We left Tesla’s Autonomy Investor Day feeling more optimistic about the company’s long-term prospects. Our takeaways from the event:

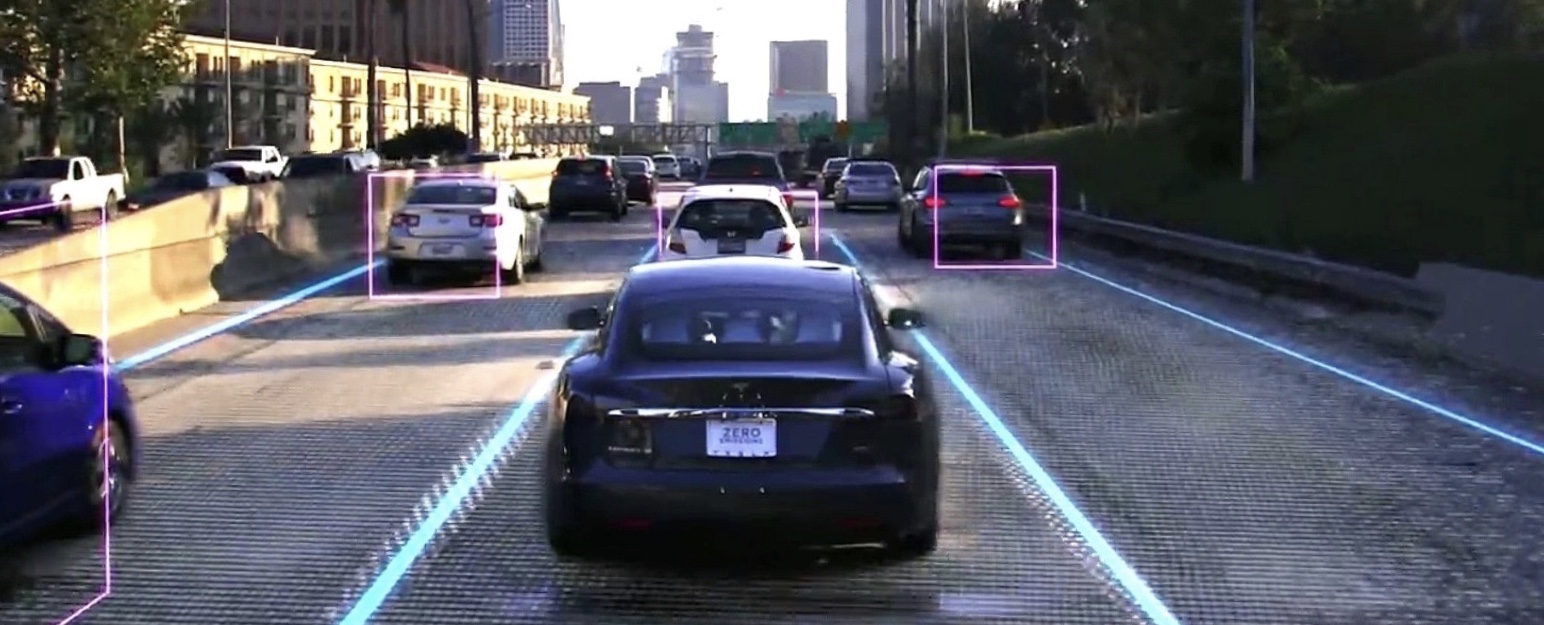

- We are more comfortable with Tesla’s camera-based (non-LiDAR) approach to autonomy. If correct, this approach could actually be preferred (safer, more reliable, efficient, better design) and afford Tesla a several-years headstart as other players unwind LiDAR from their solution.

- Our test ride in a Model 3 equipped with full autonomy was, at times, jerky but overall most impressive.

- We believe it’s likely that Tesla will both sell and operate autonomous vehicles.

- Autonomy will take longer than Tesla thinks but will be bigger than Tesla thinks. The initial rollout of these vehicles will likely be 1-3 years later than the company’s end of 2020 target.

- We were given more detail on Tesla’s plan to own and operate a fleet of self-driving “robotaxis” and enable Tesla owners to add their personal vehicles to the fleet once full autonomy is widely enabled.

- Musk suggested Tesla could, in about 10 years, operate up to 10M of their own robotaxis, which he thinks can generate a gross profit of about $30k per car per year.

- The implications of this are staggering. If you take Musk’s comments at face value (which we don’t recommend), the company could go from a loss of $1.3B in 2019 to over $300B in gross profit in 10 years.

- Given investor optimism on the autonomy theme, we believe this is the right time for Tesla to raise money (debt or equity) to de-risk the story with additional working capital.

Disclaimer: We actively write about the themes in which we invest or may invest: virtual reality, augmented reality, artificial intelligence, and robotics. From time to time, we may write about companies that are in our portfolio. As managers of the portfolio, we may earn carried interest, management fees or other compensation from such portfolio. Content on this site including opinions on specific themes in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making any investment decisions and provided solely for informational purposes. We hold no obligation to update any of our projections and the content on this site should not be relied upon. We express no warranties about any estimates or opinions we make.