This NFT market overview was originally posted on Doug’s blog, Uncomfortable Profit.

I’m more certain than ever that 95%+ of NFT projects are zeroes, but that the NFT space is still going to be bigger than almost everyone realizes.

The first part of that statement finds easy believers. Skeptics look at people paying tens of thousands of dollars for jpegs and think Tulip mania or Beanie Babies all over again.

The second part of the statement — that NFTs are going to be bigger than anyone realizes — finds fewer believers. Combining the two statements is even more confounding.

How can a market that might shrink by 95% still be bigger than anyone believes?

A rational assessment of the current state of the NFTs, and the markets they will affect, tells the story.

This is my 2021 NFT Market Overview.

State of the Market

For skeptics and believers alike, it’s natural to try to quantify the future in terms of the present, even if the future ends up being wildly different. Arthur C. Clark offers the definitive description of the dangers of predicting the future in either case:

“If by some miracle a prophet could describe the future exactly as it was going to take place, his predictions would sound so absurd that people everyone would laugh him to scorn. The only thing we can be sure of about the future is that it will be absolutely fantastic. So, if what I say now seems to you to be very reasonable, then I will have failed completely. Only if what I tell you appears absolutely unbelievable have we any chance of visualizing the future as it really will happen.”

I believe NFTs touch a core addressable market worth over $1 trillion with an expanded market beyond $2 trillion. Fantastic enough? Maybe not because I believe there is a reasonable case to get there.

NFTs address several basic human desires. We have a natural tendency to collect things we find beautiful or relevant. We want to define ourselves through a unique and meaningful identity. We need recreation, which we sometimes find in taking financial risk with the hopes of quick wealth.

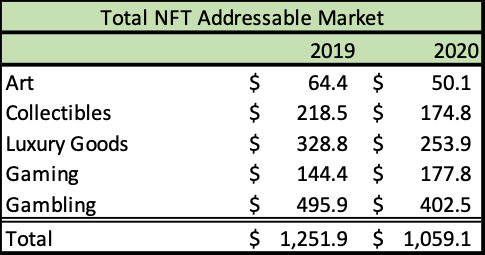

These are the obvious core addressable categories for NFTs today: Art, collectibles, luxury goods, games, and gambling.

The global annual spend for those categories combined to a $1.05 trillion market in 2020. In 2019, those categories totaled $1.25 trillion, which I believe is reasonable to expect in the 2021 post-pandemic recovery. Given recent history, the total addressable market should grow 4-7% in a normal year.

That’s the NFT market opportunity, but how far along are we today?

