March deliveries, earnings, gross margin and outlook all represent a step forward for Tesla.

The big picture is the shift to EVs, autonomy, and renewable energy will take longer than most think but in the end will be more transformative than most appreciate. We maintain the view that this reality will likely create near-term volatility in shares of Tesla. In the end, we continue to believe these segments will be the foundation of the future of transportation and energy consumption and will increase Tesla’s market cap over the long run.

The safety topic

The safety topic was addressed on the earnings call, with the company maintaining that while the recent Tesla crash was horrible, its vehicles are the safest on the road. Notably, commentary on the timing of full autonomy was absent from the call, with Musk saying it is a function of time. In our view, full autonomy will take longer than Musk had previously suggested (end of 2021) and ultimately be more transformative than we can imagine. Overall, autonomy remains a meaningful untapped opportunity for Tesla.

The March quarter

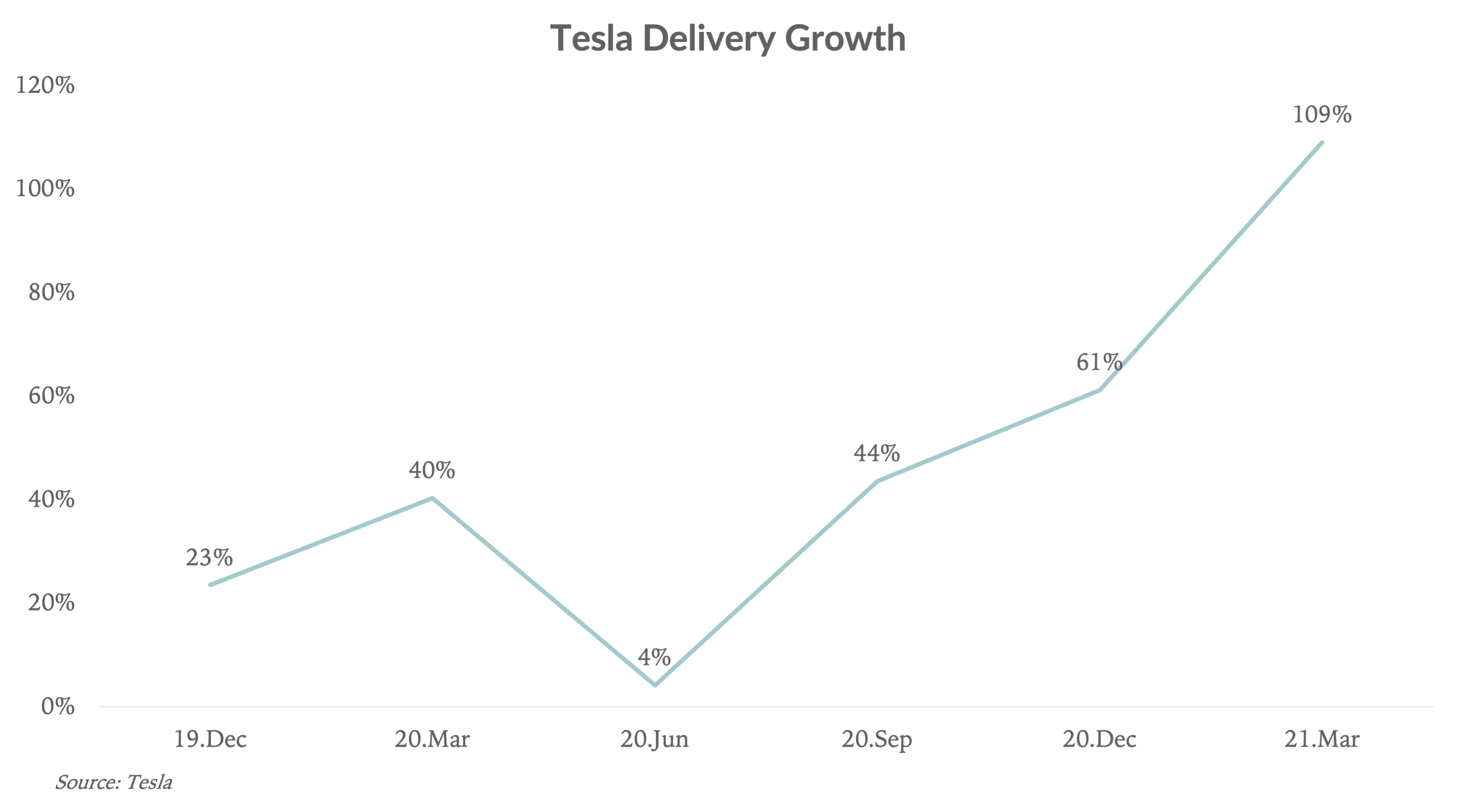

Tesla reported its seventh consecutive profitable quarter in March, driven by 109% vehicle delivery growth, versus the broader auto industry up 15%. Here are our takeaways from the March quarter report:

- Delivery guidance: The company reiterated its 50% average annual delivery growth rate over a “multi-year horizon” and expects deliveries to grow greater than 50% in 2021. The Street is around 70%, and we estimate 2021 delivery growth will be closer to 80%, driven by the Model Y ramp in Shanghai, the beginning of vehicle deliveries from Giga Berlin and Austin, as well as favorable 2020 comps. Tesla is experiencing accelerating delivery growth, the defining feature of a growth company:

- Auto gross margins were up sequentially in March to 22%, from 20.7% in December and 20% in March 2020.

