Unity is on the road to becoming the next great creative software company.

Since going public in mid-September, shares of Unity are up more than 60% from the issue price. The company currently trades at a $26.2 billion market cap. Despite this short-term gain, we see material upside to the company as it continues to capitalize on the three major elements to our long-term thesis:

- Gaming as a Social Network. Gaming is now established as a “third place” where Millennial and Gen Z consumers spend time.

- Merging the Physical and Virtual Worlds. We believe that the physical world will be transformed more rapidly by thinking about it more like a game. Industries outside of gaming use Unity to create unique digital outputs that increase the effectiveness and efficiency of their work, ultimately saving time and money.

- Augmented and Virtual Reality. AR and VR provide long-term optionality for Unity, as the emergence of both technologies will create an acute demand for rich 3D experiences.

The two best public comps for Unity are Autodesk and Adobe. Both sell creative software to similar markets through a subscription plan. Many of Unity’s subscribers are also utilizing Adobe Creative Cloud and Autodesk products like AutoCAD, Revit, and Maya. We think Unity’s market cap could compare to Autodesk’s, and even Abobe’s, over the long term.

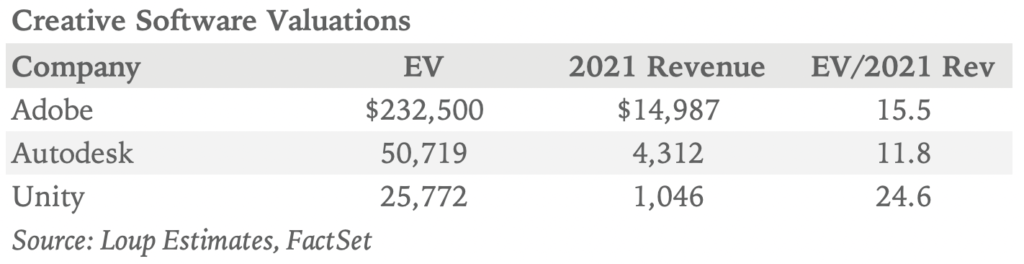

Based on our 2021 revenue estimates for Unity and consensus estimates for Adobe and Autodesk, Unity is currently trading at a 24.6x multiple, well above both Adobe and Autodesk. Unity deserves a higher multiple in part as it is growing twice as fast as Adobe and Autodesk. Through the first half of 2020, Unity’s revenue is up 39% from the same period a year ago. Comparatively, Adobe’s revenue in the previous two quarters has grown about 14% compared to a year ago, while Autodesk’s revenue has grown 17% over the same period.

Despite where Unity is trading today, the larger question remains – What would Unity need to do to reach market cap levels of Autodesk or Adobe in the future?

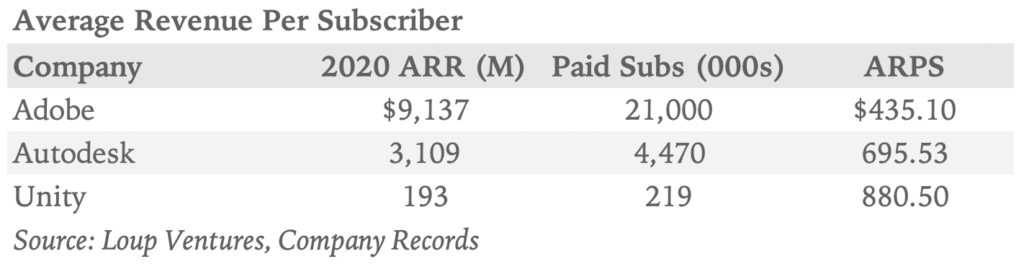

In our recent note about the company’s IPO, we presented two hypothetical scenarios for Unity to build a subscription business of a similar size to that of Autodesk or Adobe. In order for Unity to reach Autodesk’s current ARR, the company would need to add 3.3 million paid subscribers at its current ARPS. In order for Unity to reach Adobe’s current ARR, the company would need to add 10.1 million paid subscribers at its current ARPS. Both scenarios focused only on Unity’s Create segment and excluded Operate revenue.