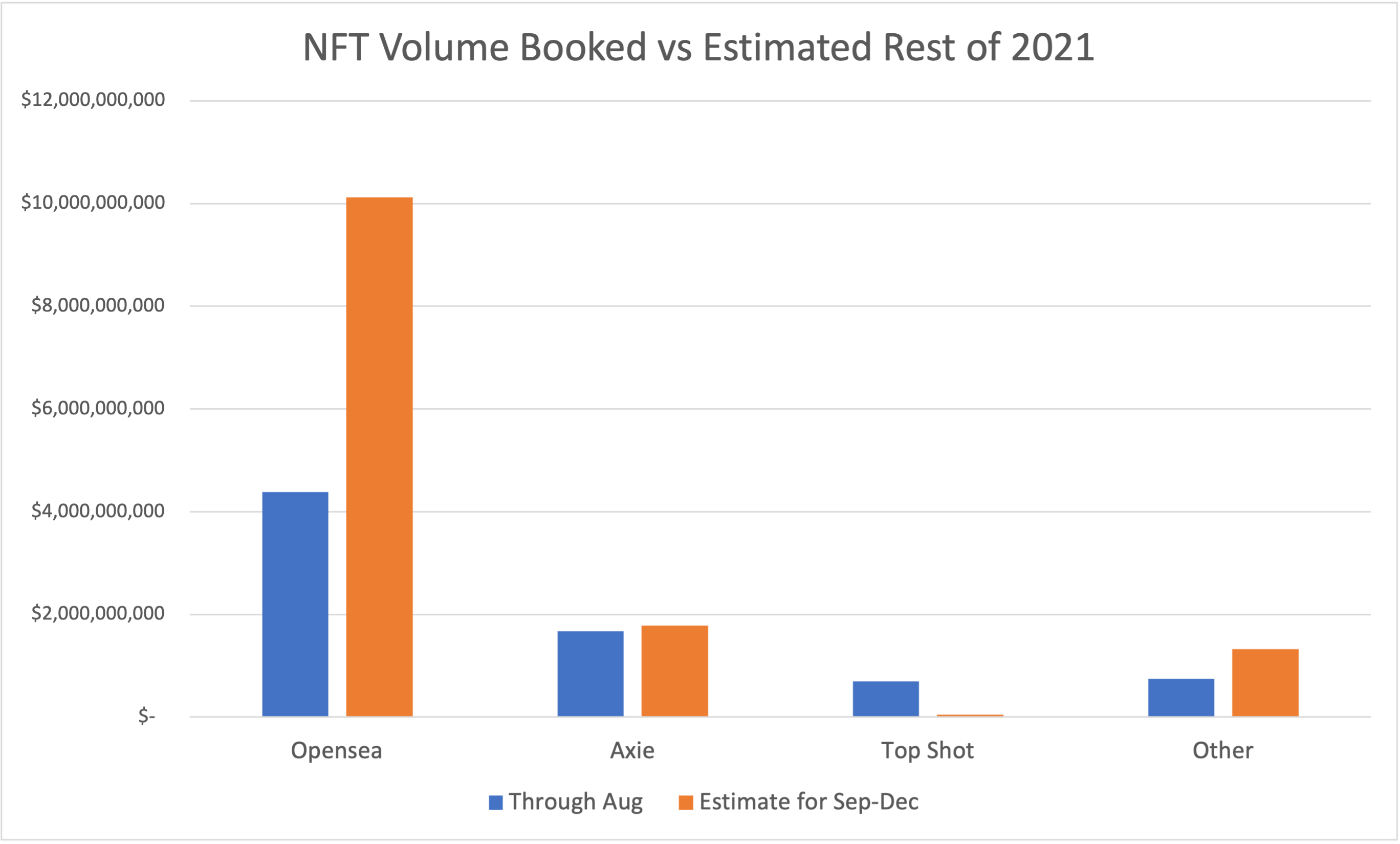

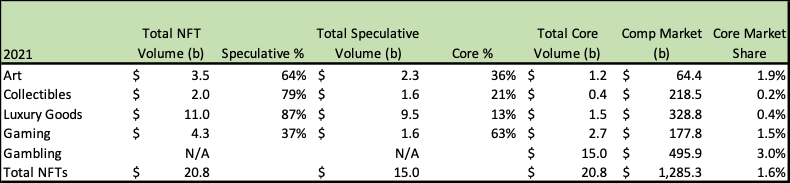

I estimate total NFT volume will be $20.8 billion this year. Opensea is the biggest contributor with expected volume of $14.5 billion, 70% of the total. The company has already done $4.4 billion in volume through August this year. It’s on track to do around $3 billion in September, down slightly from the August craze of $3.4 billion.

Aside from Opensea, Axie Infinity and Top Shot are the two other most significant individual platform contributors. I expect Axie to do $3.5 billion in volume this year ($1.7 billion through August) and Top Shot to do $750 million ($700 million through August).

Rounding out the assumptions for the $20.8 billion 2021 estimate, I expect 10% m/m declines in volume across the NFT market the rest of the year given the slowing in September. I also assume Opensea, Axie, and Top Shot make up 90% of total NFT market volumes.

A $20.8 billion market may seem large already, but it’s only 1.7% penetrated relative to the total $1.25 trillion opportunity. The market only gets more attractive as an investor the deeper you dig into the numbers to separate what’s real vs speculation.

