- While Tesla missed their original Model 3 production goal (exiting Mar-18 at 2,000 per week vs guidance of 2,500), the miss was not as severe as investors were expecting.

- Importantly, Tesla doubled the Model 3 production run rate in Mar-18 over Dec-17 and is now 20% of the way to its goal of 10,000 Model 3s per week, which we expect in mid-2019. We expect Model 3 production to double again in the Jun-18 quarter to 4,000 vehicles per week.

- Tesla addressed the investor cash concern, predicting they will not need to raise money in 2018.

- While on a bumpy road, we believe Tesla remains exceptionally positioned for the future around EV, autonomy, and sustainable energy.

- Tesla reiterated their goal of exiting Jun-18 at a run rate of 5,000 Model 3s per week. We are modeling for 4,000 per week.

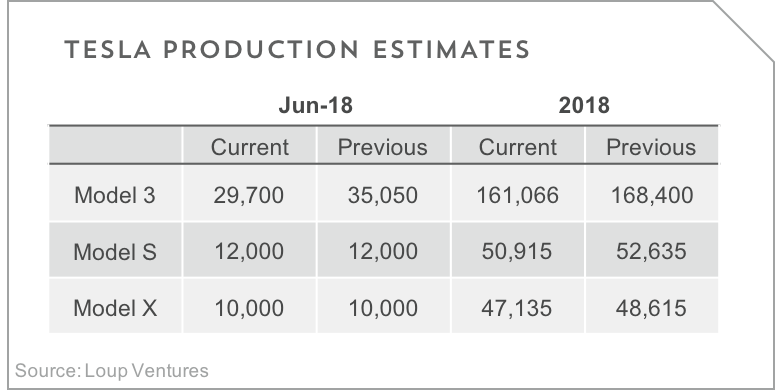

- To factor in Mar-18’s miss, we are lowering our 2018 Model production estimate to 161k from 168k.

Perspective on expectations. Tesla continues to miss Model 3 production numbers. Mar-18 is the third out of three quarters that they have failed to meet this important target. Investors are up in arms over these misses and have lost confidence in Tesla’s production guidance. While we share some of the same frustration, this hyperfocus on missing high, self-imposed production targets causes investors to miss the bigger story, which involves the company nicely ramping production of a car that is exceptionally difficult to produce and could potentially usher in global adoption of EVs.

Changes to our numbers. The table below outlines the changes to our production estimates.

Note: given the ~20% gap between Model 3 production and delivery numbers, we are now adjusting our Model 3 estimates to be driven by deliveries. This results in a ~20% reduction in Model 3 deliveries, however, there is little change in our Model 3 production numbers. No changes to S and X modeling methodology given our model had been driven by deliveries. Link to updated model here.

Expecting Profitability in Sep-20. We continue to model for Tesla to reach profitability in ten quarters. We will publish an updated cash flow model in the next week, but conceptually, we expect the company to be cashflow positive before Sep-20.

Disclaimer: We actively write about the themes in which we invest: artificial intelligence, robotics, virtual reality, and augmented reality. From time to time, we will write about companies that are in our portfolio. Content on this site including opinions on specific themes in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making investment decisions. We hold no obligation to update any of our projections. We express no warranties about any estimates or opinions we make.