US Healthcare accounts for 20% of the GDP. It’s not only a massive TAM, but it’s a sector that remains resilient even in the face of economic downturn. At the peak of the Great Recession (October 2009), the national unemployment rate was 10% yet employment within the healthcare sector continued to grow.

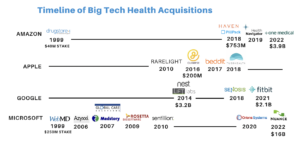

While there were few mentions of health-related efforts on Big Tech’s June quarter earnings calls—apart from Apple announcing 510(k) clearance for its AFib feature—the companies continue to make moves toward the goal of healthcare disruption. From 1999-2022, Amazon, Apple, Google and Microsoft collectively made announcements of acquiring or investing in 22 health-oriented companies, ranging from Apple’s $200M acquisition of Gliimpse in 2016, to Google’s $2.1B acquisition of Fitbit in 2021, to Microsoft’s $16B acquisition of Nuance just under six months ago. The actual number of companies that have been acquired during that time is much higher, given that most of the deals have been small and have flown under the radar. Within the last two decades, Microsoft has made the most consistent investments within the health sector. We expect that over the next two decades, Amazon, Apple, Google and Microsoft will play increasing roles in healthcare and will siphon sales from the industry’s massive addressable market. We recognize that twenty years is a big window, and a long time to wait, but it is appropriate given how slow the industry is to change.

Source: Loup Funds

Big Tech Healthcare Focus

- Amazon‘s contributions to health will likely be centered on logistics, testing, and primary care, with a separate ambition of providing insurance.

- Apple will stick to their hardware, software and services core competency and provide the device layer along with data storage. Notably, we don’t expect Apple’s Project Casper, a primary care program pioneered in 2016, to materialize.

- Google will continue to offer advancements in research with AI, and a thin device wearable offerings.

- Microsoft will continue to offer cloud solutions to healthcare providers.

How much revenue can healthcare add to these giants?

Given it will be years before any of these companies see measurable revenue from health—setting the Apple Watch aside—we don’t believe that the wellness opportunity is priced into any of Big Tech’s share prices. As for how much these initiatives can add to tech revenue in the decades ahead, it’s an unknown. That said, US healthcare alone, apart from global opportunities, defines a large addressable market with annual spend hovering above $4T. As a point of reference, 10 years ago it was $2.9T in spending.

Taking a closer look at Amazon and Apple: If each company could capture 2% of that annual spend, it would add $80B in yearly revenue today. Ten years from now, 2% of healthcare spend is more likely to be $125B. Factoring in that Amazon and Apple will likely grow at ~5% per year over the next ten years, Amazon’s revenue would likely increase by 13% and Apple’s by 20%. In short, wellness is a big enough market to move the needle for both tech giants.

Source: KFF analysis of National Health Expenditure (NHE) Data

Will the government allow Big Tech to take over healthcare?

The simple answer is no, they won’t let them “take over” healthcare, but they’ll likely allow the companies to participate in the market given it’s a highly fragmented one. We don’t believe Washington will allow any of the companies to have the same influence in healthcare as they do in search, commerce and devices today due to increased anti-trust regulation by the FTC. Outside of the FTC regulating competition, the industry has a maze of operational regulations. We counted 629 regulatory requirements that health systems, hospitals and post-acute care providers must comply with—not limited to HIPAA and the HITECH Act. All of the those requirements make it difficult to enter and to disrupt the broader healthcare market.

AMZN: logistics and testing

In July, Amazon Health’s SVP, Neil Lindsay, commented that “healthcare is at the top of the list for reinvention.” It’s clear Amazon wants to be a participant in that reinvention.

To date, some of Amazon’s health acquisitions include the following:

- 1999: Founder Jeff Bezos purchased an approx. $40M stake in drugstore.com

- 2018: Haven Healthcare, an est. $100M joint venture with JPMorgan and Berkshire Hathaway

- 2018: PillPack, an effort to eliminate the face-to-face pharmacy interaction, purchased for $753M

- 2019: Health Navigator, clinical API solutions for EHRs, telemedicine provider and chatbots, later implemented into Amazon Care

- 2021: An est. $15B investment in COVID-19 protocols and testing labs

- 2022: One Medical, a chain of 113 primary care clinics, acquired for $3.9B acquisition

