It’s hard to imagine manufacturing cars will someday have the same margins as a hardware-software tech company today. It’s equally hard to imagine how much cars will change in the next decade, from 97% gas-powered and human-directed today, to eventually 100% electric and machine-driven. This shift opens a window for automakers to realize tech-like margins. To succeed, the industry needs to get high-margin software right. Our recent analysis looked at one aspect of the auto software stack, over-the-air (OTA) updates, and found Tesla enjoys a multi-year lead over traditional auto. Closing that gap will be a challenge – another sign legacy automakers are in a tight spot.

As evidence of this lead, Tesla recently released early access to its Full Self-Driving (FSD) beta, a milestone that is at least three years away for traditional auto.

An introduction to vehicle software updates

Historically, when you bought a car, a vehicle’s features were static for the life of the vehicle. However, OTA updates enable a vehicle’s performance and features to be continually updated and improved. Effectively, your car gets better over time. The mechanics of OTA updates are simple, with the software updates delivered remotely through a cellular or WiFi connection (similar to updating apps or the OS on your phone).

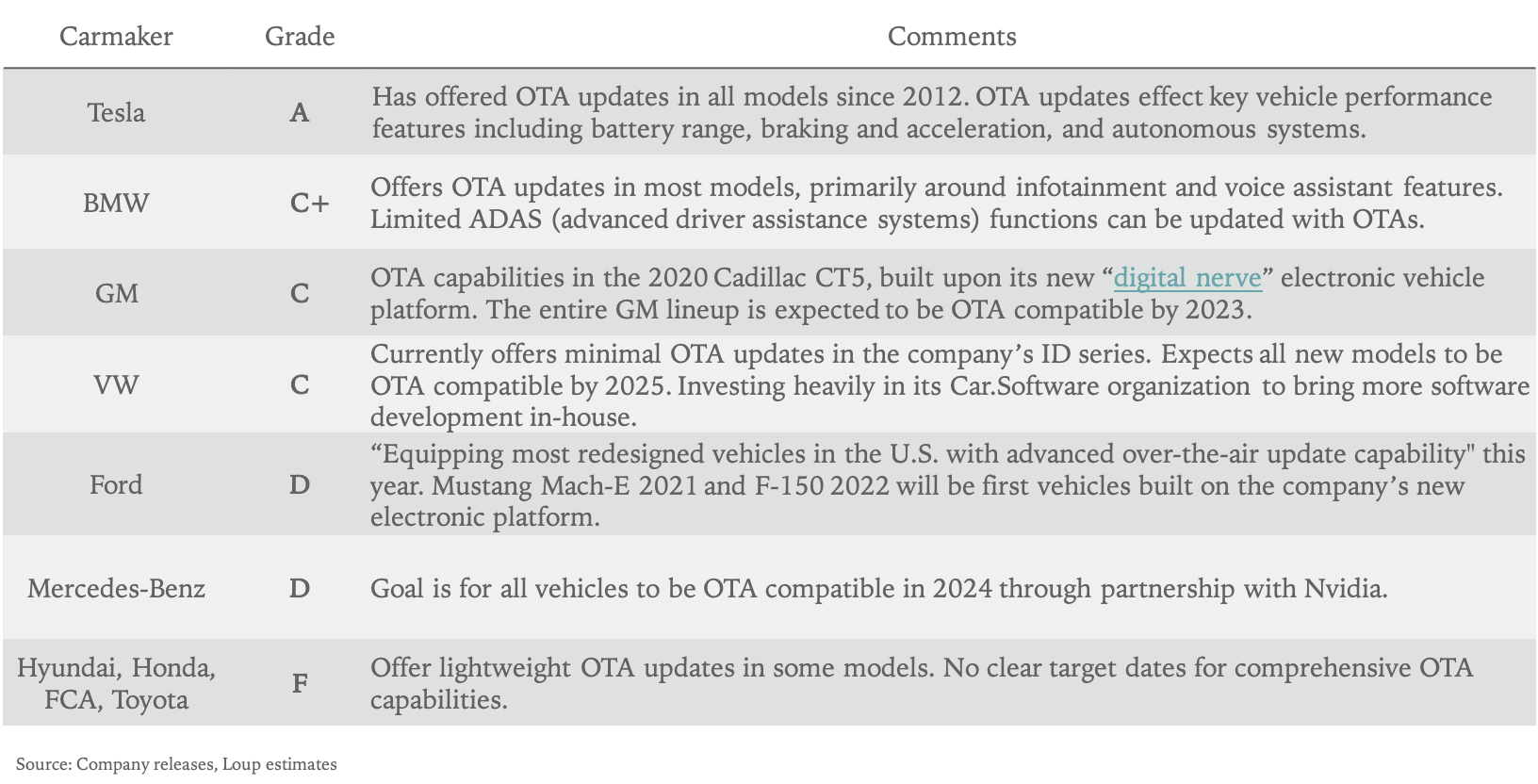

OTA report card

Tesla was the first car company to make use of OTA updates in 2012. While legacy automakers have since begun to add some OTA update capabilities, their progress has been slow.

Not all OTAs are created equal

The above report card doesn’t show the full extent of legacy auto’s OTA shortcomings. Today, most automaker’s OTA updates improve a vehicle’s infotainment system (maps, Apple CarPlay, Bluetooth compatibility), which, in our view, does not add material value to a vehicle. On the other hand, Tesla’s OTA updates improve infotainment systems, along with range, autonomy features, braking/acceleration functions, and safety systems.

We believe most legacy automakers are 3-5 years from offering meaningful OTA updates. The reason is that OTA capability is just one piece of the puzzle. There must be important functions built into the car and controlled by software for OTAs to be valuable. Commentary in Tesla’s 2019 10K filing illustrates this point: “Software algorithms control traction, vehicle stability, the acceleration and regenerative braking of the vehicle, climate control and thermal management, and are also used extensively to monitor the charge state of the battery pack and to manage all of its safety systems.”

