This piece is from Steve’s Substack, Markets + Metaverse.

Microsoft’s rumored $10 billion bid for Discord would be a major win for both companies. Discord, the communication platform of choice for gamers, would find a long-term, strategic partner in Microsoft. This would alleviate some pressure around monetization and allow Discord to continue to build out its platform to best serve its users.

Over the last year, Discord has seen a significant jump in its valuation. The company raised $100 million at a $3.5 billion valuation in June 2020, only to see that valuation double in a similar raise in December. The primary driver of this rise in valuation is the activity the company has seen outside of gaming, as Discord is increasingly being used in the workplace. Despite this recent uptick, Discord’s monetization woes are likely to continue. As a result, Discord makes more sense as a strategic acquisition than it does as a standalone public company.

It’s no secret as to why Discord is an attractive acquisition target for large tech companies with ambitions in gaming. Communications tools are where gamers hang out, make decisions about which games they’re going to play, and talk during play. Communication is a critical component to the Metaverse. As it exists today, the Metaverse is a fragmented space. People spend their time in different worlds, whether playing Fortnite or Call of Duty, talking to friends about the latest NFTs, or conversing in Twitch chat. A platform like Discord spans all of those areas and allows for persistent communication. Having access to that platform and ensuring high-quality integration is a powerful advantage for any company with Metaverse ambitions.

The argument against going public

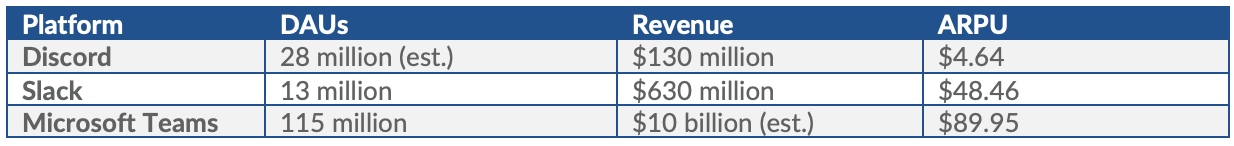

For investors, monetization has been a key question for Discord. If Discord sets itself on the path to become a public company, monetization of its userbase would be the central talking point. Despite the platform’s immense popularity, having 140 million monthly active users, its revenue per user lags its counter parts significantly. Discord reportedly generated $130 million in revenue in 2020. To try to make an apples-to-apples comparison with Slack and Microsoft Teams, who report daily active users, I’ll assume Discord has a 20% stickiness rate, which results in about 28 million daily active users. It’s worth noting that WhatsApp, at the time of its acquisition by Facebook, saw 70% of its monthly users engage on a daily basis. Bumping the stickiness number up would only make Discord’s comparison to Slack and Teams look more discouraging.

For Microsoft Teams revenue, I’ll again be conservative. Microsoft’s Productivity and Business Processes business segment generated $49.2 billion in 2020. This segment includes Teams, Office 365, and LinkedIn among others. Assuming Teams represents about 20% of this segment (the majority is Office 365, although 40% of commercial users are now on Teams) it’s reasonable to estimate that Teams generated $10 billion in revenue in 2020.

Discord’s answer to the monetization question is to either add a significant number of new users, offsetting costs with scale, or turning the dial on monetization. For users, the second option could negatively impact their experience. The vast majority of Discord’s users aren’t paying to use the platform. Discord monetizes through its subscription offering, Discord Nitro. Nitro allows individuals to better customize their profiles, upload larger files, boost servers, and stream video in HD. These features are nice to have, but don’t materially impact the experience on the platform for the majority of users. In order to ramp up monetization, Discord has a few options:

First, they could add more features to Nitro to incentivize more people to subscribe. Discord could partner with creators and share revenue for any users they turn into subscribers, similar to how Twitch shares subscription revenue with creators on its own platform. Creators could then set specific features, like invite-only channels and server recognition, to drive more users to Nitro. While it seems like every social media platform is trying to add audio rooms after the rise of Clubhouse, Discord has a unique advantage. Audio is already a core component of the platform and creators in many cases have already built an audience on the platform. Discord’s announcement of its new feature, Stage Channels, shows that the company understands the opportunity it has in live audio.

