As part of our ongoing work on game development software, we surveyed 24 Unity developers to better understand how they use the product. Given the small sample size, we view the data as directional rather than definitive but were left with three main takeaways:

- Unity developers appear to be a very stable customer base. 96% of respondents plan on maintaining or increasing their subscription tier over the following year.

- 62.5% of respondents said ease of use is the most important factor, and 83% included ease of use in their top three. In the duopoly between Unity and Unreal Engine, we believe Unity’s philosophy around ease of use has translated to the developer base it has built and will remain a key component of the company’s competitive advantage.

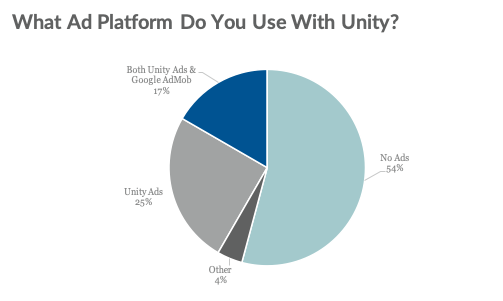

- Despite Unity creating a large ad network to date, less than 50% of respondents have any sort of ad monetization, pointing to some modest remaining runway in ad growth. Some of the lower ad penetration in our sample may be due to free-tier developers that don’t have applications that generate enough traffic to warrant using an ads platform.

Of our respondents, 22 (92%) use Unity for some type of game development, 9 (37.5%) use Unity for AR/VR development, 3 (12.5%) use Unity for film and animation, 3 (12.5%) use Unity for architecture and construction, and 3 (12.5%) use Unity for other use cases such as education or medical visualization. Many of these developers are using Unity for multiple different applications or simultaneous use cases (i.e. a VR game) which causes the overlap in responses.

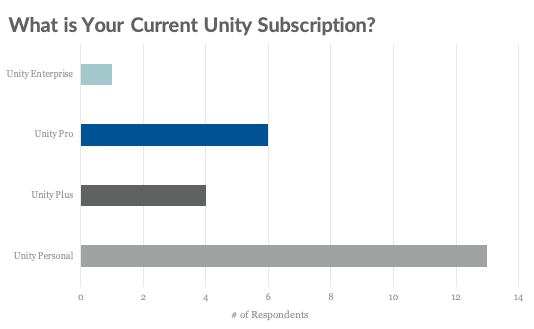

Regarding subscription tier, 13 respondents (54%) use Unity Personal, the free version of Unity, 4 (17%) use Unity Plus, 6 (25%) use Unity Pro, and 1 (4%) uses Unity Enterprise. While Personal made up 54% of our sample, we think Personal skews even higher for Unity’s overall user base, although that cohort likely consists of many infrequent users. Our sample is more representative of users that work with Unity on a near-daily basis.

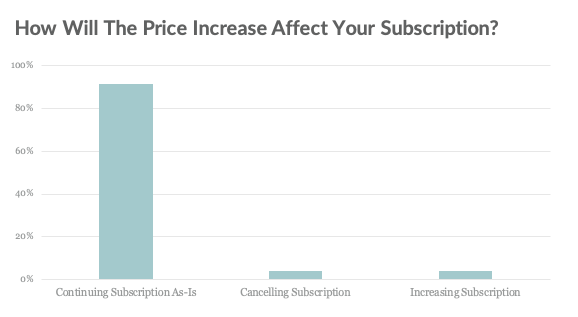

In October 2019, Unity announced it would be increasing its prices for new users and additional seats in January 2020. While few respondents will likely see an immediate price increase, 92% of survey respondents said they would continue their Unity subscription at the same tier, which we view as a positive indicator of the value of Unity. Only one respondent, 4% of the sample, said they would cancel their subscription. This individual was a Unity Plus subscriber using Unity multiple times per week. One respondent, a Unity Personal and Unity Ads user, said they planned to increase their subscription to a higher tier.

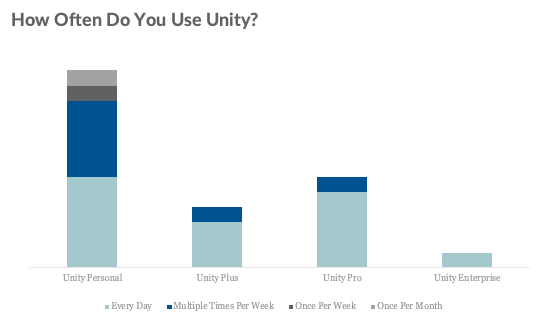

Unsurprisingly, paying Unity users use the software more often as 81% of respondents who pay for Unity use the software every day compared to only 46% of Unity Personal developers. 58% of respondents use Unity every day and 92% use Unity multiple times per week.

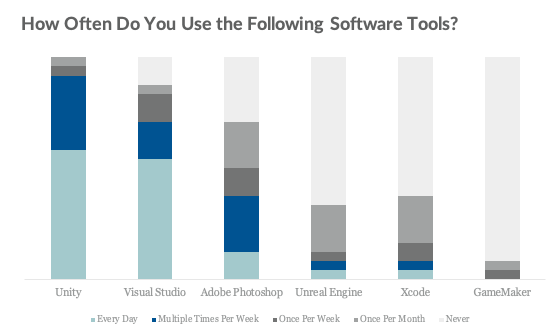

In terms of other popular tools, 70% of respondents use Visual Studio multiple times per week and 37.5% use Photoshop multiple times per week. Other tools mentioned include Blender, Affinity Designer, VS Code, and GIMP.

There was minimal overlap between Unity and Unreal Engine usage which is to be expected. It would make little sense for someone to work in both tools often given the use-case overall. Only a third of respondents said they use Unreal Engine at all, and the majority of those users use it infrequently.

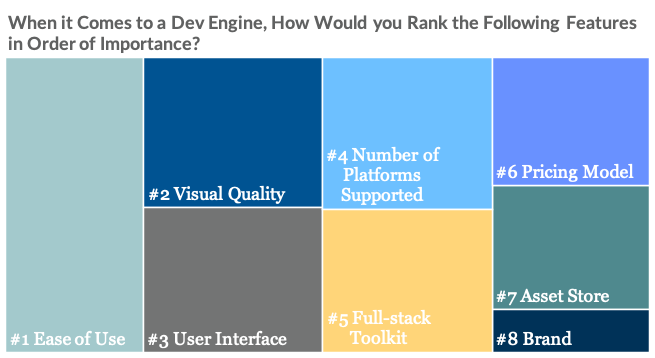

To get a sense of how developers decide which development engine to use, we asked developers how they rank certain key features. The number one factor was ease of use. 62.5% of respondents said ease of use is the most important factor, and 83% included ease of use in their top three. Aside from the price insensitivity amongst users, the value Unity users put on ease of use was the most important insight from our survey. We believe one of Unity’s core advantages against Unreal Engine is a relatively shorter learning curve. While Unreal Engine may cater more to hardcore developers, Unity is more accessible to the broader masses.

The next four key feature categories — visual quality, user interface, number of platforms supported, and full-stack tool kit — ranked in close proximity. The average placement for the categories ranged from 4.042 (#2 visual quality) to 4.417 (#4 number of platforms supported). Brand was least important to developers, chosen last by 54% of survey respondents.

Our final question focused on how developers integrate ads into their applications. 54% of respondents were not integrating ads at all, 25% were using only Unity Ads, 17% were using Unity Ads and Google Ad Mob, and 4% were using a different ad platform. Respondents highlighted Appodeal and Pollfish as alternative ad platforms they were using. Despite Unity creating a large ad network to date, the sub-50% penetration of ad monetization usage seems to point to some modest remaining runway in ad growth.