real estate agents in the country, spend time and money repairing and improving the condition of their home, stage and show their home, wait for an offer (the national average is 25 days), haggle with the buyer over terms, accept the offer, go through an inspection, haggle over the post-inspection counter-offer, then enter the closing process, which averages 40 days and involves a myriad of different parties and expenses.

In a sale to an iBuyer like Zillow or Opendoor, the seller provides basic info on their home, receives an all-cash offer within 48 hours, schedules a walkthrough, and then chooses a closing date based on when they plan on moving. No renovations or real estate agent necessary.

Zillow and Opendoor make money by charging a fee that essentially replaces the standard 6% agent commission and varies based on how risky it will be to resell the house. They use data on comparable home transactions and factors like interior improvements, school districts, crime rates, and road noise, combined with machine learning algorithms to price homes. They then buy a home outright, mostly using debt, and keep it on their balance sheet as inventory until the home is sold to a new buyer. The inventory homes generally appreciate in value a few hundred basis points as they make improvements and repairs, but this is not the primary way of generating revenue. We think of revenue as the fee that they charge (take rate), minus the holding costs of the house (repairs, taxes, HOA fees, etc.), minus the selling costs of the house (mostly agent commissions), plus any price appreciation during the holding period.

Our three-part iBuying thesis

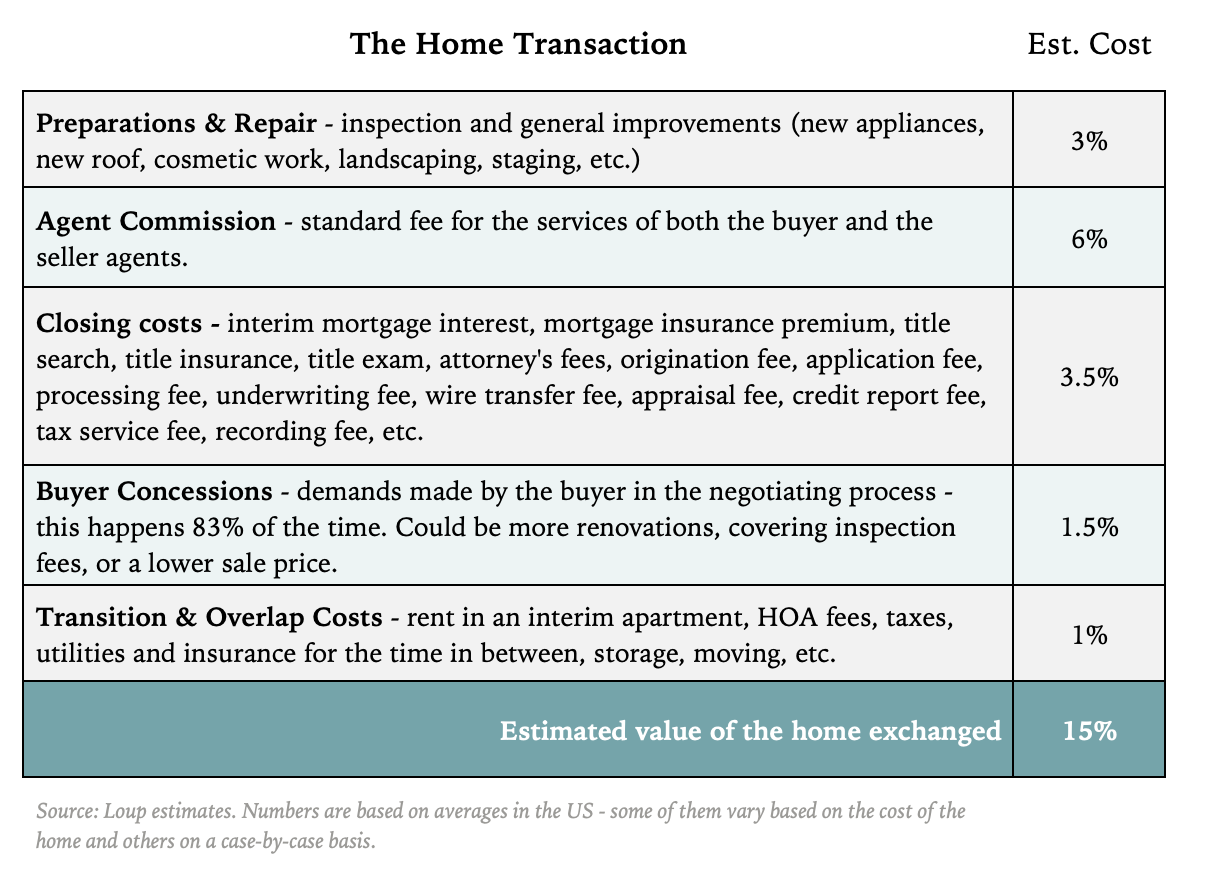

- There is a larger-than-appreciated amount of value (we estimate as much as 15% of a home’s value) that changes hands in the series of transactions related to moving homes. That value, along with expanded adjacent services, is the opportunity for Zillow and Opendoor. Their ability to consolidate the various pain points and inefficiencies associated with real estate transactions will determine their success.