Amazon’s most recently announced deal with One Medical will be the company’s first step into primary care. One Medical reported 790K members at the end of the June quarter, up 27% y/y. While that member count is small compared to Amazon Prime’s 100M membership, it’s a measurable start that Amazon can build on. One Medical members pay $199/year for access to next-day doctor appointments (either online or in-person), blood work, vaccines and prescription renewals. What’s unique is that One Medical is a hybrid clinic at scale. Not surprisingly, CVS recently announced that they will be expanding beyond the existing 1,100 MinuteClinics they have into primary care clinics via an acquisition of a primary care company by the end of this year. The company’s CEO, Karen Lynch, said they’re looking for “a provider with a strong technology background and capacity for rapid growth.”

One obvious way that Amazon could leverage One Medical’s network is to integrate the acquisition into Amazon’s existing logistic network. This could include Amazon’s 2019 acquisition of PillPack for prescription delivery to One Medical members. Additionally, Amazon’s primary care physicians could order from a spectrum of medical supplies fulfilled by Amazon Prime next-day shipping.

AAPL: devices and data

Tim Cook has long said that “health” will be “Apple’s greatest contribution to mankind.” While saving a life surely checks that box, we believe that the company has ambitions to make a lot of money addressing wellness. The pivot in marketing of the Apple Watch is testimony to the power of positioning Apple devices around wellness. Originally, the smartwatch was sold as a tech/fashion statement and it was a value proposition that failed to generate meaningful sales. Once the company redirected the product marketing around fitness and wellness, sales took off.

To date, some of Apple’s health acquisitions and partnerships include:

- 2010: RareLight, non-invasive glucose monitoring using spectroscopy

- 2016: Gliimpse, a personal health data platform that democratized health data for patients, reportedly acquired for $200M and implemented into HealthKit, CareKit and ResearchKit

- 2017: Beddit, a sleep tracking app which monitors breathing, heart rate and room temperature, on watchOS

- 2017: Health Gorilla partnership with startup health record systems to aggregating diagnostic data

- 2018: Tueo Health, a startup developing an app for children with asthma

Leading with Watch, we see the company’s health ambitions anchored in devices and data that can be leveraged by doctors and clinicians for care. Today, Watch measures pulse, EKG, oxygen levels and tracks tremors and gate. What’s missing to be a replacement for a doctor’s visit: additional vital signs such as blood pressure, blood sugar, temperature, intermittent reports of O2 and EKG, as well as height and weight (to monitor fluctuations in inflammation, for example) which can be a powerful biomarkers of certain medical conditions. We expect blood pressure to be added within next three years, along with tighter integration with third-party blood glucose monitoring offerings.

In 2018, Watch received its first Class II FDA 510(k) clearance for the EKG app, which paved the way for a similar clearance of the new AFib feature in 2022. The two designations are noteworthy given they come in a field that is littered with devices that lack FDA endorsements. In short, Watch is moving in the right direction, but it’s going to take time for clinicians to proclaim the value and reliability of its data. For now, it’s not a replacement for traditional medical evaluation, but provides tangible, additional information that can calm nervous patients and assist physicians in identifying issues and providing more comprehensive solutions.

Outside of Watch, Apple’s health initiatives have rumored to be around Project Casper (code name for an internal primary care project). While primary care is a big opportunity, we would be surprised if Casper ultimately sees the light of day given that it’s outside of the company’s core competency.

Recently, Apple published a 60-page report detailing their initiatives in tech and health. The document outlines its health related products including Apple Watch, Health App, HealthKit, Fitness+ and ResearchKit, while promoting its partnership with over 800 health institutions who use Health Records on the iPhone. While the report stopped short of outlining how the companies health offerings will evolve, the trend line is clear; Apple has a unique position to capture, protect and share health data. In a sense, Apple is the data platform and it wants physicians, providers and future patients to keep that in mind.

