Believers in the Tesla story are accustomed to having their faith tested. Last week’s 7% headcount reduction, what appears to be an upcoming revenue and earnings guide down for Mar-19, and pending $920M debt payment due in March emphasize that point. Despite these warning signs, we continue to believe the company will be successful in riding the EV, autonomy, and renewable energy curve thanks to what could be a “business miracle.”

At this year’s CES, traditional auto OEMs made a statement that they are serious about electric vehicles. The prevailing wisdom holds that OEMs are quite good at producing cars and switching the drive train to electric will be simple, allowing them to profitably scale EV production and maintain their market position. If this is true, it would dramatically lower Tesla’s market share and make the story less compelling overall, but we believe Tesla’s 7-year head start sets the company up to control a significant share of the market for a long time. Three key benefits from Tesla’s head start:

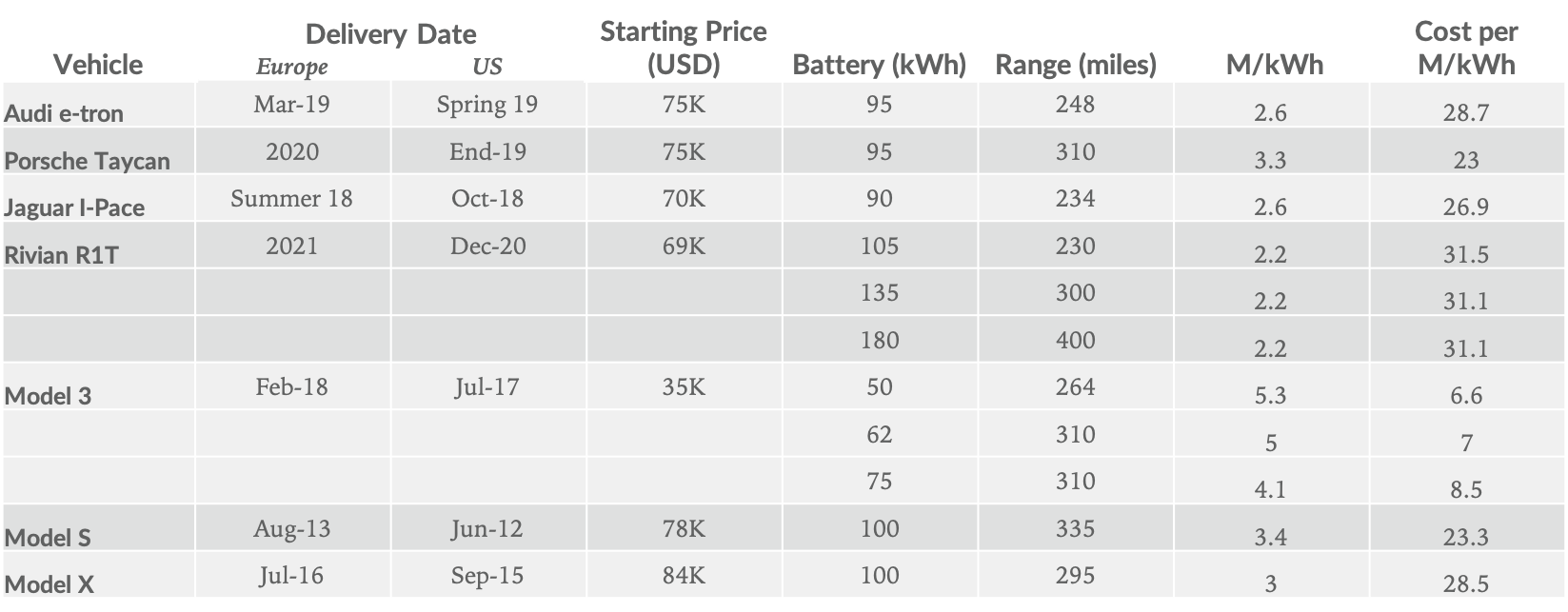

- 92% more efficient batteries than four other EV manufacturers, adjusting for differences in range evaluation methods.

- Vertically integrated Supercharger network is easier to use compared to generic charging stations.

- More advanced self-driving capabilities.

AWS’ Business Miracle

In September 2018, Jeff Bezos gave a wide-ranging, hour-long interview at The Economic Club. His comments about why AWS was a “business miracle” suggest Tesla may also benefit from a similar landscape.

Bezos described why AWS is a success:

“And then something – then a business miracle happened. This never happens. This is, like, the greatest piece of business luck in the history of business, so far as I know. We faced no likeminded competition for seven years. It’s unbelievable. And we – like, I’ll give you – like, when I launched Amazon.com in 1995, Barnes & Noble launched Barnesandnoble.com in 1997, two years. That’s very – that’s very typical if you invent something new. We launched Kindle; Barnes & Noble launched Nook two years later. We launched Echo; Google launched Google Home two years later. When you pioneer, if you’re lucky, you get a two-year head start. Nobody gets a seven-year head start.”