- We think of Zillow Offers and Opendoor as a real estate transaction platform, not a home flipper or tech-enabled real estate agency. Their goal is not to make a profit by selling homes for more than they paid, but to capture a percentage of the value exchanged in a home transaction by offering a better experience and value.

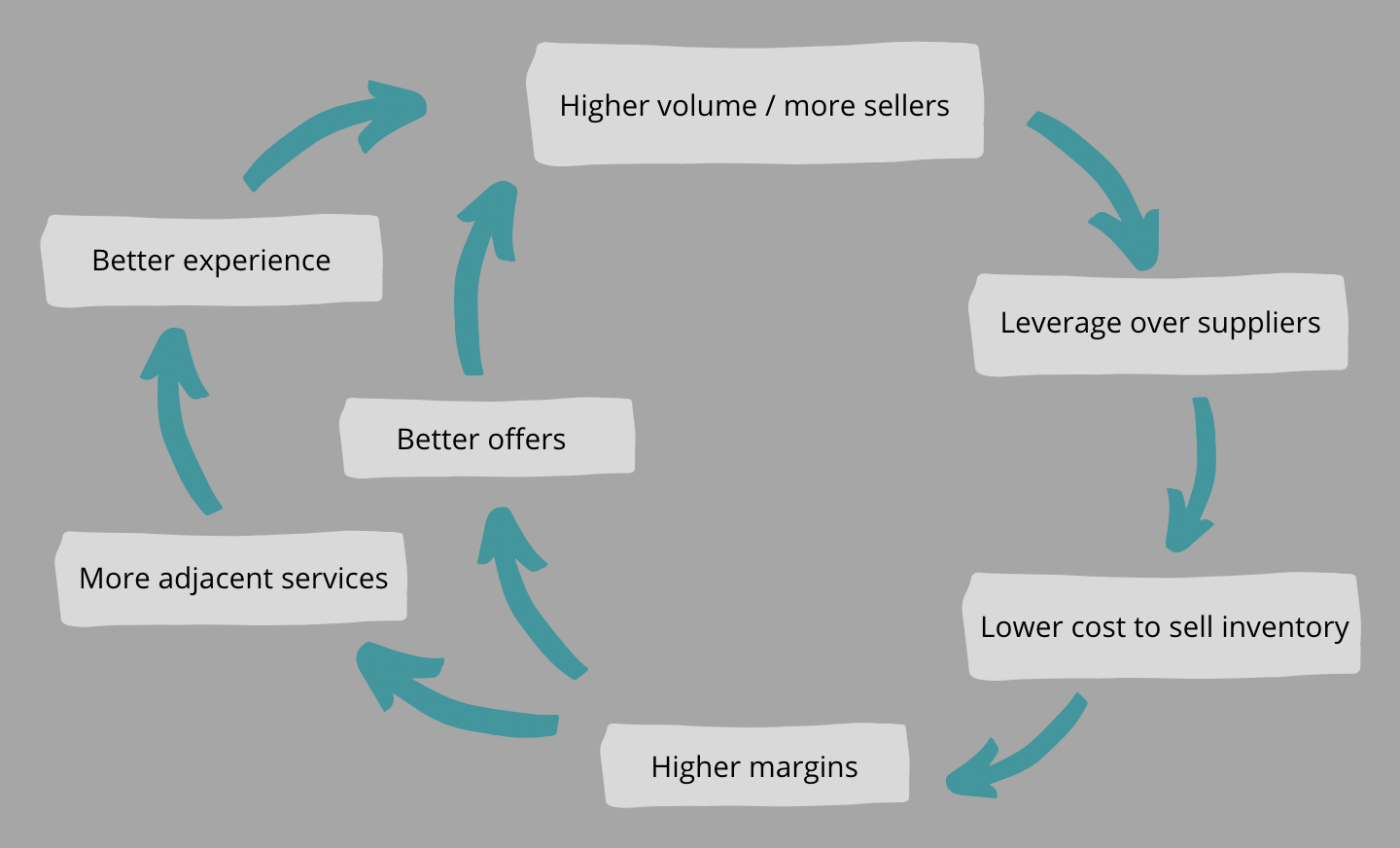

- As these platforms expand further into adjacent services like mortgage, title, escrow, renovation, and more, the incremental monetization and improvement in experience turns a powerful flywheel. Simplified, more sellers leads to more leverage over suppliers, leading to a lower cost to sell inventory homes, leading to higher margins, then to better offers, which means more transaction volume, and so on.

A larger-than-appreciated amount of value

Ask someone how much it costs to sell their home, and the typical answer is 6% — 3% for each the buyer and the seller’s agents. However, that fee doesn’t cover things like renovations, closing costs, or transition costs. The real number is more like 15%. Here is a breakdown:

This ~15% that changes hands during a home transaction, along with ongoing services like mortgage and insurance, is what we think of as the opportunity for Zillow and Opendoor.

