Elon Musk has said September 22 will be “one of the most exciting days in Tesla history,” with the company expected to unveil developments around their battery technology, among other things.

The updates from Battery Day will likely soften some investors’ primary long-term concern: that traditional automakers will catch up to Tesla’s 80% US EV market share. While we believe the gap will shrink, other automakers will struggle to close the gap over the next decade in part because Tesla’s lineup is appealing to an expanding base of car buyers.

EV’s market share small today and growing quickly

EVs currently account for only about 3% of total US auto sales or about 500k of the likely 15m cars that will be sold this year. We believe that, as consumer attitudes warm toward EVs, the category will account for greater than 40% of the US auto market in 10 years, reaching over 8m vehicles sold in 2030.

60% US EV market share in a decade

This begs the question: how much will Tesla participate in this upcoming EV demand surge? Our answer: most of it. We expect that, in 10 years, Tesla will capture 60% of US EV market share, down from 80% today. If we’re right, 60% share would be impressive. As a point of comparison, GM currently leads the overall US auto market with a 17% share, followed by Ford at 14%.

Our confidence in Tesla’s 60% market share in a decade is based on the belief that, in two years, half of US auto buyers will consider buying a Tesla, up from about 20% today. We believe this expansion is based on four factors: 1) new model releases and better Model Y availability, 2) more consumers considering a vehicle’s true cost of ownership when making purchasing decisions, 3) modest price declines for the Model 3 and Model Y over time, and 4) Tesla’s aspirational brand status.

Charging infrastructure only a small limiting factor

Given that the public EV charging infrastructure in the US is relatively undeveloped, most EV owners must charge their vehicles in a garage overnight. We estimate the average installation cost of a 220V Tesla charger for the average homeowner is about $1,200. While we don’t believe this additive cost is a material limiting factor, being a homeowner is. Based on research from Hedges & Company, over 90% of new car buyers are also homeowners. The bottom line: we view charging infrastructure as a 10% limiting factor of EV adoption.

