- While a long ways away, we believe there’s a greater than 50% chance that Tesla will operate a ride-sharing fleet by 2023.

- The fleet could add $2B to $6B in high margin revenue for Tesla starting in 2023. Tesla does not make money today.

- Separately, we believe there is also a greater than 50% chance that Tesla will allow Tesla owners to add their vehicles to the fleet part-time. While only a small percentage of owners will opt in, the financial reward is measurable and could earn the owner enough to pay their vehicle lease.

- We believe Tesla could have between 4% and 10% of the U.S. ride-sharing market in 2023.

- If several key obstacles are overcome, most notably achieving autonomy, Tesla will have a handful of substantial advantages over competitors in the space.

What Tesla has said about an autonomous fleet. Don’t count Tesla out of the shared mobility space. The idea that Tesla vehicles could be utilized in an autonomous fleet has been shared in a handful of public statements by Musk, and in the 2016 blog post, Master Plan Part Deux. Details have been scarce, but the idea is that Tesla owners are able to add their vehicle to a shared fleet to have it generate income while it would otherwise not be in use, and that Tesla will operate its own fleet of vehicles to supplement the network. We did a rough analysis to estimate the size of the opportunity for Tesla and for the individual Tesla owner.

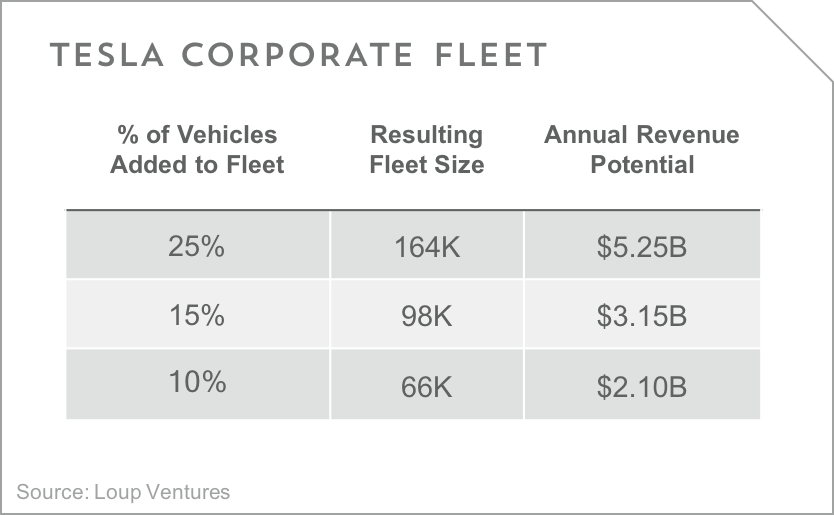

How big is the opportunity for Tesla? While we have not been given many details on how this service would play out, one option is for Tesla to buy back previously leased vehicles to be used in a fleet for the remainder of their useful life. Looking five years ahead to 2023, operating a fleet could be a multi-billion-dollar opportunity for Tesla. The table below shows the fleet size annual revenue potential starting in 2023 based on the percentage of leased vehicles 3 years old or older brought into an autonomous mobility fleet.

We think a higher percentage of Tesla owners lease their vehicles compared to traditional cars due to the perception of a quicker innovation cycle. Therefore, we estimate that 70% of vehicles 3 years old or older to be the addressable market for the Tesla fleet. By repurchasing just 15% of those vehicles and operating them in an autonomous fleet, Tesla could amass a network of nearly 100k vehicles with a revenue potential of more than $3B. This compares to Uber which we estimate has a network of 500k drivers and annual revenue (excluding drivers) of $10.5B. We also expect Tesla to take ~10% of the revenue of individuals who decide to add their vehicles to a fleet, which could add several hundred million to the size of the opportunity.