Separating the Real from the Bubble

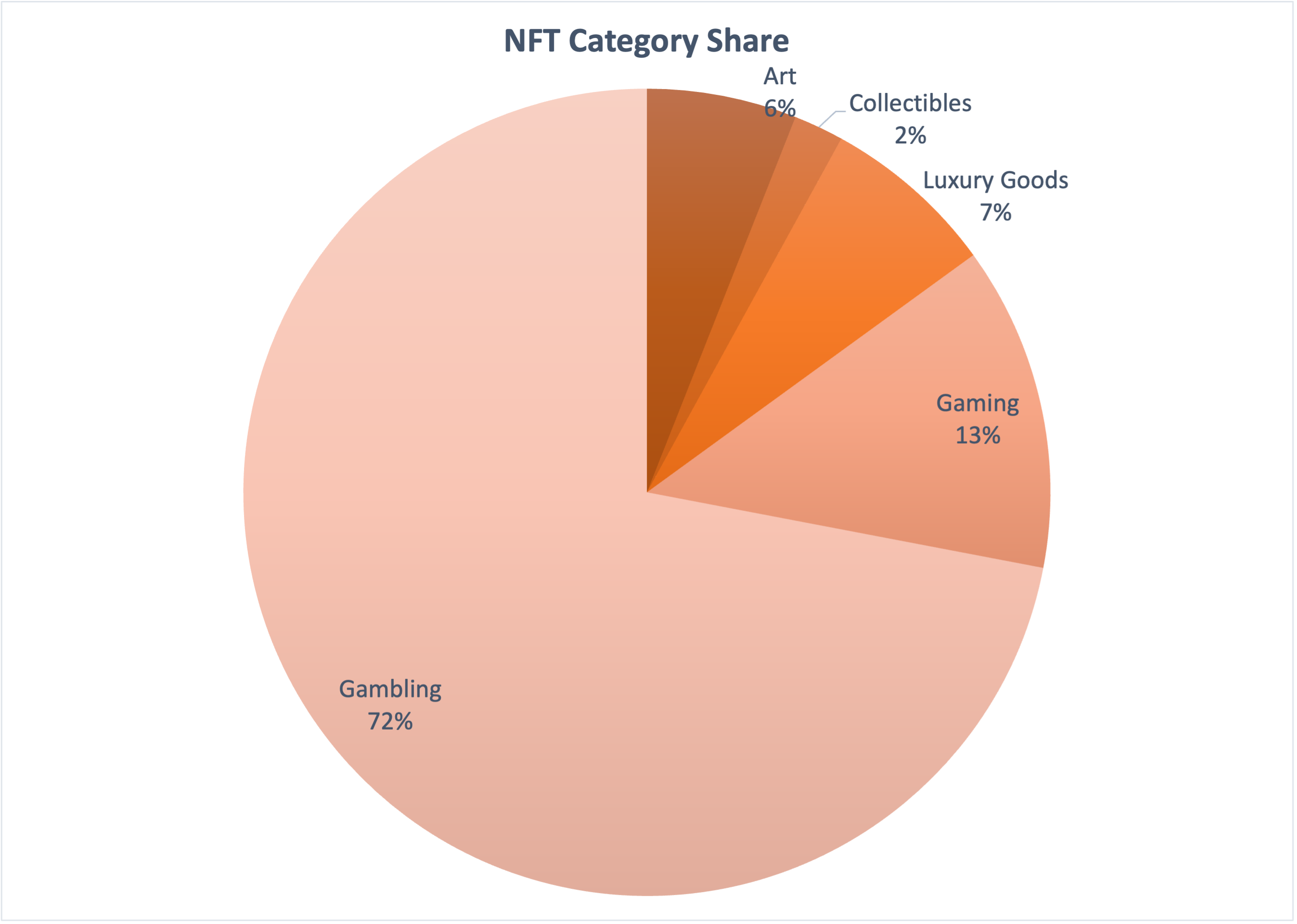

Exploring the NFT market numbers, it became clear that understanding the long-term opportunity requires separating volume into two categories: core and speculative. Core volume comes from the art, collectible, luxury, and gaming categories where buyers are either collecting or using NFTs for a productive purpose. Speculative volume is gambling volume where users hope to flip for a quick profit. Setting aside some obvious cash grabs, there are few meaningful NFT projects with the specific use case of gambling. This creates an overlap where speculators bet on NFTs that happen to be art, collectibles, luxuries, and game tokens.

As an example, a collector may buy a Fidenza to own forever, or a flipper may buy one because he hopes to sell it to someone else for more money in the near future. The collector’s spend is core volume, while the flipper’s spend is speculative.

The distinction between core and speculative is important because core spend is sticky and recurring, while speculative spend is flighty and unreliable. If NFTs grow to take a meaningful piece of that trillion-dollar-plus opportunity, it will be because core volume overtakes speculative volume, signifying real productive use of assets.

I believe that more than 70% of current volume is speculative.

Two notes before we explore the categories:

- Utilities, like ENS domains, are another viable use case for NFTs, but there isn’t an easy parallel market to comp the opportunity against. That use case also seems limited relative to the others, so it’s not included here, nor would it meaningfully change the market estimates.

- All market estimates are meant to be directional, not precise. Maybe core art NFTs have 3% share of the art market, or maybe they only have 0.5%. The point is that they probably don’t have 10% or 20%.

Across all of the categories, reasonable current estimates suggest it’s incredibly early for every core NFT use case.