- Free cash flow of $293m, down from $1.9B in December 2020 and $1B in December 2019. Cash flow was impacted by the company’s Bitcoin purchase and factory builds. Operating expenses increased in March quarter-on-quarter due to greater R&D spend for Model S & X Plaid production, investing more into new battery tech, along with neural net and custom silicon investments. We expect absolute levels of spending to continue to climb in the years to come, but decline as a percentage of revenue in 2022 as revenue grows faster.

- Cash on hand stands at $17.1B, down from $19.4B in December, largely due to a $1.2B net cash outflow from the Bitcoin purchase and capex increases. We continue to believe this represents sufficient cash to fund the company’s 50% compound delivery growth outlook for the next several years. Specifically, significant investments will be made in factory building, hiring manufacturing and engineering talent, and service center expansion.

- EPS of $0.93 was above analyst expectations of $0.78 and represents a step up from December at $0.80. Helping the beat was a step down in stock-based compensation to $614m in March, compared to $633m in December.

- Energy generation and storage grew 69% in March compared to 72% in December and -10% in March 2020. While the segment is still small (~5% of total revenue), long term we believe it has the potential to be 25% or more of the overall business. The challenge of growing this segment is that the auto segment is experiencing comparable growth rates; therefore, gaining as a percentage of revenue is difficult. Musk was notably optimistic about the segment on the earnings call, noting Tesla will become akin to a distributed utility company in the future, with homes capturing energy from the sun and feeding it to the grid. The demand for electricity in an all-electric future is staggering – Elon believes the world will need 3x more electricity for transportation and HVAC to undergo the electric transition.

- Services and other revenues were up 59% in March y/y compared to 17% in December and 14% in March 2020. This segment accounts for about 9% of overall revenue. Over time, as Tesla increases FSD availability, along with its ancillary offerings such as insurance, we believe this segment will account for a larger percentage of overall revenue, and, more importantly, help Tesla expand its margins closer to that of a tech company than an automaker.

- Tesla Semi deliveries are expected to begin in 2021, which will mark the company’s entrance into the commercial trucking market. Long, predictable highway miles are ideal conditions for full autonomy. We believe Tesla’s long-term vision for its trucking segment is to sell semis and eventually offer a high-margin logistics and dispatch layer that would compete with traditional logistics companies like C.H. Robinson. The biggest, recurring constraint on Semi production will be battery cell availability. Semis require 5x more cells than a car, and the company is already cell constrained.

We believe the following are the central topics to Tesla increasing its market cap:

Solar and storage

As mentioned, Musk referred to future Tesla as a giant, distributed utility, in which Tesla homes capture the sun’s energy, store it in a Powerwall, and feed excess energy to the grid. The company is focusing on streamlining solar installation to keep up with consumer demand, which continues to outpace Tesla’s install capacity. In a distributed utility future, Tesla homes will enjoy energy independence and stability in the event of grid outages.

Full Self-Driving (FSD)

There seemed to be an understandable pause in the company’s public commentary around FSD. As mentioned, Musk did not give a timetable for FSD, with his previous public commentary expecting this feature to be widely available by end of this year. Tesla may still believe in this end-of-year target but appears to be opting for a more conservative public posture on the topic. Our best guess is that widespread Tesla FSD is three to five years away.

Semi

Tesla reiterated that it expects initial deliveries for Tesla Semi by the end of 2021.

Robotaxi

We continue to believe Tesla will launch a chaperoned robotaxi in 2021. We believe regulatory approval in the US will take a couple of years. Until then, we expect Tesla to ease consumers into the future with a chaperoned robotaxi fleet. The earliest versions of Tesla’s robotaxi service will likely require a driver to accommodate the regulatory environment (think of it as an Uber driver in a Model 3 running FSD). In this scenario, drivers will benefit from reduced stress and fatigue, and Tesla will benefit by starting to build a ridesharing brand by easing riders into the robotaxi age with a human behind the wheel. Eventually, AVs will be approved, and Tesla, along with its third-party operators, can turn on its autonomous fleet. In the near term, we don’t see this as a risk to Uber and Lyft, given the number of chaperoned vehicles in the Tesla fleet will not provide meaningful competition for the next couple of years.