The Case for Tesla’s Business Miracle

We believe Tesla could be the beneficiary of an AWS-like business miracle. The idea is in the handful of years that Tesla operated with effectively no competition, they have been aggressively investing and building expertise in areas that will make a new EV buyer more likely to buy a Tesla than a new EV from a traditional automaker. Tesla has nearly a decade head start in EVs because other automakers have under-invested in the space, giving the company deeper knowledge related to battery design, a charging network with greater coverage, a better user experience, and more advanced self-driving capabilities.

Tesla’s original Roadster became available in 2008. The EVs launched over the next 7 years by traditional auto OEM’s were essentially hobbies. Today, Tesla has, of course, released three vehicles that in 2018 accounted for about 50% of the US EV market. After CES, it’s clear that traditional OEMs are going to shift electrification from a hobby to the foundation of their future. For example, Mercedes Benz EQC marketing material lead with the statement that “the automobile’s future is electric.” It is still unclear what the impact will be on Tesla’s business in the coming years.

Retaining Market Share Leadership, but Gap Will Tighten

We expect Tesla’s US market share to decline in the next decade from about 50% in 2018 to closer to 20% long-term. 20% share of a stable US auto market of 18m units a year, yields 3.6m annual Tesla sales in the US, compared to 245k Tesla deliveries in 2018. As a point of reference, GM had about 17% US share in 2018. The iPhone growth analogy offers some perspective related to market share changes and the success of individual companies against incumbents. The iPhone controlled over 80% of the nascent smartphone market in 2007, selling 1.4m iPhones. In 2015, iPhone’s share had declined to 18%, but the company sold 231m phones.

A More Efficient Battery

Range is one of the most important factors of an EV buying decision, and range anxiety represents the biggest headwind for mass adoption near-term. We believe that over the long run, once the entire industry has gone through the massive transition to electric, things like long-range batteries, electric drive trains, and a ubiquitous charging network will be largely commoditized. That said, in the next ~10 years, differentiation in these areas will be important in gaining market share. Tesla’s accumulation of advantages in these areas is the center of its potential business miracle.

Evaluating the range for electric cars can be confusing given the difference in EPA (Environmental Protection Agency) and WLTP (Worldwide Harmonised Light Vehicle Test Procedure) estimates. Most US electric cars use EPA estimates, which are generally accepted as being more accurate, while also being lower than the WLTP estimates. EPA tends to be about 15% lower than WLTP. The easiest way to achieve a comparison is to reduce the WLTP range by 15% to make it consistent with EPA ranges. Both of these estimates are based on test driving the cars in a laboratory driving space, so the difference comes from the differing courses.

Comparing the three Tesla models to four upcoming EV entrants, we found Tesla’s batteries are 92% more efficient, adjusting for differences in range evaluation methods. Excluding the range adjustments, we found Tesla’s batteries to be 76% more efficient.

Vertically Integrated Charging Network

There are currently 604 Tesla Supercharger locations in the US, with 80 under construction. Elon Musk promised on Twitter to double supercharger capacity by the end of 2019. There are 835 Tesla Supercharger locations outside of the US. Separately, there are over 21,000 public charging stations in the US that can charge most EVs (including Tesla’s with adapters). It is generally accepted that Tesla’s charging network, because of its near ubiquity (99% of the US population lives within 150 miles of one) and ease of use (integrated route planning and payment) is preferred to using generic EV charging stations. This has been a huge area of investment for Tesla and will be for years to come. Although we believe, very long-term, that EV charging will be commoditized similar to current fuel infrastructure, it represents a huge comparative advantage vs other entrants. Nothing eases range anxiety like knowing you can charge your car at several locations nearby, and it’s a compelling selling point when EV buyers are considering their options.

Advanced Self Driving Capabilities

Tesla’s Autopilot had a difficult 2018, with 3 accidents that resulted in a debate if Autopilot was a fault. This compares to no accidents in 2017 and 2 in 2016. Third parties have weighed in on which driving assistance system is most advanced, including Consumer Reports October 2o18 survey which rated Tesla’s Autopilot higher for capability, performance and ease of use, but also rated Cadillac’s Super Cruise higher on safety measures. The take away: Autopilot still needs work, and with the exception of Super Cruise, it’s far ahead of the competition.

Disclaimer: We actively write about the themes in which we invest or may invest: virtual reality, augmented reality, artificial intelligence, and robotics. From time to time, we may write about companies that are in our portfolio. As managers of the portfolio, we may earn carried interest, management fees or other compensation from such portfolio. Content on this site including opinions on specific themes in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making any investment decisions and provided solely for informational purposes. We hold no obligation to update any of our projections and the content on this site should not be relied upon. We express no warranties about any estimates or opinions we make.