Category Definitions and Assumptions

Art

The primary function of art NFTs is the aesthetics of the piece. Art is collectible for its beauty first, not secondary characteristics like history or community membership. Any NFT with a focus on something beyond aesthetic excellence may use art as part of the project but would not be defined as art in this market estimate.

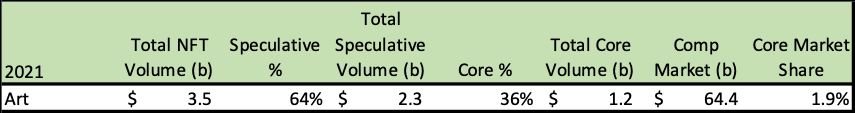

I estimate core art will make up 6% of total NFT volume in 2021, or about $1.2 billion.

Art category assumptions:

- Art Blocks is king of the NFT art world with nearly $900 million in volume YTD.

- SuperRare, Foundation, Makerspace, Knownorigin, and Asyc — the other major NFT art platforms — have done $250 million YTD.

- I estimate this NFT art cohort will total ~$1.7 billion in volume this year, representing 50% of the total NFT art volume of $3.5 billion

- Art Blocks has an owner/transaction ratio of 19%. We can think of owner/transaction ratio as a very rough proxy for core purchase behavior, as in around 20% of Art Blocks transactions may be from collectors rather than speculators.

- The ratio for the broader art category is likely higher given higher liquidity and popularity of Art Blocks.

- I assume 36% of total NFT art volume is core vs 64% speculative.

$1.2 billion in core NFT art volume would represent 1.9% penetration of the $64.4 billion art and antiques market (Art Basel – 2019).

Collectibles

Collectibles depend on historical or tangential cultural relevance for their value. Classic collectibles like stamps, sports cards, coins, military items, toys, and comics all rely on history and/or cultural relevance for collectibility.

There aren’t many NFT collectibles other than sports card and comic adaptations to speak of yet, so the category is the smallest of the current group. I expect core collectible volume will be 2% of total NFT volume in 2021, or just over $400 million.

Collectibles assumptions:

- Top Shot, despite its recent slowdown, represents the biggest player in collectibles with over $700 million YTD. At its current trajectory, it likely closes the year somewhere around $750-800 million in total volume.

- Sorare, a soccer-focused sports collectible offering, is a tenth the size.

- Punks Comics, the most important comic in NFTs, has done $100 million in volume YTD.

- Curio Cards, one of the earliest crypto collectibles, has also done $100 million volume YTD.

- I estimate Top Shot, Sorare, Punks, and Curio Cards make up ~60% of $2 billion in total collectible volume.

- Top Shot has an anemic 5% owner/transaction ratio, although I believe many other NFT collectibles perform far better. Punks Comic is closer to 50%

- I assume that roughly 20% of total collectible volume is core vs 20% speculative.

A $400 million NFT collectibles market is only 0.2% penetration of the ~$220 billion collectibles market (HobbyDB plus my own estimates). Collectibles are probably the most overlooked category as NFTs related to blockchain history will grow in value as some of the most important relics in Internet lore.

Luxury

Luxury is by far the biggest category in NFTs by my definition.

The purpose of a luxury good is to let the owner say something about him or herself to the world. Intentionality around identity is always a luxury. NFTs are the perfect tool for owners to describe something intentional to the digital world. Every 10,000 avatar project is about identity in a literal sense.

Cryptopunks are the quintessential crypto luxury. They are the Bitcoin of NFTs. We’ve talked here at length about the power of using a Punk as your identity. It admits the owner to an exclusive club that says a lot about the person — rich, digitally hip, crypto supporter. Bored Apes, Cool Cats, Gutter Rats all fit into the luxury category even if their names may not sound it.

A five-figure jpeg is a luxury whether we joke about it or not. Even a three-figure jpeg is a luxury.

Luxury assumptions:

- Cryptopunks have done $1.3 billion in volume this year alone. BAYC has done nearly $1 billion including Mutants and Kennel Club. I expect the group to generate nearly $3.5 billion in volume for 2021.

- Despite this scale that makes them bigger than either of the entire art or collectible categories, Punks and Apes only make up 30% of the broader $11 billion volume of luxury NFTs. This speaks to the mass of other pfp (profile picture) avatar projects out there.

- Punks have an owner/transaction ratio of 17%. BAYC is at 26%. The broader industry is likely far lower, meaning far more speculative.

