Hats off to the box office — 2022 has been a good year driven by the return to normal. Now that economies are reopening, top execs at Warner Brothers and other movie companies want back into theaters. Warner’s CEO, David Zaslav, mentioned on a conference call that the company plans to forgo the “streaming first” approach in lieu of fully embracing theatrical. He said that Warner “cannot find an economic case” for releasing high budget films direct to streaming. The facts look encouraging, highlighted by Paramount’s Top Gun: Maverick which cleared $1.38B in global box office revenue over a 17-week run, making it one of the Top 10 domestic movies of all time.

There’s more good news for theaters. Next year, momentum should continue with an increase in ticket sales due to a recession. Economic downturns have historically triggered upticks in box office revenue. Take 1929, for example, when sales jumped nearly 60%. Or, in 2019, when they rose almost 18%. While we expect increasing box office revenue next year, those sales don’t change the revenue bullseye for content producers: streaming.

Even after the pandemic, it’s still all about streaming

Taking a step back, pre-pandemic global theatrical revenue was about $42.3B while global streaming services made up $45.5B of the global market (source: Comscore, Netflix reports, Loup Funds). In other words, theatrical’s 43% of market share was behind streaming at 46%. The pandemic accelerated the transition to streaming with digital eating up nearly half of theatrical’s share in 2020. This was driven by Netflix growing its revenue +47% from 2019 to 2021.

We estimate that in early 2021, streaming subscriptions made up 95% of global entertainment revenue market share (excluding digital downloads). As we exit the pandemic, the digital streaming market share has remained surprisingly high. To get a current read, we compared the first half of this year’s streaming revenue for the top five platforms (Netflix, Prime Video, Apple TV+, HBO Max and Disney+) to total box office revenue, and found that streaming still captures 90% of revenue spend. This excludes the long tail of 95+ other streaming services that would inch the digital market share higher.

The winning formula

Even with the surge in box office revenue this year, the underlining trend remains clear. There is more money to be made selling content for home/mobile and the digital distribution model is near free, in the case of Amazon and Apple. For Disney, Paramount and Warner Bros, making money in Hollywood is simple: take a pre-loved action series, add A-list talent, spend >$100m in marketing, and out comes Top Gun: Maverick.

Apple has an advantage: the deepest pockets in Hollywood

Apart from Amazon Prime sitting on more than 20K titles from MGM’s pre-1986 catalogue, we think it’s Apple that is best positioned to grow share from its fractional 2% streaming revenue share today (30m paying subs). Funded by nearly $100B+ in annual operating income, Apple’s content spend is without bounds. This gives them an advantage in Hollywood development deals and attracting top tier talent. On the company’s March 2022 earnings, Tim Cook said that Apple doesn’t make “purely financial decisions” on its content acquisition—which underscores the company’s commitment to developing quality content. In terms of UI, Apple may also be the only streaming service that can run ad-free in the long term. Currently, Prime Video and Peacock have part of their library supported by ads, while HBO, Disney+, and Netflix are exploring ad-based models. The bottom line: it seems inevitable that most streaming services will show ads in the future, which can become a selling point for Apple TV+.

Apple’s content spend supports its growing list of talent, including a recent deal with Tom Hanks’ production company, Playtone; Natalie Portman’s production company, MountainA; Leonardo DiCaprio’s production company, Appian Way; and Idris Elba’s production company, Green Door Pictures. Not to mention contracts with Oprah Winfrey, Alfonso Cuarón, Ridley Scott, A24, and Sesame Workshop. Separately, Apple continues to develop its sports broadcasting capabilities, with its MLB Friday Night Baseball deal and a 10-year deal with MLS. We believe that NFL and Formula 1 races will follow within the next two years.

The one downside of Apple TV+: While the quality of its content is high, its library isn’t filled enough to compete with the likes of Netflix, Hulu and HBOMax. In the end, we believe quality will win over quantity.

Competition is only slightly intensifying

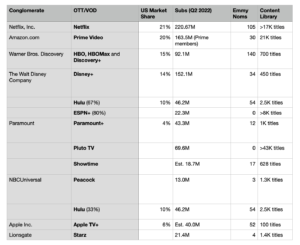

Over the last six months, we have seen negative headlines from the streaming services with a recurring theme of increased competition and a return to normal headwinds. While Netflix has been tagged with the “biggest loser” label, with shares of NFLX down 60% this year, the business has been surprisingly stable. In 2022, we estimate that the company has lost only 2% market share which amounts to about 1M canceled subscriptions out of 220m total. On Netflix’s June 2022 earnings call, management mentioned “competition” a total of 9 times compared to 4 times in the prior year period. Its competitors (Prime Video, Apple TV+, HBO Max and Disney+) each gained 1% market share, still leaving Netflix with 21% at the close of the June 2022 quarter. Prime Video follows with 20%, HBO Max with 15%, Disney+ with 14%, and Apple with about 2%. This implies that the Top 5 have generated about $100B in streaming revenue globally over the past 12 months.

The takeaway: Streaming is a profitable ancillary business alongside the revenue of Amazon’s retail store, Disney’s parks and merchandise, and Apple’s iPhone. As Jeff Bezos said: When Amazon wins a Golden Globe, it helps sell more shoes.

Paramount and Universal have a chance

There are four major film studios (Universal, Paramount, Disney, and Warner Brothers) that made up 76% of the $5B in box office sales this year. Disney is already a cornerstone of streaming, leaving two studios that stand out as streaming laggards: Paramount and Universal.

Good news for them: There is still time to change course, and return to a “streaming first” approach.