GOOGL: AI and machine learning

To date, some of Google’s health acquisitions include the following:

- 2014: Lift Labs, a company that developed tremor-canceling devices for people with Parkinson’s, joined Verily

- 2014: Nest Labs acquired for $3.2B, which now includes sleep sensors and algorithms for snore detection

- 2018: Senosis, health monitoring for lung function (SpiroSmart), osteoporosis (OsteoApp), hemoglobin counts (HemaApp), features implemented into Nest

- 2021: Fitbit acquired for $2.1B, on Wear OS

Of Google’s many health projects in development, the company is most notably leveraging its DeepMind AI research for a list of diagnosis efforts including early detection of breast cancer, tuberculosis, eye conditions like diabetic retinopathy and even offering improvements to current approaches to colonoscopy screening (C2D2). Google’s developing ML models are able to detect physical manifestations, or signs of disease, in comparative photographs or x-rays. In regard to data compliance, DeepMind has faced obstacles in the form of regulatory probes around the division’s “Project Nightingale,” a classified initiative with Ascension involving data archives from 50M patients, which ultimately killed the project, from our understanding.

Google’s investment in consumer wearables started in 2021 with its $2.1B acquisition of Fitbit, which, today, measures oxygen saturation, skin temperature, breathing and heart rate variability. While Fitbit is a starting point in wearables, the product has lost momentum with consumers, in part because Apple Watch redirected its marketing energy toward fitness.

In the lab, Google’s Advanced Technology and Projects (ATAP) division is currently developing Google Tag, a small computing technology that acts like a sensor on the body. The idea is to bring motion capture data (generally calibrated in medical labs) into the real world. This would mean that athletes and patients could simply wear a tag on their body to collect and monitor their biomechanics throughout the day. However, these innovative efforts have faced challenges, including rejections from the FDA to implement such devices in clinical trials. However, the company’s DermAssist product received Class I Medical Device clearance from the European Economic Area (EEA)—EU, Iceland, Liechtenstein and Norway—but is still undergoing additional research. It’s a guided skin search app that reviews three images of your skin to provide more information, but isn’t a medical evaluation. DermAssist is not FDA evaluated for safety or efficacy, and it’s not available in the US. So, it seems that for now, the only Google device available for consumers is Fitbit.

At the company’s second annual health event, “The Check Up,” Google reinforced its ongoing efforts to eradicate medical misinformation from the web—starting with YouTube. The goal is simple: remove misleading health information from the platform and increase the volume of videos produced by accredited medical institutions. This includes research from the New England Journal of Medicine and the American Academy of Pediatrics, all available for free. In terms of data collection and interoperability with health institutions, Google has partnered with Ascension to develop its EHR search tool to reorganizes patient medical history. Google Care Studio also recently partnered with Meditech, an electronic medical record system, and is in collaboration with Beth Israel Deaconess Medical Center. Separately, Google Cloud Healthcare API and Google’s healthcare data engine launched in 2021.

MSFT: cloud solutions and applied AI

Similar to Amazon, Microsoft has been investing in health-related developments since 1999. To date, some of Microsoft’s health IT acquisitions include the following:

- 1999: A $250M minority stake in WebMD

- 2006: Azyxxi, which later became Microsoft Amalga, employed in hospital systems to access medical records in 1/8-sec. response time, parlayed into Microsoft’s launch of HealthVault, an online health record system for patients (later shut down in favor of other healthcare portal solutions like Get Real Health)

- 2007: Medstory, vertical search engine for health-related information

- 2007: Global Care Solutions, health IT systems including clinical workflow, billing, regulatory compliance and medical records

- 2009: Rosetta Biosoftware, certain software assets purchased from Merck & Co. Inc., to integrate genetic, genomic, metabolomic and proteomics data management software into Microsoft Amalga

- 2010: Sentillion, healthcare software whose customer base included >1,000 hospitals at the time

- 2020: Orion Systems, AI healthcare company that uses video analytics and human-machine collaboration

- 2022: Nuance, a voice recognition specialist like Apple’s Siri and Amazon’s Alexa, acquired for $16B

Microsoft’s health ventures include a partnership with Epic to store archived medical data on Microsoft Azure and Cloud for Healthcare launched with features including the ability to monitor remote patients. Separately, Microsoft partnered with health insurer AXA to build a new digital healthcare program. In Azure Marketplace, Microsoft launched a chatbot for healthcare providers including Kaiser Permanente and the Children’s Healthcare of Atlanta. Soon after, the company launched its five-year (now $60M+) philanthropic program called AI for Health, under their larger $165M AI for Good program, in effort to upgrade R&D and clinical trials. The partnerships have led to grants and collaborations, like using AI methods for drug development with the Novartis Foundation. Microsoft has also teamed up with Teladoc Health to integrate its surface devices and Teams app into acute care spaces and health systems.