A year ago, we published AI Portfolio: Non-Tech Companies Making AI Investments. We’re following up to see how the portfolio performed over the last year. As a quick refresher, to build our portfolio we scraped the text of the most recent earnings call (2Q 2017) of every company in the S&P 500 to see which had specifically referenced “artificial intelligence” and/or “machine learning.” We also looked at companies that had been in the news talking about specific AI-related initiatives.

One disclaimer: As former stock analysts we still pay a lot of attention to the public markets, but we did not cover any of these companies or sectors. Our analysis centered purely around each company’s efforts in AI, not business fundamentals.

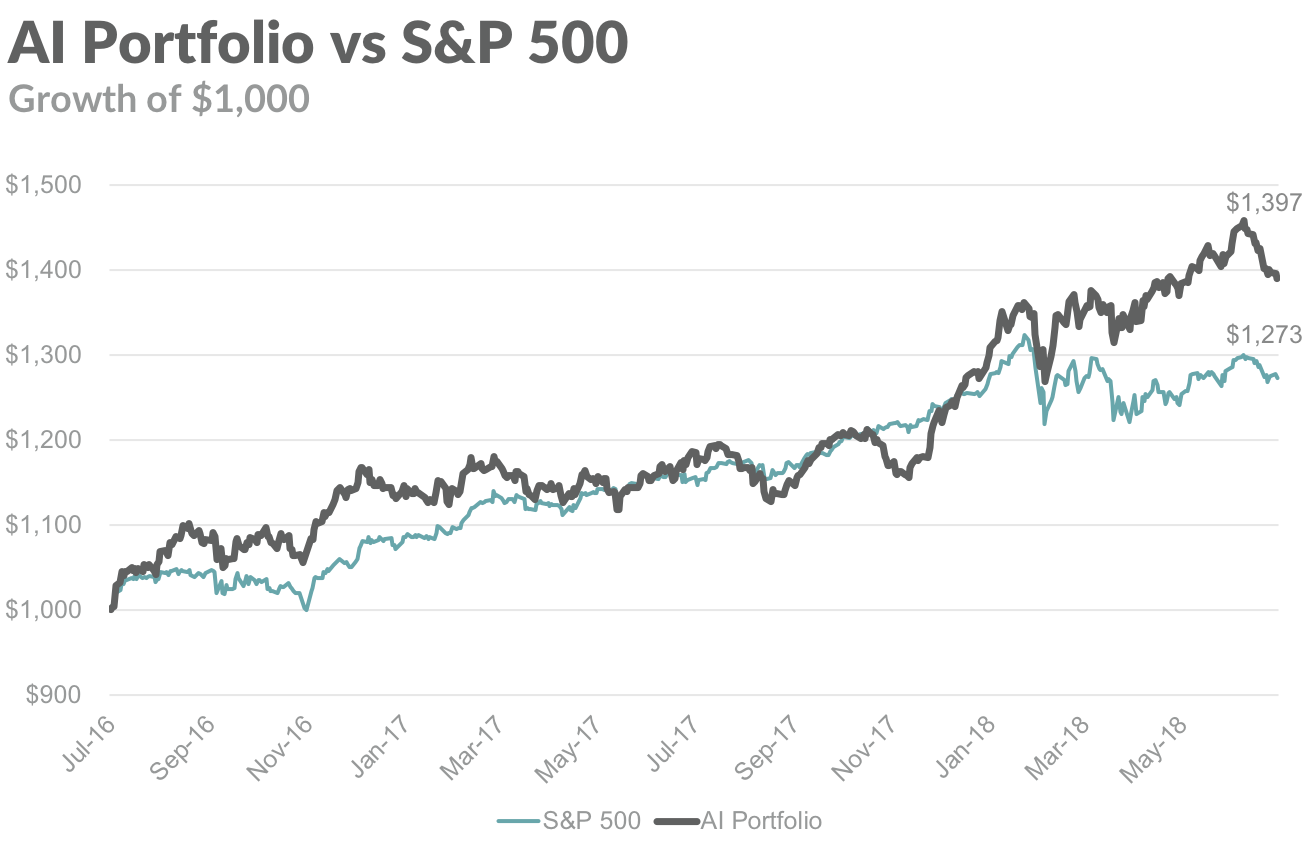

Over the last year, the AI portfolio is up 19% compared to the S&P 500 up 13%.

Over the last two years, the AI portfolio is up 39% compared to the S&P 500 up 27%. While the AI portfolio and the S&P 500 have tracked each other closely, the gap is widening. Broadly, we expect companies placing an emphasis on AI to outperform their competitors. The use of AI is, of course, not entirely deterministic, as other factors will contribute to performance. However, we believe the AI portfolio shows the impact that AI will have in the coming years.

A few notable movers

- Boeing (BA) up 68% – Boeing continues to perform well. The company booked new orders at the latest airshow and announced a new division devoted to flying taxis. As we stated when we launched the portfolio, while many planes use auto-pilot for portions of flight today, reducing or removing pilot control from the aircraft would be a significant change. Boeing is making meaningful progress in this space.

- Macy’s (M) up 56% – Last fall, Macy’s partnered with Microsoft and added a chatbot to its online platform in an attempt to improve customer service. This follows Macy’s 2016 partnership with IBM through which they developed Macy’s On Call, an in-store shopping assistant.

- IDEXX Laboratories (IDXX) up 37% – IDEXX manufactures and develops products for the animal healthcare sector. IDEXX utilizes AI in many products, such as their SediVue Dx analyzer.

One notable change

- Monsanto (MON) – Monsanto was acquired by Bayer for $128 a share, which was closed on June 8th, 2018. This translates to an 8% increase from the July 5, 2016 start date. For our numbers, we’ve assumed that our portfolio took the cash on the exit date and held until the end of the period.

- We’ve chosen to replace Monsanto with Coca-Cola Co (KO) – While this isn’t a direct agriculture replacement, Coca-Cola has been leveraging artificial intelligence in several ways. Coca-Cola uses the data it collects to predict popular beverage flavors. This led to the launch of Cherry Sprite in 2017. Coca-Cola is also adding a virtual assistant to some vending machines, which helps consumers customize their drink. Coca-Cola is also leveraging AI to purchase crops for use in orange juices and track its presence on social media.

Disclaimer: We actively write about the themes in which we invest: artificial intelligence, robotics, virtual reality, and augmented reality. From time to time, we will write about companies that are in our portfolio. Content on this site including opinions on specific themes in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making investment decisions. We hold no obligation to update any of our projections. We express no warranties about any estimates or opinions we make.

Loup Ventures employees may currently or in the future hold positions in any or all of the stocks listed here.