Earlier this year, about 20% of US new car buyers considered a Tesla

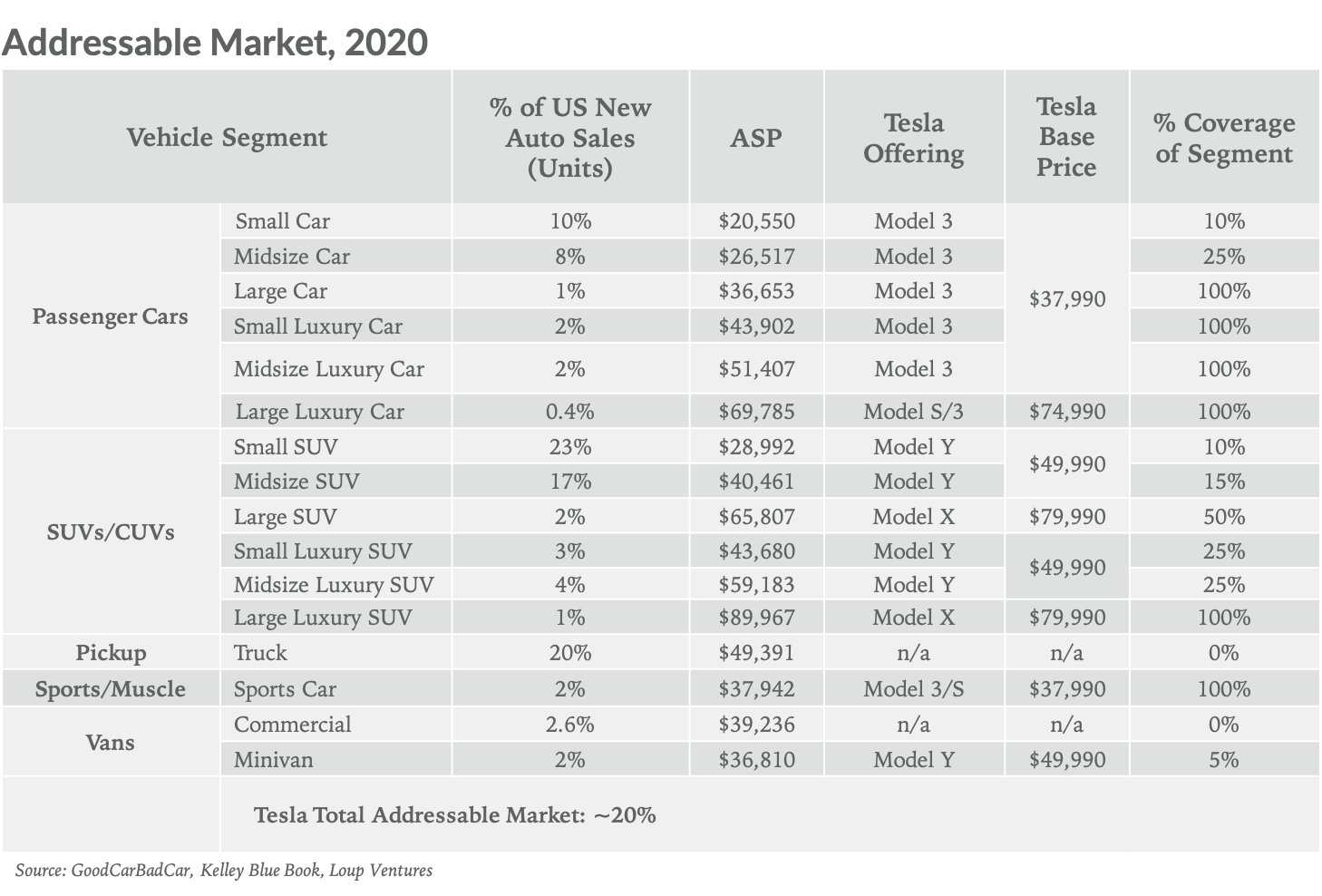

We estimate Tesla’s vehicle lineup in Jan-20 covered about 20% of the total US auto market, including gas and electric buyers. This is based on dividing the car and light truck buying market into 16 segments. In each segment, we estimated the percentage of new cars sold, selling price, and whether Tesla had an offering for a potential buyer to consider purchasing.

We found that earlier this year, Tesla models had a dramatic range of appeal depending on vehicle price, features, body size, and availability. For example, in January of this year, Model Y appealed to only 5% of US buyers, as deliveries did not start until March. The table below outlines Tesla’s coverage of each segment.