A real estate transaction platform

One of the biggest pain points in a traditional home sale is the sheer number of disparate parties and costs that must be accounted for. Today, about 15% of the home’s value is split among a dozen or so players. Zillow and Opendoor aim to centralize as many of these services as possible under one umbrella. As Zillow CEO Rich Barton explains in a 2019 interview, “we are creating an integrated digital platform so that one day… you [can] have a trade-in experience with your house.”

Today, both Zillow and Opendoor offer in-house mortgages and closing services (with very high attach rates), and have plans to offer a similar suite of adjacent services including home insurance, home warranties, moving services, and home repair and maintenance. This would create a true one-stop-shop and push closer to the “trade-in experience.” Ongoing services like mortgages, insurance, and repairs also mean further monetization beyond the initial home transaction.

We see Zillow and Opendoor building real estate transaction platforms that are radically simple for the consumer, with a complex set of operations on the back end. Zillow or Opendoor buys a home and works with third parties to coordinate a mortgage, closing services, renovations, moving arrangements, and more, then pays holding and selling costs on the home. While there are multiple transactions taking place for a single home, their revenue can be thought of similar to a payments company that reports total payment value (the total value of goods transacted on their platform), but records revenue as TPV * their take rate. Zillow or Opendoor’s TPV is the total value of the home plus any ongoing services, and their take rate is the fee they charge plus the margin on those ongoing services.

The iBuyer flywheel

We believe Zillow and Opendoor can one day achieve the holy grail of offering both a vastly better customer experience and a higher offer on your home compared to a traditional sale. At that point, iBuying becomes a true no-brainer and its share of real estate transactions takes off.

This is achieved through the flywheel (see below) where transaction volume leads to leverage over suppliers and passing those cost savings on in the form of better offers on homes. Remember that Zillow and Opendoor are not trying to maximize the margin on each home they sell, but rather they are trying to maximize the number of customers they can incrementally monetize – so volume is the most important metric. In order to increase the volume of sellers, they need to make better offers on homes. If they make better offers, margins need to be sacrificed. However, margins can be increased by lowering selling and holding costs with scale economics. If a single homeowner must pay $8,000 for a new roof, but Zillow, who plans to re-roof 500 homes in the area in the next year, offers a contractor all of that business at a negotiated $6,000 rate, Zillow can pass those cost savings on in the form of higher offers for more sellers. This dynamic plays out across most of Zillow and Opendoor’s costs.

Today, the conventional wisdom is that iBuying is a good solution for a small fraction of buyers that either need to optimize for speed of sale or have the luxury to receive a lower price in exchange for a better experience – basically, by going this route, you are leaving money on the table. While historical data suggests that the cash offers from Zillow and Opendoor are within about 1% of the home’s value, there is a considerable psychological headwind that must be overcome for iBuying to gain traction. A home is often the most valuable asset a person owns, and transactions are very infrequent, so there is a big incentive to “do it the right way.” In the long run, however, just as internet dynamics have invaded and redefined countless industries, we believe they will redefine residential real estate.

There is a repeatable playbook for transforming an industry, just ask Rich Barton. Take a complex process with too many involved parties, remove friction by vertically integrating the disparate parts, and give consumers more information, value, and convenience through a digital platform.

What could the market be worth in five years?

Broadly, we expect iBuying to account for 10% of all US residential real estate transactions by 2030. This involves a ramp from about 35k total transactions in 2020, to about 550k in 2030 and results in around $220B in revenue between home sales and adjacent services.

Specifically, we believe shares of both Zillow and Opendoor can be three times higher than today’s levels in the next five years. Here’s how we get there:

For Zillow, we are modeling for 2026 home sales to be 110k, resulting in $825M in Homes segment EBITDA on top of $1.5B in combined IMT and Mortgages segment EBITDA. This yields an EPS of $5.88. A forward earnings multiple of 80x yields a share price of $470.

For Opendoor, we are modeling for 2026 home sales to be 100k, resulting in $620M in EBITDA and an EPS of $0.73. A forward multiple of 110x, gives us a price of $80. We assign a higher multiple to Opendoor as Zillow’s multiple is blended between iBuying and its legacy IMT business.

These earnings multiples may seem aggressive, but they are in line with the multiples of other fast-growing, open-ended market stories. As a point of comparison, since the beginning of 2017, the average forward earnings multiple for Amazon has been 125x. Square’s has been 152x. Over the same period, Amazon shares have appreciated 345% and Square shares have appreciated 1,641%. In a high-growth, transformative market, the leaders will always appear expensive, but in hindsight, are worth paying up for.

There are few multi-decade market opportunities, but when we find one, which we believe we have in iBuying, we try to be careful not to outsmart ourselves by being overly valuation sensitive. Zillow and Opendoor may pull back from current levels, but if we wait for that pullback, we may also not get another chance to enter at these levels. We learned a lesson to this effect with Amazon about a decade ago.

As tech investors, it’s our job to find these multi-decade growth markets and the companies best positioned to benefit from them. We invested in Zillow and Opendoor based on our belief that the iBuying model, which is in the early innings of redefining a large market, has a good chance of producing some valuable companies.