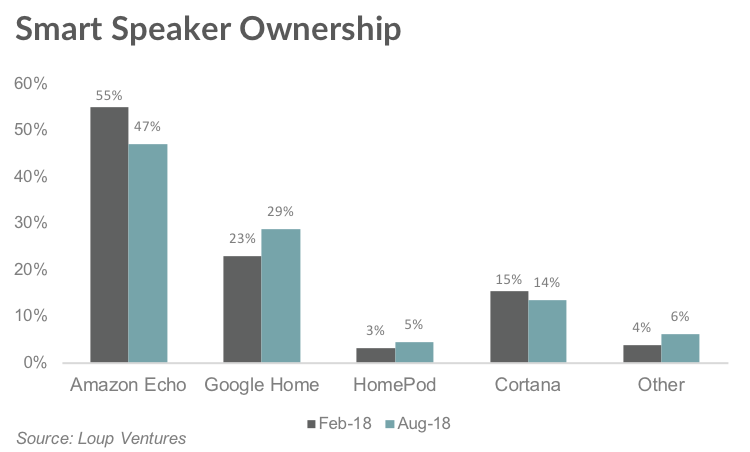

We recently surveyed 520 consumers about smart speakers and found that over 45% of respondents own at least one smart speaker. 9% of smart speaker owners surveyed owned more than one. In a similar survey earlier this year, only 27% of respondents owned a smart speaker, suggesting an 18% jump in adoption among our samples just since February.

This time, Amazon Echo lost market share, mostly to Google, which we believe to be reflective of the current landscape, as Google devices have outsold Echos for the past two quarters. While, in this sample, Cortana seems to be slightly overrepresented and HomePod slightly underrepresented, we believe market share findings from this survey represent today’s landscape.

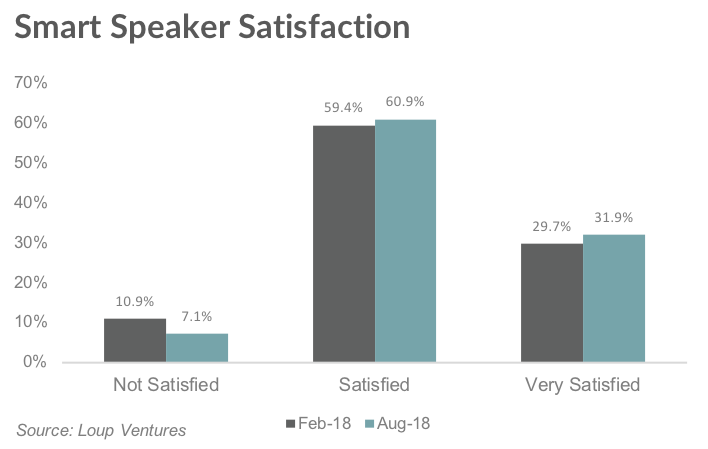

Satisfaction Remains High

Nearly 93% of respondents claimed to be “satisfied” or “very satisfied” with their smart speaker. This is essentially unchanged from results earlier this year.

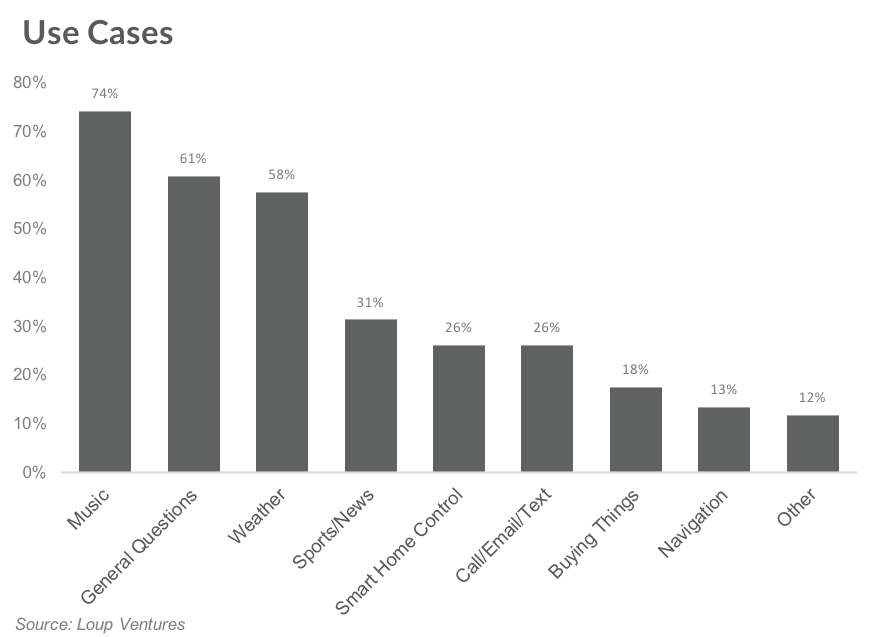

In February, we wrote that satisfaction is high because the most common use cases are very simple. We think this still rings true today, as the top 3 use cases by far are music, general questions, and weather. Down the road, as voice computing becomes more prevalent and more capable, we expect the use cases to evolve and be more complex. Music, weather, and general questions won’t go away, but other activities will increasingly take place via voice. Notably, smart home control and buying things were notably more popular this time.

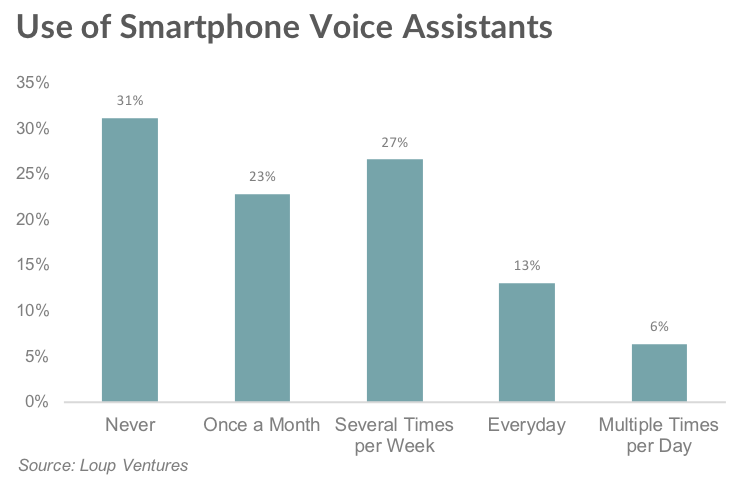

We also asked how often respondents use a voice assistant on their phone, e.g. Siri or Google Assistant. The results show just how far voice technology has to go before it is mainstream. The most common answer was “never,” and only 6% of people use it multiple times per day, which would indicate real adoption.

Disclaimer: We actively write about the themes in which we invest or may invest: virtual reality, augmented reality, artificial intelligence, and robotics. From time to time, we may write about companies that are in our portfolio. As managers of the portfolio, we may earn carried interest, management fees or other compensation from such portfolio. Content on this site including opinions on specific themes in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making any investment decisions and provided solely for informational purposes. We hold no obligation to update any of our projections and the content on this site should not be relied upon. We express no warranties about any estimates or opinions we make.