What’s Changed?

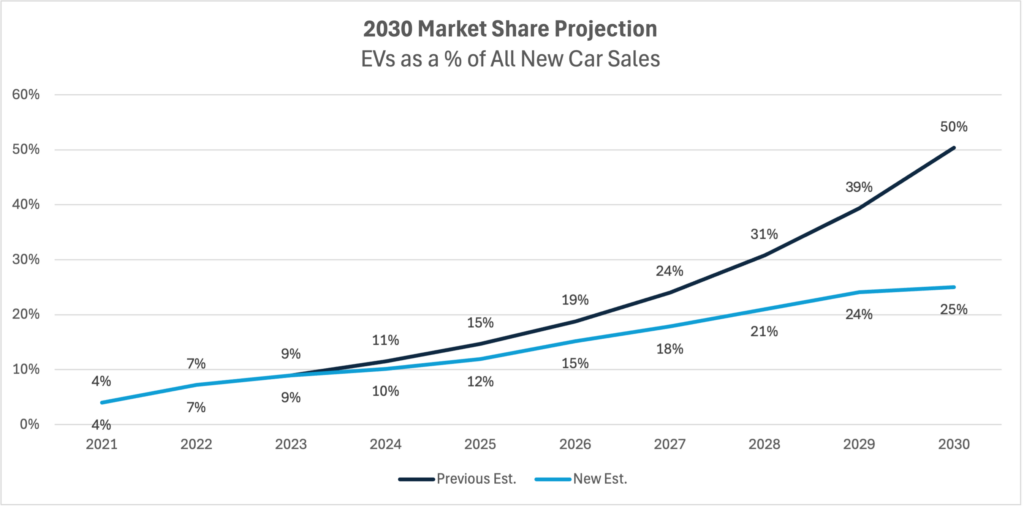

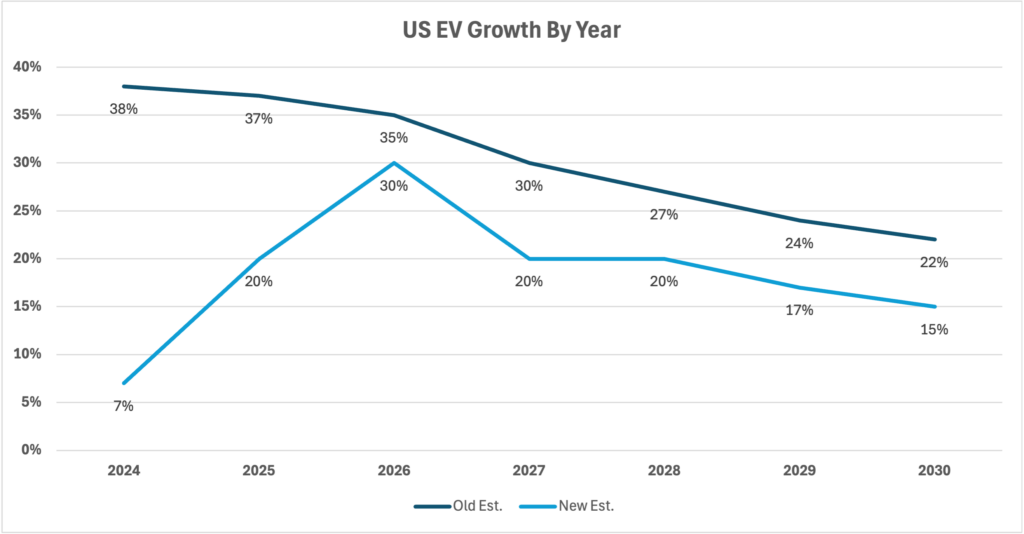

The pace of EV adoption in the US has slowed over the past year as the market growth shifts towards hybrids. EV growth has gone from 40% in 2023 to what will likely be 7% in 2024, compared to internal combustion engines (ICE) sales that we estimate will be down 3% this year. That means EVs are still gaining share on gas car.

I attribute about half of the EV slowdown to consumer anxiety regarding the availability of charging infrastructure and range, as well as the fact that EVs typically cost 10% more than their gas-powered alternatives. Another dynamic that’s likely impacting EV sales is there was a pull-forward in EV sales in 2021, 2022, and 2023. Essentially, consumers who had been thinking about getting an EV for years finally had compelling options, including Model Y, Model 3, as well as traditional automakers releasing an assortment of EVs. These factors have created a negative snowball effect as traditional auto sees slowing consumer interest in EVs and pares back investments in the space. This results in fewer EV options, which compounds the slowdown.

It is important to note we are only talking about fully electric vehicles, or BEVs (battery electric vehicles). We do not factor in hybrids or plug-in hybrids (PHEVs) because we believe eventually BEVs will win out given they should have a long-term cost advantage over hybrids.