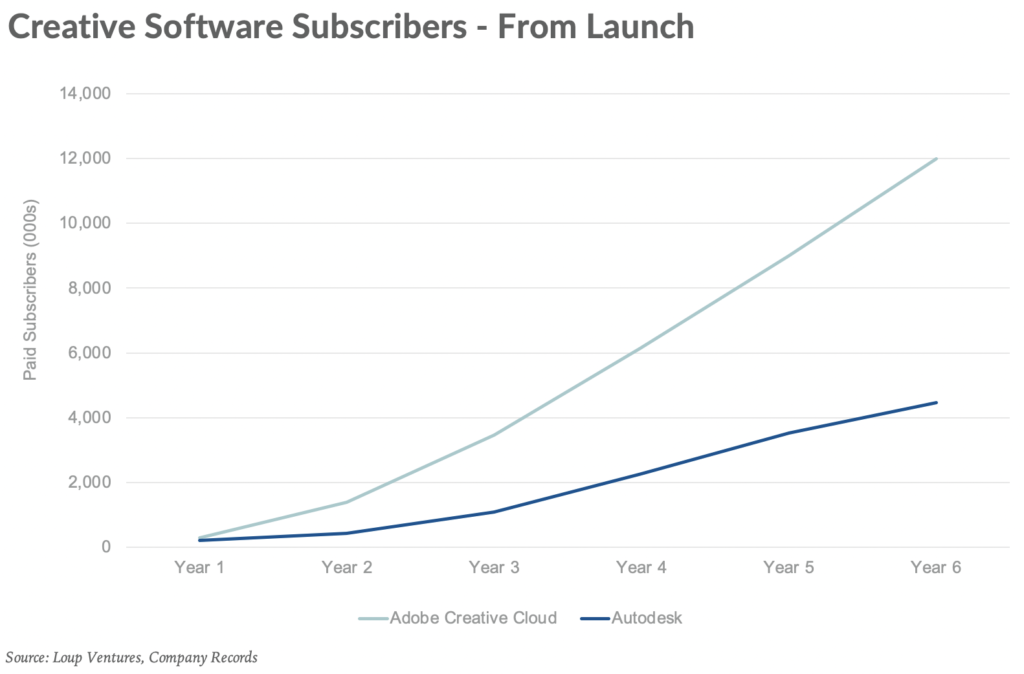

As an indication of what it will take for Unity to build its paid subscriber base, we can look at the historical growth of Adobe and Autodesk. Both Adobe and Autodesk sold licenses to packaged software before moving to a subscription model, so each started with strong existing user bases. Adobe was first to make the transition to subscription in 2012. Autodesk followed in 2015. Both companies converted a similar number of users in the launch year. Adobe converted about 300,000 paid subscribers by the end of 2012, and Autodesk converted 220,000 paid subscribers by the end of 2015. We believe Unity has a similar number of paid subscribers today.

Adobe ramped from zero to 12 million subscribers in six years, while Autodesk went from zero to over four million in the same length of time; however, both Adobe and Autodesk were converting existing customers to a subscription product. Unity’s trajectory is likely to be somewhat different as it will need to convince new users to adopt its software, particularly in industries outside of gaming. Despite this comparative difference, we think the demand tailwinds from gaming and other industries outside of gaming work in the company’s favor. As a result, we think Unity’s subscriber growth trajectory could resemble something closer to Autodesk’s on a slightly flatter scale.

Unity’s first hurdle is to add 3.3 million paid subscribers to reach a similar ARR to Autodesk. It took Autodesk about four years to accomplish this. We think it’s reasonable to believe Unity could do the same in 5-7 years. If Unity succeeded in this ramp, the company’s valuation would likely be significantly higher than Autodesk’s given the concurrent increases in Operate revenue not factored into this analysis on pure SAAS revenue.

The second hurdle for Unity is to add 10.1 million paid subscribers to reach a similar ARR to Adobe. Autodesk has yet to reach this level. It took Adobe about 5 years to do so while tapping into a massive existing user base. Even if it takes Unity more than twice as long to reach this paid subscription level, it illustrates a plausible path for Unity to become the next great creative software company over the next decade plus.

Disclaimer. We are currently investors in Unity.