In two years, we expect half of US new car buyers will consider a Tesla

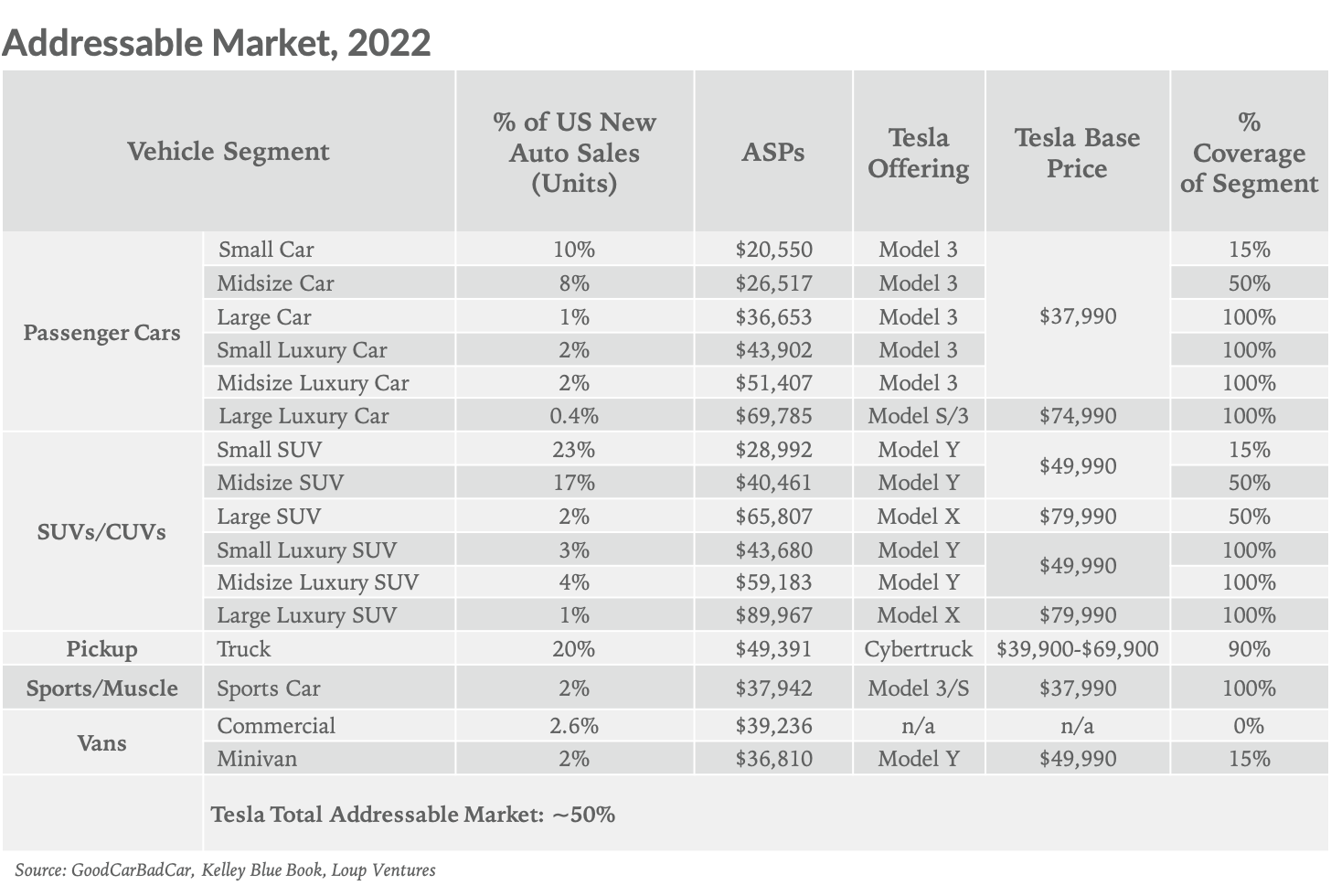

By January 2022, we estimate Tesla’s lineup will be considered in about 50% of US gas and electric vehicle buying decisions.

Four reasons why Tesla’s addressable market will continue to expand

- New models and better availability of Model Y. Cybertruck, expected in 2021, will expand the company’s addressable market, as pickup trucks represent around 20% of all new vehicle sales in the US. Increased Model Y availability will also play a key role, as the Midsize and Small SUV segments together represent around 40% of new auto sales.

- Total cost of ownership. We believe an emerging theme in automotive over the next decade is that consumers will begin to think more about the total cost of vehicle ownership. Our work in the past has shown that when maintenance, insurance, fuel costs, and the resell value of the car are taken into account, owning a Model 3 is cheaper than a Toyota Camry LE over the course of 5 years. Our assumption that 50% of US consumers will consider buying a Tesla in two years assumes the majority of consumers don’t do a cost of ownership exercise. If all buyers would factor in the total cost of ownership, we believe Tesla’s addressable market would be closer to 75% of total new gas and electric auto sales by 2022.

- Price declines. While the company hasn’t announced specifics, we believe there will be modest price declines (~$5,000) on Model 3 and Model Y vehicles in the coming two years. A central goal of Elon Musk is to “make cars as affordable as possible.” We’ve seen evidence of this already, with the base price of the Model Y decreasing $3,000 from $52,000 to $49,000 this year, and the Model 3 receiving about a $2,000 price cut.

- Aspirational brand. We also believe more entry-level consumers will be willing to stretch to buy a Tesla because it is becoming an aspirational brand. The most current data we have on this trend is from 2018 when four of the five most popular trade-ins for the Tesla Model 3 were Honda Civic, Honda Accord, Toyota Prius, and Nissan Leaf.