Tesla reports its Dec-18 quarter on Wednesday, January 30th. As a recap, the company announced on January 2nd that it had produced 86,555 vehicles including 61,394 Model 3s in the Dec-18 quarter, essentially in line with the Street. Here is what we’re expecting:

Dec-18 Earnings

Commentary from Elon Musk’s recent email to employees suggests that Dec-18 earnings will be below the Street, which is at $2.26 (down from $2.90 in Sep-18). Our interpretation of Musk’s comment, “In Q4, preliminary, unaudited results indicate that we again made a GAAP profit, but less than Q3,” is that Q4 EPS will fall somewhere below $2.00 and above $1.00. Our best estimate is $1.70 compared to the Street at $2.26.

Mar-19 Guidance

We’re bracing for March guidance to be below current Street pro forma EPS expectations of $1.40. We believe the potential exists for guidance calling for a GAAP loss. This is based on Musk’s comment in the same email, “This quarter [Q1’19], as with Q3, shipment of higher priced Model 3 variants (this time to Europe and Asia) will hopefully allow us, with great difficulty, effort and some luck, to target a tiny profit.” This may be an attempt by Musk to temper Street expectations; his comment leaves the door open for the company to guide to a loss in the March quarter.

One potential rationale for the company guiding to a loss in March is the timing of vehicles in transit to Europe and Asia. Tesla, over the past month, has opened the Model 3 configurator to several European markets and China, with initial deliveries set for February. Our checks indicate that new orders in these markets (as of 1/23/19) have estimated delivery times in March. The 5 to 7 week lag between production and delivery (recognizing revenue), causes us to brace for an earnings loss in Mar-19.

A March loss would result in a small drag on Tesla’s cash position, but we still believe the company has the cash on hand to service both its March 1st and November upcoming debt obligations.

Demand Commentary

More import than Mar-19 EPS will be commentary around demand in the US following the step down in the EV tax credit from $7,500 to $3,750, along with commentary related to initial orders in Europe and China. If overall commentary related to Tesla demand is positive, investors’ concern over a near term loss will be softened.

Model 3 Gross Margin Outlook

We expect the company to reiterate its comments from the Sep-18 investor letter to “continue to target a 25% gross margin ex-ZEV credits on Model 3,” but caution it could take several years to achieve the mark. This compares to Sep-18 GAAP Model 3 gross margin of more than 20%. We anticipate overall automotive gross margin to be 15% in Dec-18 compared to 20% in Sep-18.

As the average selling price of Model 3 drifts lower over the next 2 years, we believe the company will achieve a 25% Model 3 gross margin. This is based on previous Tesla commentary that Model S and X Performance mix declined roughly 4-fold since 2015, but Model S and X gross margin ex-ZEV credits improved by roughly 6% over that period. Tesla’s recent workforce reduction also supports margin expansion. Musk’s comments in his January email suggested that the company can increase Model 3 production, despite the workforce reduction, through manufacturing efficiencies.

China

There is reason for optimism around the China story despite tariffs negatively affecting results by $50M in the Sep-18 quarter. First, Model 3 deliveries in China are starting in March. More importantly, construction of the China Gigafactory is progressing faster than Gigafactory 1 in Nevada; we expect production in China to start in mid-2020. The China Gigafactory will help Tesla more cost-effectively address the world’s largest EV market, advance Tesla’s political efforts in China, build its brand with Chinese consumers, and accelerate the company’s mission.

Identifying Tesla’s Top Threats

The recent downgrades of Tesla shares are evidence of growing investor concern related to the company’s liabilities. Central to most of these negative revisions is a belief that Tesla’s biggest risk is increased competition. We disagree and see competition as the fourth most important risk. We see the three primary long-term risks as follows: a $7,500 price disadvantage starting in 2020, economic downturn creating unfavorable demand for cars and luxury goods, and a fleetwide hack or recall.