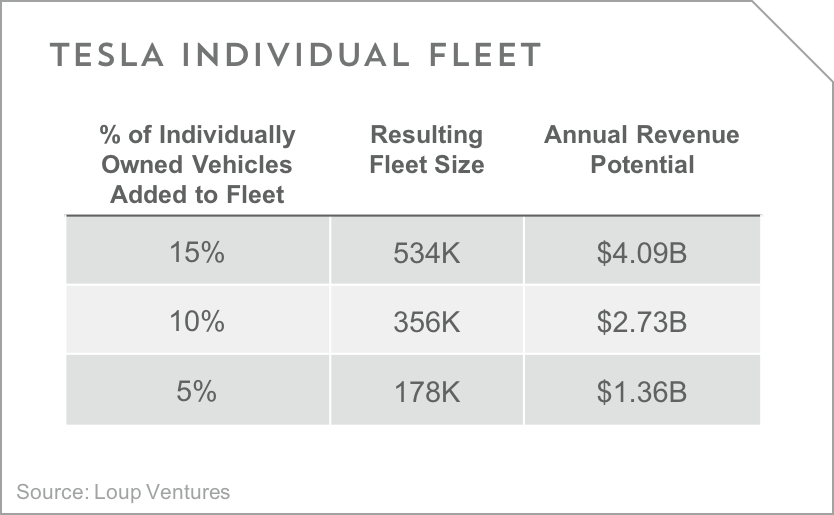

How much could a Tesla owner make? Suppose your Tesla drives you to work, drops you at the front door, embarks on a full day of autonomous ride-hailing, and picks you up when you are ready to leave. By adding your vehicle to Tesla’s autonomous fleet, you may be able to earn enough money to cover your entire lease payment and earn income. We are modeling for there to be (excluding Tesla-owned fleet) 3.5M Teslas with full self-driving capabilities in 2023. We expect that the majority of Tesla owners will not opt to add their personal vehicles to a shared mobility platform. The table below shows the potential size of the Tesla fleet provided by individual owners.

By our calculations, an individual Tesla owner could make $6,892 per year after paying 10% to Tesla. This includes energy, insurance, maintenance, and non-cash depreciation expenses. Compared to the average U.S. lease payment of $350-$500 per month (which doesn’t include fuel or insurance), a Tesla owner could earn $574 per month. This reduction in the true cost of ownership could dramatically boost demand for Teslas as well.

What this means for the autonomous mobility space. Today, Tesla is included in the conversation that is largely directed by tech companies like Lyft, Uber, and Waymo, and OEMs like GM, Volvo, and Toyota. However, it is unclear what their path will be long-term, as on-demand taxi networks, not personally owned vehicles, emerge as what seems like the obvious first step in autonomous transport.

Realizing the potential of the fleet opportunity in front of them means four things must come to fruition: Most importantly, Tesla has to successfully achieve full autonomy. They also must be able to reliably produce vehicles at scale, all vehicles coming off the manufacturing lines really do need to have all the hardware necessary to enable full autonomy, and personal ownership of autonomous vehicles needs to be legal. However, if this is the case, Tesla would find itself with several key advantages over its competitors:

- Ability to produce electric and autonomous vehicles at scale

- The largest catalog of autonomous training data collected from its existing fleet

- An extensive network of charging infrastructure and service centers

- Ownership of the entire system and ability to capture value from manufacturing vehicles, providing software services, and operating the platform

While we still expect the first iteration of fully autonomous mobility to be a shared ride-hailing platform, the Tesla fleet idea presents a differentiated approach down the road. Significant advances in software, passing of key legislation, and production hurdles stand between where we are today and realizing this potential, but the magnitude of the opportunity is too large to ignore.

Methodology. This exercise is a rough estimation and is based on many assumptions. A worksheet that includes all of our assumptions and calculations can be found here.

Disclaimer: We actively write about the themes in which we invest: virtual reality, augmented reality, artificial intelligence, and robotics. From time to time, we will write about companies that are in our portfolio. Content on this site including opinions on specific themes in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making investment decisions. We hold no obligation to update any of our projections. We express no warranties about any estimates or opinions we make.