A few days ago, we saw interesting research from RBC Analysts forecasting Amazon’s Go stores to be a $4.5 billion business by 2021. RBC’s work aligns with our $50B estimate for the total automated retail space, implying a 9% share for Amazon Go. But we think the real story of Amazon Go lie’s in the investment and the long-term strategy, not in the revenue opportunity.

Amazon Go stores are an expensive proposition with a long payback period. If the economics of an Amazon Go store are not a home run, especially in the near-term, why would Amazon go through the struggle of opening 3,000+ brick and mortar stores, as has been reported by Bloomberg?

The Economics of Amazon Go Stores

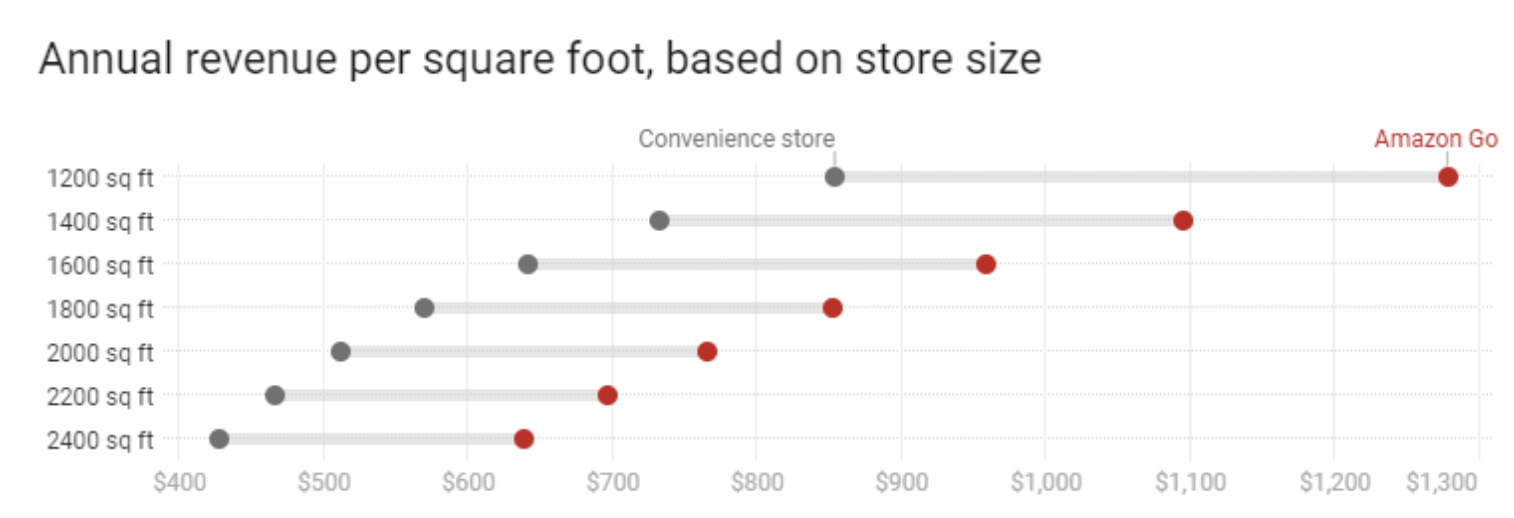

RBC estimated Amazon’s “Just Walk Out” convenience stores bring in about 50% more revenue than traditional convenience stores of equivalent size. With an average order size of $10 from 550 customers per day, Amazon Go stores are expected to generate around $1.5 million in sales per year compared to just $1 million/yr for traditional convenience stores. The jury is still out on whether this is due to the excitement of the new store or if the frictionless experience incentivizes more impulse purchases.

If Amazon were to open 3,000+ Go stores, it would generate $4.5 billion per year. While the stores have the potential to be a sizeable business – even by Amazon’s standards – it will be costly to get there. Morgan Stanley estimates Amazon could spend up to $3 billion to open 3,000 Go stores. Reports have suggested the first Amazon Go’s computer hardware alone cost over $1 million. Hundreds of high-tech cameras, sensors, and computing resources, along with actually acquiring property and constructing a physical building make Amazon Go an expensive way to build a convenience store.

Some may speculate that the savings would come from not having to pay cashiers. This is true, and 3+ million cashiers in the US (about 3% of the US workforce) will increasingly need to find other work. However, most don’t realize that robots aren’t yet stacking shelves and answering customers queries. In our experience at Amazon Go, the stores appear to have about the same number of employees as a standard convenience store, if not more. When we visited the Amazon Go store in downtown Seattle, one of the first things we noticed was a street-facing kitchen full of chefs chopping vegetables for salads and other prepared foods. The surface-level economics of Amazon Go stores don’t make sense as standalone convenience store initiative. Amazon has other motives.