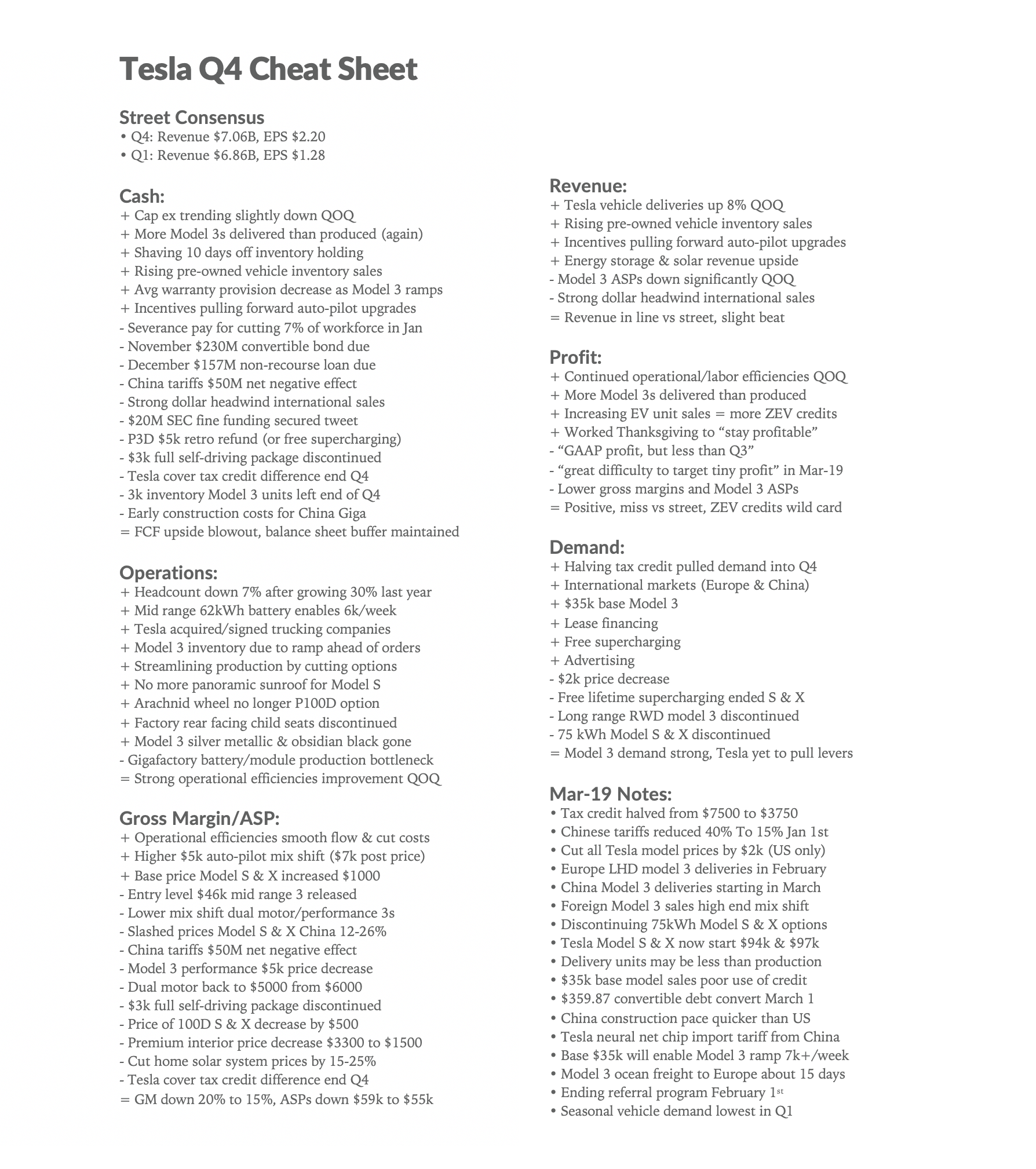

Here is a tearsheet (click for PDF) with the puts and takes of Q4 from Loup contributor Matt Joyce.

Disclaimer: We actively write about the themes in which we invest or may invest: virtual reality, augmented reality, artificial intelligence, and robotics. From time to time, we may write about companies that are in our portfolio. As managers of the portfolio, we may earn carried interest, management fees or other compensation from such portfolio. Content on this site including opinions on specific themes in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making any investment decisions and provided solely for informational purposes. We hold no obligation to update any of our projections and the content on this site should not be relied upon. We express no warranties about any estimates or opinions we make.