Having built electrification, connectivity, and autonomy capability into its vehicles from the start, Tesla can use OTA updates to improve these systems and add additional value to its vehicles already on the road. For example, over the past two years, the company has delivered OTA updates for battery range increases, power and acceleration upgrades, improved braking ability, Premium Connectivity, and most recently, the beta version of FSD.

Tesla’s latest software update illustrates tech leadership

Tesla launched the FSD beta in October to a select group of early testers. The company’s goal is to roll out the update to the wider Tesla fleet by the end of 2020. The beta release cautions drivers that FSD is not error-free:

“Full Self-Driving is in early limited access Beta and must be used with additional caution. It may do the wrong thing at the worst time, so you must always keep your hands on the wheel and pay extra attention to the road. Do not become complacent. When Full Self-Driving is enabled your vehicle will make lane changes off highway, select forks to follow your navigation route, navigate around other vehicles and objects, and make left and right turns. Use Full Self-Driving in limited Beta only if you will pay constant attention to the road, and be prepared to act immediately, especially around blind corners, crossing intersections, and in narrow driving situations.”

Tesla recognizes that FSD is not ready for prime time. That said, the features and maneuvers FSD offers (a result of years of data collection and algorithm improvements) stand alone compared to what other car companies can offer with their advanced driver assistance systems (ADAS). We believe any data traditional auto is currently collecting through its vehicle sensors is too narrow to translate to meaningful autonomy. To achieve meaningful autonomy and, in turn, OTA updates that add real value to a vehicle, traditional auto needs to redesign vehicle architecture from the ground up with software at the center, and electrification, connectivity, and autonomy built on top (this is what GM is doing with its digital nerve system and VW with its Car.Software organization). Since legacy automakers are not software/tech companies at their core, they’ll continue to rely on software-centric companies such as Waymo, Cruise, Argo, and NVIDIA for help.

If you believe it, say it.

