Written by guest author Carlos Castelán with Andrew Murphy. Carlos is Managing Director of The Navio Group.

There’s an old Sun Tzu quote that speaks to the power of a winning mindset: “Victorious warriors win first and then go to war, while defeated warriors go to war first and then seek to win.” In other words, “the battle is won before it starts.”

The notion that Sun Tzu articulated over 2,000 years ago is one that still applies today and deserves consideration in the business arena. So, how can leaders develop a victor’s mindset? Together, The Navio Group and Loup Ventures identified a key driver of sustained success for retailers and brands: long-term investments. Long-term investments – defined as Capital Expenditures plus Research & Development (R&D) – lead to winning outcomes for retailers and brands over time.

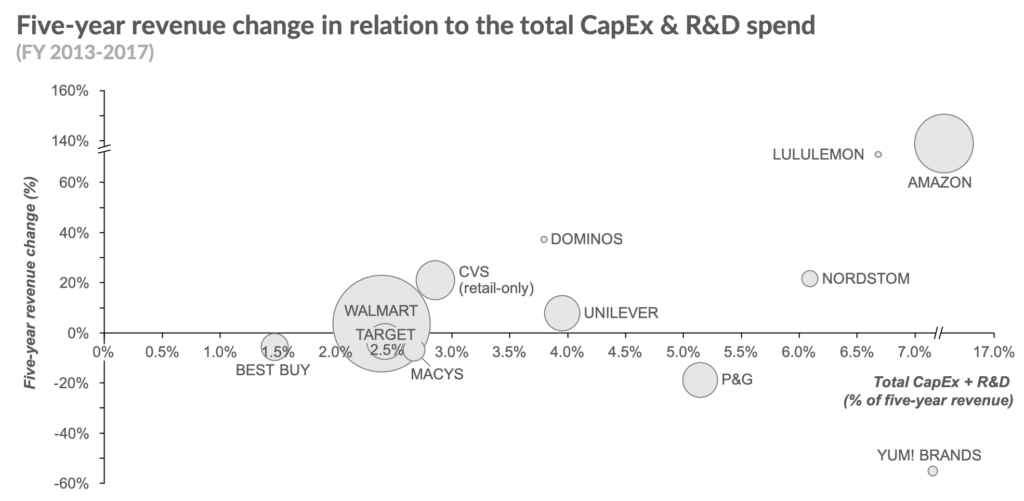

For this analysis, we focused on the same basket of companies we analyzed earlier this year in relation to transformations (to recap: the more a company talks about transforming on their earnings calls, the less likely they are to succeed in driving future revenue growth). Using our definition of long-term investment (CapEx plus R&D), we stacked the numbers against total revenue and looked at the effects over a five-year period, from fiscal years 2013-2017. Traditional metrics, such as return on invested capital (ROIC), are often evaluated against performance in the same fiscal year which can be limiting for a variety of reasons. So, we sought to take a broader view to look at growth effects over five-years since long-term investments, by definition, should be evaluated over a longer period.

It should come as no surprise that retailers and brands that invest a higher percentage of their total revenue see higher revenue growth over the long-run. What is surprising, then, is that brands don’t invest more dollars and at higher rates given the connection to growth. The linkage between investments and revenue growth held true for both mature retailers (Nordstrom) as well as younger ones (Lululemon) so the growth seems to be agnostic of brand maturity level.

In the wake of Sears’ Chapter 11 bankruptcy, a lack of investment in presentation, products, and needed technology should be viewed as an omen of future performance for any retailer or brand. From our work with clients, we’ve seen a hesitation to make investments most often come down to “unclear” ROIs in financial models and, in one instance, speculation about how Wall Street and the media would perceive these very visible upgrades. It’s important to have a clear vision and rationale of the future to back up the investments and bring stakeholders along. As some of the leading companies, like Amazon and Nordstrom, in our model show, long-term investments are about making bets on what the customer will want in the future rather than identifying a short-term ROI from that specific investment. Amazon pushes the envelope in relation to ecommerce and technology. Nordstrom does the same for high-end retail concepts, as Nordstrom Local and their flagship in Manhattan demonstrate.

So how does a company manage to dig in and make the long-term bets that will protect them from a nose-dive like Sears? The key, as with most many questions in business, comes down to exceptional leadership. It’s no surprise that leaders of both Amazon and Nordstrom appear in the recently released list of Harvard Business Reviews top CEOs. Without a doubt, there is a significant place for ratios and finances when preparing for long-term investments, however, just as important, is the company’s willingness to make bold bets.

As technological change continues to accelerate, and consumers continue to be empowered, it will be more critical than ever to identify emerging leaders at brands and set up the right structure for them to innovate and pursue new ideas. We once heard an executive joke about the number of “store of the future” projects he had worked on during his career and the similar arc they had followed: 1) stores of the future were branded a success at launch to ensure continued executive support, 2) they were expanded quickly and communicated publicly to create buzz, and then 3) killed just as fast when the reason for building the stores became diluted or unclear and the project ran out of money. These issues at larger organizations are common and happen when there are competing focuses across teams and many handoff points.

To ensure focus, Amazon has the famous memo/press release concept to help others envision what the solution could look like for customers and empowers small teams to doggedly pursue new/out-of-the-box ideas. Without the sizzle of visuals or the oft-used PowerPoint presentation, the idea must stand on its own in the memo. Dominos was successful because it rallied its teams and franchisees to invest in and support new technologies that allowed it to leap ahead of its competitors and earn praise as a “tech company that happens to make pizza.” These are examples of the victor’s mindset that great leaders engender across their company: be proactive and on the offensive. The brands that will win during the next decade of immense change will be the ones that adopt the mindset of the victorious warrior from Sun-Tzu’s saying by being bold and investing today.

Disclaimer: We actively write about the themes in which we invest or may invest: virtual reality, augmented reality, artificial intelligence, and robotics. From time to time, we may write about companies that are in our portfolio. As managers of the portfolio, we may earn carried interest, management fees or other compensation from such portfolio. Content on this site including opinions on specific themes in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making any investment decisions and provided solely for informational purposes. We hold no obligation to update any of our projections and the content on this site should not be relied upon. We express no warranties about any estimates or opinions we make.