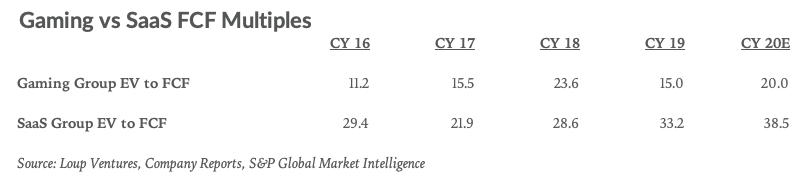

As AAA games evolve from their legacy retail sales model to something that more closely resembles a SaaS business, gaming multiples still lag far behind. This is a long-term positive for gaming investors, as the industry should see multiple expansion as the business model gap closes between SaaS and gaming companies.

While there has been a consistent gap between the gaming and SaaS groups, we’ve seen the gap expand significantly from 2018 to where we are today. In our analysis, average FCF multiples for gaming businesses are roughly half those of SaaS businesses when looking at the past two years. At current valuations, gaming companies trade at around 20x expected FCF for 2020 vs 38.5x for SaaS companies. To arrive at this multiple, we took the enterprise value at the beginning of 2020 and compared it to the street estimates for free cash flow for the upcoming year.

The gaming group includes the three major US game publishers: Activision-Blizzard, Electronic Arts, and Take-Two Interactive. The SaaS group includes Adobe, LogMeIn, Microsoft, Salesforce, Slack, and Workday.

In order to justify a SaaS-like multiple, game publishers need to continue to change their business models. In the legacy game publishing model, publisher revenue largely consisted of unit sales of individual titles, primarily driven by physical copies of games moved through traditional retail channels. Once launched, publishers were unable to meaningfully update or modify titles after the initial sale to the consumer. Game success was dictated by how many copies a particular title sold, which creates a hits-driven dynamic where every new launch needs to be a hit vs the SaaS model where you need one hit, and then you keep iterating. Some titles, like Starcraft, sold expansion packs to games, but expansion pack sales were essentially the same model as the initial sale. It was software to support software, not software as a service.

As technology has evolved, new game releases have been harder to differentiate purely on better visuals or gameplay. The annual improvement in the underlying graphics of games has become more incremental, so unique stories and evolving game experiences are more important. There has been a running joke that each year, gamers pay $60 a year for updated Madden rosters, as the game itself isn’t very different.

Publishers have begun to turn to new forms of distribution for games and supporting content, very much inspired by the success of the SaaS model. Publishers now monetize their player bases through recurring revenue products like battle passes, downloadable content, in-game purchases, loot boxes, and more.

While the transition to a more SaaS-like gaming model has been slow, a few successful outliers have shown the gaming world that a different model can exist. Riot Games launched League of Legends in 2009 as a free-to-play title. League is now arguably the most popular esports title in the world. Instead of selling individual copies of the game, Riot monetizes League through in-game purchases. The company only wants satisfied players to spend money in the game. While Riot wasn’t the first company to come up with this concept, as it was more common in Asia, it proved to the gaming industry that the model could work for titles in the United States. From 2017 to 2019, League of Legends generated $5 billion in revenue.

Fortnite has a similar model to League of Legends. It’s a free-to-play game where players can purchase a battle pass for access to in-game items and can purchase other cosmetic items if they so choose. New battle passes are available for every season of Fortnite, which creates a recurring mechanism for Epic Games, the developer, and publisher of Fortnite. Since the game launched in late 2017, there have been 12 seasons of Fortnite, with the next season coming out in mid-June. As each season progresses, Epic frequently changes the map, tweaks the weapons and items, and adds new content for players to encourage them to keep playing and keep spending money on battle passes and in-game items.

In a SaaS-like relationship, customers expect software they subscribe to will improve overtime as compared to a relationship where you buy software as a “finished product.” The new model of game publishing realizes that software is never a finished product and must always be improving.

Publishers like Riot and Epic Games are betting that a frequently updated title that players already enjoy will keep a player base more engaged than trying to reinvent the entire game every few years, regaining a new user base, and repeating. In 2018, the average revenue per monthly active user of Fortnite was $30, League of Legends $18, and Call of Duty $19. In 2019, we saw these numbers change to $23 for Fortnite, $19 for League of Legends, and $20 for Call of Duty (not including its mobile version). While the revenue generated per player is similar in 2019, League of Legends and Fortnite did not have the same marketing and development costs that Call of Duty incurred during the year.

Gaming has become an undeniable part of and a significant player in the battle for our attention. We’re believers that gaming may be the best absolute way to monetize attention in the long run, particularly as publishers treat games as ever-evolving worlds rather than single-release-and-repeat short stories.

As more publishers move to a model where their franchises are less reliant on unit sales and more reliant on cultivating and engaging the player base of those franchises, we think gaming companies will be deserving of multiples that are closer to SaaS companies, maybe even higher.