Tesla reported third-quarter earnings with a positive surprise related to profitability, while revenue was essentially in line with expectations. Shares are trading up nearly 20% in the aftermarket as investors re-evaluate Tesla’s long-term risk factor related to the company running out of cash. The trend in profitability is a measurable and potentially sustainable positive that could change the long-term trajectory of the Tesla story.

Highlights from the quarter:

- Automotive gross margins were 22.8% vs. about 19% last quarter. Automotive margins excluding ZEV credits were 20% compared to 16.9% last quarter. The takeaway: manufacturing efficiencies related to labor, logistics, and procurement are improving.

- The business model is slowly shifting to high-margin software. Tesla recognized $30M in deferred revenue related to Autopilot this quarter. We had expected deferred revenue recognition closer to $100M. Recognizing less high margin revenue in the near-term is a positive, as it leaves room for future margin improvement. Tesla currently has just under half a billion in unrecognized revenue on the books. To illustrate potential margin improvement, at a 100k/quarter delivery run rate, every ~$60M in FSD deferred revenue recognized adds about 1% to auto gross margins.

- Tesla is now expecting volume production of Model Y (1,000 per week) by mid-2020. This is 6-9 months ahead of what we had been expecting. Long-term, the company expects Model Y to account for about half of total deliveries and be slightly accretive to gross margins.

- Gigafactory Shanghai is now ahead of schedule and production is expected to start this quarter. Previously we had expected production in early 2020. China currently represents about 11% of total sales, but that percentage will grow once the Gigafactory is operational and vehicle sales don’t face a price headwind from import tariffs of >15%.

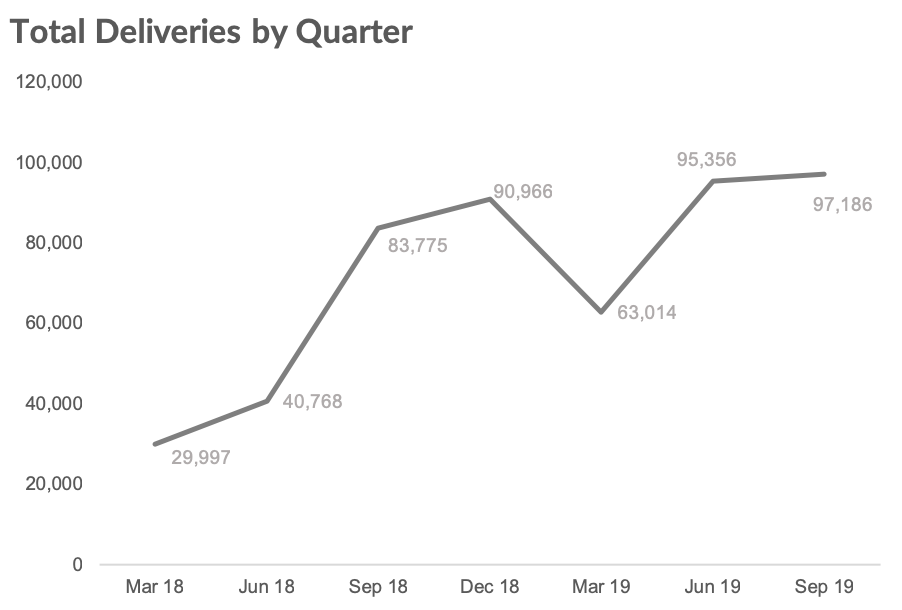

- Tesla reiterated their guidance of delivering at least 360,000 vehicles in 2019. This implies that Tesla will deliver greater than 104k vehicles in Q4 vs expectations of 104k. This would result in y/y delivery growth of 16%, in line with Sep-19’s y/y growth.