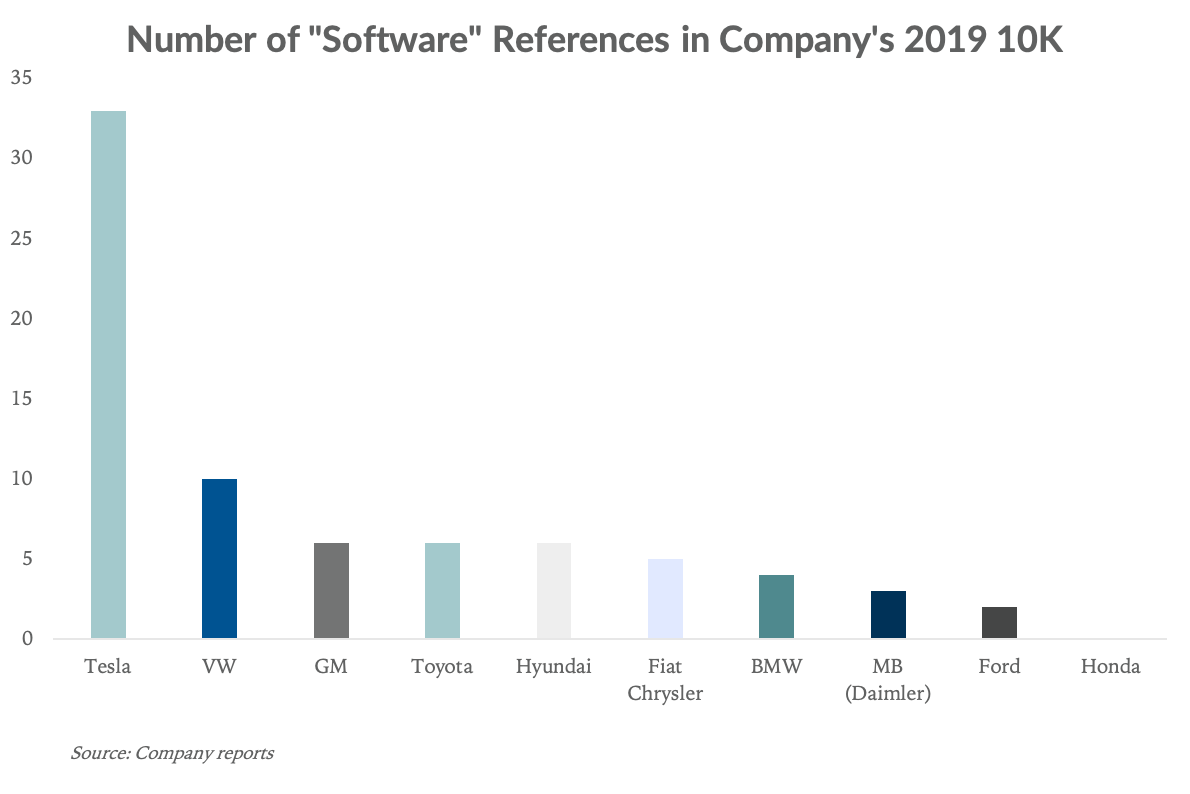

As an exercise to illustrate Tesla’s prioritization of software compared to other automakers, we counted the number of times “software” was mentioned in each company’s 2019 10K:

A deferred pile of profitability

Tesla reports deferred revenue from “access to our Supercharger network, internet connectivity and Full Self Driving (“FSD”) features and over-the-air software updates.” In its 2019 10K filing, the company said it expected to recognize $751m in deferred revenue in CY 2020. Through the Sep-20 quarter, Tesla had recognized $223m, with a total deferred revenue balance of $1.73B. Assuming the company achieves its goal, it would imply recognizing $528m in deferred revenue in the Dec-20 quarter.

We estimate Tesla will recognize $1.1B in deferred software revenue in 2021, increasing to $1.5B in 2022, and representing material high-margin revenue for Tesla that should loosely mirror operating income contributions. To put this into perspective, GM’s operating income in 2019 was $5.4B and Ford’s was $574m. In other words, Tesla’s deferred revenue next year can account for about 20% of GM’s operating income today and 200% of Ford’s.

Methodology for modeling deferred revenue

We estimate both vehicle deliveries and recognized revenue will grow at 40% annually (Elon Musk has suggested a 40%-50% annual delivery growth target for the next five to ten years). The total deferred revenue balance will grow primarily as a function of FSD adoption. We estimate the ASP for FSD is $8,500 in 2020 with an attach rate of 35%. As FSD gets closer to full autonomy and users find it more valuable, we believe the attach rate will increase, as well as the price. Putting it together, we model for a 37.5% attach rate and $10,000 ASP in 2021, moving to 40% and $11,000 in 2022. There’s a school of thought that argues once Tesla reaches FSD, it will recognize all deferred revenue on the balance sheet. We disagree and think that FSD is a journey, not a destination, and that there will be a deferred revenue factor into perpetuity.