- I estimate only 13% of luxury NFT volume is core, while 87% is speculative, making it the most speculative category of the group.

Only $1.5 billion of luxury NFT category spend is the core equivalent of buying a Louis Vuitton handbag. That represents 0.4% penetration of the $329 billion personal luxury goods market (Bain).

Gaming

The primary purpose of Game NFTs is to serve some function in a game environment. It may consist of playable characters, weapons, items, or land.

Play-to-earn games are one of the most promising developments from the NFT game space, and Axie Infinity leads the way. Axie’s already done $2 billion in volume, most of it coming in just the last few months. Even more impressive, Axie has more owners than any other NFT at over 1.8 million. The next closest is Top Shot with over 560,000. Regardless of what happens to either product, both have been an incredible on ramp for new NFT buyers.

Core NFT gaming spend will total $2.7 billion in volume in 2021, about 13% of total NFT volume.

Gaming assumptions:

- I expect Axie to end the year with around $3.5 billion in total volume.

- Assuming 80% gaming market share for Axie, the NFT game space will total $4.3 billion in volume this year.

- Axie’s owner/transaction ratio is higher than peers at 34%, but even that may understate the amount of core vs speculative buying given that players need to participate in the marketplace as part of the game.

- I assume 63% of NFT gaming revenue is core vs 37% speculative with a caveat: Many game tokens are used with a gaming purpose, but the play-to-earn phenomenon has even made that a form of speculation. Token owners who play to make money, or who pay scholars to play for them, aren’t necessarily the same as someone buying a skin in Fortnite or even a Punk as an avatar.

Pulling out the third of speculative volume still makes gaming the largest NFT category outside of gambling. The $2.7 billion in core volume is just 1.5% of the broader $177.8 billion gaming industry (NewZoo).

Gambling

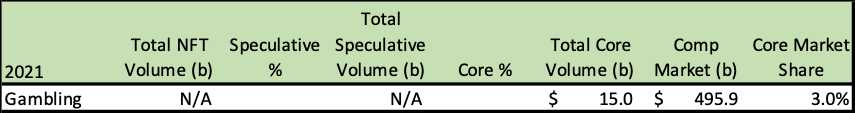

The speculative volume from the four core NFT categories totals $15 billion for 2021. That’s 72% of all NFT volume, but it’s only 3% of the nearly $500 billion global gambling and lottery industry (sources here, here).

It shouldn’t be a surprise that speculation is by far the largest contributor to NFT volume. A ~1,000x vertical acceleration from a few million dollars of monthly NFT a year ago to several billion now can’t happen without speculative fervor. Real market adoption usually takes years, not months.

Herein lies the blessing and curse of speculation. Vertical increases in values bring attention and interest from real, long-term users. But speculation also brings volatility. It’s fast money, and when fast money moves on, prices tend to plummet.

When I said 95% of projects might go to zero, I meant it. Speculation might be 72% of all volume, but I believe speculative volume makes up the lifeblood of more like 95% of NFT projects today. Any project that lives on speculative volume for relevance won’t survive an NFT winter.

Bull Cases

The bear case on NFTs is loud and obvious. It’s a jpeg bubble, and when it bursts, no one will ever care about NFTs again.

On the contrary, I believe these market estimates paint a potential near-term bull case as well as the case for thriving long term.

The near-term bull case for NFTs is that the massive speculative component is a fraction — just 3% — of the broader gambling and lottery space. Maybe NFTs consume a permanent share of our natural human desire to gamble. It’s no accident that most NFT launches incorporate lottery-like mechanics where users can get lucky by minting a rare and valuable token. It’s great when something looks rare.

Maybe NFTs are privatized lotteries of the metaverse. It wouldn’t be a complete surprise if NFTs permanently replaced some of the $200+ billion we spend globally on lotteries a year. At least with NFTs you get to keep some fun art even if you lose.

While this near-term lottery bull case could happen, the rational side of me says you should still expect a winter in the next 12-18 months. Speculative fervor like this always calms, but the lottery thesis is why gambling is a relevant long-term part of the NFT opportunity.

The broader long-term bull case is clear, too. True penetration levels across the most meaningful categories in NFTs are sub 2%, and those penetration rates don’t include broader market categories that could further contribute to NFT spend including fashion retail (about a $1 trillion industry), luxury cars ($500 billion industry), and home furnishings ($500 billion industry).

The NFT industry may do $20 billion in volume this year, but we are just starting the first inning of the transition from a physical-first world to a digital-first one. There’s far more volume to come.