Zero-Click Purchases

Convenience is at the heart of Amazon’s mission to be customer-centric. The pursuit of the frictionless purchases has been and always will be a top priority for the company. Alexa devices, another zero-click channel, can reorder laundry detergent with one sentence. The company is ruthlessly removing friction from its buying experience, and Amazon Go is another step in that direction.

Rounding Out the Data

In our view, consumer behavior and preference data collected from Amazon Go stores is another key driver. It’s becoming increasingly clear how Amazon will leverage that data in new ways. Amazon knows what we want and need before we do — based on an increasing share of our consumption. Understanding a customer’s buying patterns at physical retail stores adds valuable data to Amazon’s understanding of a given shopper.

Amazon has already started sending free samples to households based on similar insights. Soon we could see Amazon proactively send a box of items to either keep/purchase or return in that same package. Prime Wardrobe, for example, sends clothes to try on and then keep or ship back.

Brick and Mortar Retail Isn’t Dead and Isn’t Dying

The death of brick and mortar has been overstated. Companies that don’t adapt to changing times will perish, but physical stores will be a staple of the economy for a long time. Sure, we see headlines of malls closing and well-known retail stocks tanking, but retail is still a multi-trillion dollar industry and e-commerce still represents around 10% of total retail revenue.

In his book The Four, Scott Galloway says it’s not stores dying but the middle class. In our view, Amazon’s interest in Whole Foods showed that the company’s core customer is in an above-median income bracket. Over 80% of affluent households have Prime, and Amazon is expected to position its Go stores in busy metropolitan, likely more affluent areas. Amazon hasn’t come as close to retail domination as many think. Winning in brick and mortar retail will prove critical to Amazon’s long-term strategy.

Note that Amazon has already built 107 physical store locations under the Amazon Books, Amazon 4-star, Amazon Pop-up, and Amazon Go brands, plus 500 more with Whole Foods.

Creating A Single Retail Experience

The winners in the future of retail will be those who integrate e-commerce and brick and mortar best. In our view, a retail duopoly between Amazon and Walmart is emerging, given their early advantage in building such an experience. We also wrote about how Amazon is investing heavily in retail and Walmart is investing more and more into e-commerce.

Consumers want to conveniently order something online and be able to go into a physical store to see, touch and feel products. Groceries are a great example. Amazon had previously been unsuccessful in groceries. Turns out people would prefer to select the bananas they like best and the piece of meat with just the right amount of fat on it. Consumers want to try on and test things like clothes and electronics before making a purchase. Shipping items back and forth is not sustainable in the long-term; retailers need to offer both when it comes to online and brick and mortar retail.

Shipping

Amazon’s core value proposition is convenience, driven by its core competency in logistics, but fulfillment expenses also represent the companies second biggest line item (after cost of sales). They are constantly searching for the next best way to reach more people in less time.

It’s no secret this thinking went into the acquisition of Whole Foods, and we think it’s just as clear Amazon Go stores will have a similar utility in the future. We believe convenience stores are an untapped resource that will one day support broader same day delivery. 93% of Americans live within 1 mile of one of the 155,000 convenience stores in the U.S., according to the NACS.

Amazon Go stores could also be used as hubs for return shipping. When a customer receives his or her clothes from Wardrobe, instead of sending the box back from a crowded post office, they can drop their package off at an Amazon Go and pick up a fresh sandwich, too.

Conclusion

Jeff Bezos has said he was very interested in physical retail, but only if he had something new to offer. Amazon Go appears to be one of the first few examples. Whole Foods has nearly 500 stores, — not enough for Amazon’s scale. The Amazon Go buildout will be costly, but Amazon has shown time and again that it’s willing to invest significantly in risky, long-term bets. Amazon Web Services was unprofitable for years and now represents over half of all the company operating income (as of the Sept. 2018 quarter). Even at near a $1 trillion valuation, Amazon continues to make decisions like a day-1 company.

Disclaimer: We actively write about the themes in which we invest or may invest: virtual reality, augmented reality, artificial intelligence, and robotics. From time to time, we may write about companies that are in our portfolio. As managers of the portfolio, we may earn carried interest, management fees or other compensation from such portfolio. Content on this site including opinions on specific themes in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making any investment decisions and provided solely for informational purposes. We hold no obligation to update any of our projections and the content on this site should not be relied upon. We express no warranties about any estimates or opinions we make.