This piece was originally posted on Doug’s blog, Uncomfortable Profit.

Imagine a world where you bought a new $200 pair of Genesis Jordan 1s. Nike validates your ownership of those Jordans on the blockchain. When the next pair of Jordans launches, you get first rights to purchase them for $200 as the verified owner of the Genesis pair. You can keep that second pair as a collector or sell it in the vibrant aftermarket for sneakers.

Imagine the Genesis 1s also grant you the right to purchase every future Jordan launch before the public. In just a few years, you could earn back the original purchase from profits from resale. You could also sell your pair of Genesis Jordans, transferring the rights to future launches to the new purchaser.

This isn’t how the sneaker world works, but it should.

You could say the same for many other popular consumer products. Trading cards — imagine if your Patrick Mahomes rookie spawned a new Mahomes card every year sent to you by Topps. Video game consoles — imagine if PS 4 owners had first rights to buy a PS 5. Handbags, sports cars, you get the gist.

Traditional consumer product companies don’t distribute products to loyal customers this way, but NFT projects do.

I’ve been arguing that this means NFTs create dividend streams like stocks, so they can be valued like stocks; however, for the uninitiated in the NFT world, the idea that airdropped digital files can be valuable dividends is sometimes too abstract. It’s hard to imagine selling a free digital good for tens-of-thousands of dollars. It’s easy to envision selling shoes that you get as a “shareholder” on the aftermarket because we’ve all seen it happen on StockX or even eBay.

The Jordan analogy helps explain why NFTs should be thought of like traditional equities through three concepts:

- Cultural relevance is future demand

- Valuing sneaker dividend streams

- Customers are shareholders

Investing in Cultural Relevance

To invest in any company that sells consumers products or services requires a belief that consumer demand will continue over time. For fashion and collectibles, consumer demand depends on the cultural relevance of the product. Jordans are Jordans because they’re endorsed by the greatest basketball player of all time. The shoes have an iconic history that spans dunk contests to NBA championships, to pop culture.

Yes, Nike spends billions a year on R&D and marketing to support products, but what they’re really investing in is continued cultural relevance. Nike shareholders invest based on a belief that Nike the company will maintain that relevance.

The same relationship is true of NFT creators and investors. Creators need to build community, game mechanisms, and new IP to keep their product relevant in the digital world. Investors bet that those creators will be successful in their quest to relevance. An NFT project that loses the imagination of the public, and ultimately the community that supports it, is a project that will end up worthless. Not much different than a shoe company that makes shoes that no one wants to buy.

Calculating the Value of Genesis Jordans

The value of some asset at any given time is always a function of supply and demand at that moment.

We can consider Genesis Jordans through the eyes of two market participants: investors and collectors. Each provides unique views of value that translate into supply and demand.

Genesis investors would concern themselves with the potential for future earnings from the rights to purchase future Jordans. To establish fair value, the investor would calculate the potential profit from future sneaker sales discounted back to the present through a dividend discount model.

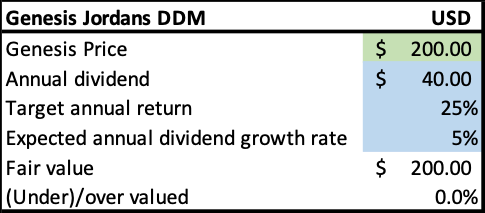

For example, a $200 Genesis Jordan price would seem fair to an investor with a 25% discount rate and 5% dividend growth expectation if he believed he could generate $40/year in profit selling shoes purchased with the Genesis rights.

A $40 profit on Jordans seems conservative. According to StockX, the average premium on Jordan sneakers was 54% last year (see below). A $100 markup on a $200 sneaker would be about $60-70 in profit after platform fees. It’s also likely that there is more than one Jordan launch a year for Genesis holders. The Genesis 1s might be a true bargain to investors at $200.

Collectors value things differently than investors. They don’t think in terms of discount rates and dividends. They think in terms of personal taste, rarity, and emotion. A Jordan collector would almost certainly pay more for a Genesis pair than an investor because they value access to future drops at a higher level than the investor.

The Jordan analogy highlights an important element of NFTs as equities of the future: They’re also collector’s items. No one collects shares of Google stock other than investors who believe in the company. The shares are fungible and liquid. There’s nothing aesthetically beautiful to display if you own a share of GOOGL.

NFTs come with aesthetic and communal value. They come with a history detailed on chain. And they will attract collectors in ways that stocks never could.

Equity investors have always competed with emotion in the stock market, but not the emotion of a collector. Investors who can acquire NFTs early can benefit from asset prices that far exceed fundamental investment prospects given collector demand. Then those investors just have to be disciplined enough to sell and not turn into collectors themselves.

Customers are Shareholders

Owning a pair of Genesis Jordans is like owning an alternative share of Nike stock. Instead of accruing a share of Nike’s corporate earnings, Genesis owners accrue a share of potential secondary sale value of future Jordan releases. The Genesis 1s shift profits from sneaker resellers to owners of the asset.

That’s better for customers and collectors given that Genesis shoes should gravitate to true Jordan fans given their willingness to pay more than others as described above.

It’s also better for Nike.

StockX transacted $1.8 billion in secondary streetwear sales, and most of that was probably Nike goods. I’d estimate more than $2 billion in Nike goods were sold on secondary this year. The company could earn an additional $100-200 million in pure margin annually through a 5-10% secondary royalty.

A few hundred million may not be significant to a company that did over $6 billion in operating income last year, but Cowen estimates the streetwear resale market could top $30 billion by the end of this decade. If that happens, then Nike could see annual secondary royalties in the billion-plus dollar range. That would be meaningful.

Translating to NFTs

Now replace Jordans with Bored Ape art or Punks Comics or choose your NFT. Can that asset establish and maintain relevance over the next several years to create valuable distributions to collectors and investors? And if that project is as relevant in the digital world as Jordans are in the physical world, do you think that project should get a market cap to match?

The current market cap of Cryptopunks is about $3 billion. It’s just over $1 billion for Bored Apes. Many emerging NFT projects are in the tens of millions in market cap. They’re seed stage startups or pink sheet stocks. You should invest in them as such, and they have upside as such given the $1 trillion NFT market opportunity.

Projects that create IP as relevant as Jordans in our physical world will be great investments, like investing in Nike in the 80s or 90s. Those projects that can’t generate cultural relevance will fall like so many shoe companies to the Goddess of Victory.