If Discord can’t find new features to build out to drive Nitro subscriptions, they could cut down on features of the free platform to entice current users to subscribe. Discord could set something similar to what dating apps have in a limited number of messages and interactions over a given time period, then provide unlimited access for Nitro subscribers. This option would be bad news for users and may cause many to leave the platform.

If turning the dial on monetization isn’t a viable option, Discord must find a way to add a large number of users. While Discord has been able to branch out during the pandemic, it’s unlikely to be a major competitor to Slack and Microsoft Teams without changing what makes Discord great. While Discord will certainly continue to grow and add users over time, adding enough to meaningfully move down the path towards profitability will prove difficult the way the platform stands today.

If Discord can’t ramp up monetization or tell a compelling story of future user growth, it’s best off acquired by a large company with the resources to support the platform.

The argument for Microsoft acquiring Discord

Microsoft’s acquisition of Discord would remove any near-term monetization issues. Microsoft also has the resources to fund further development of the platform. On the user growth front, adding Discord to the Xbox platform would open up both new users and higher engagement from existing users. Whereas Discord has primarily been used for PC games in the past, with the recent shift towards cross-platform play, gamers are seeking a standalone communication platform across console and PC.

An early hint that this may be a reality – Xbox announced that its Xbox Party Chat service is now free for all users, not just those that subscribe to Xbox network (formerly known as Xbox Live Gold). Microsoft is leaning heavy into making more of its games and services free-to-play. It’s upcoming premier first-party title, Halo Infinite, will have free-to-play multiplayer, a first for the franchise. The company is also allowing players to play other free-to-play titles, like Fortnite, without a subscription to Xbox network. Discord will likely be available to all Xbox owners. While a subscription to Discord Nitro may still be an option in the future, it could also be bundled with Xbox Live Game Pass Ultimate, Microsoft’s game subscription service. Full-feature Discord access could be appealing to many users, and Microsoft has shown it intends to invest heavily in its gaming platform, acquiring ZeniMax for $7.5 billion in 2020. Discord would fit nicely into Microsoft’s gaming ambitions.

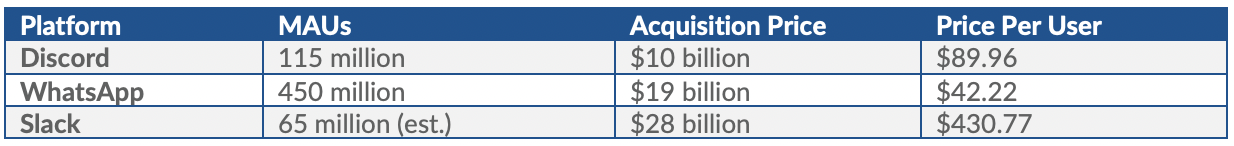

At $10 billion, Discord would be Microsoft’s largest gaming acquisition to-date, surpassing ZeniMax and Minecraft, which was acquired for $2.5 billion in 2014. Discord would actually be Microsoft’s second largest acquisition next to LinkedIn. It’s worth asking, is Discord worth $10 billion? When it comes to users, Microsoft would be paying double what Facebook paid per WhatsApp user in 2014, but about 1/10th what Salesforce is paying per Slack user. It’s important to note, Slack is a positive cash flow enterprise business and is able to generate much higher revenue per user. It’s unrealistic to assume Discord is worth the same price per user.

It’s a steep price, but Discord’s long-term value to Microsoft is greater than WhatsApp for Facebook. Microsoft would give itself another strong platform in the gaming world, the premier communications tool for gamers. A Discord acquisition would further build out Microsoft’s ultimate gaming platform and set the company up to be a major player in the race to build out the future Metaverse.